EU sow prices falling

Wednesday, 29 April 2020

By Bethan Wilkins

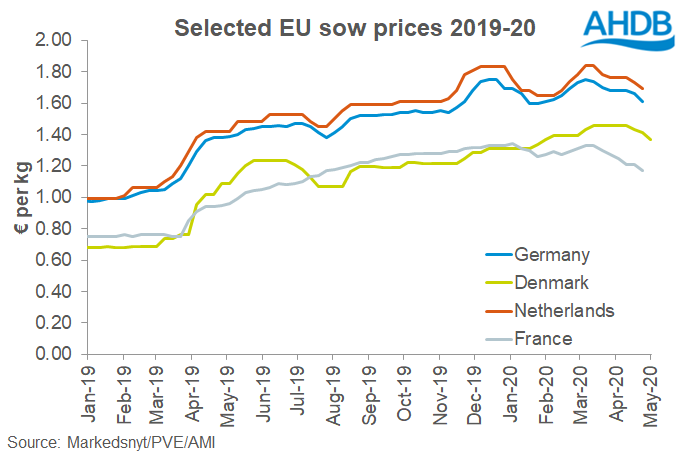

Since February, sow prices in the EU have shown some volatility across the main markets, following the pattern in the finished pig market. Although there had been some uplift in February, fortunes have turned and quotes for the latest week are now, in general, lower than the start of the year. They are still significantly higher than last year though.

Demand has been fickle across the pork market, reflecting changes in Chinese export prospects and the recent closure of most European foodservice outlets. Lately, reports suggest demand has been insufficient for supply and cold stores have been filling. Prices have therefore been falling.

The key German M1 price was €1.61/kg in the week ended 26 April, similar to levels in early February. However, the VEZG price, quoted for the upcoming week, has dropped significantly compared to last week (-€0.12/kg) suggesting a more significant fall in the M1 average may be imminent.

The picture was similar in Denmark and the Netherlands, with the latest prices at €1.37/kg (w/e 3 May) and €1.69/kg (w/e 26 April) respectively. France has already seen a more severe fall, with the quote for week ended 26 April at €1.17/kg, back to levels last seen in July last year.

Due to close trade links to the German sow market, GB cull sow prices tend to follow the German M1 sow price. Reports already indicate the recent drop in the German market has fed through to prices here, with booking slots also reportedly lower as export demand suffers.

Moving cold storage volumes continues to be challenged by both the lack of European foodservice demand and difficulties with container availability constraining exports. As a net pork exporter, Germany is particularly sensitive to limitations on its export market. Although, the upcoming grilling season might provide some support to German consumption, especially if Germans are unable to take their usual foreign holidays. Nonetheless, there is still no real clarity around when the current challenges may ease, and so the British sow market faces a period of uncertainty.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.