Overall impact of Brexit on UK beef and sheepmeat

Thursday, 1 August 2019

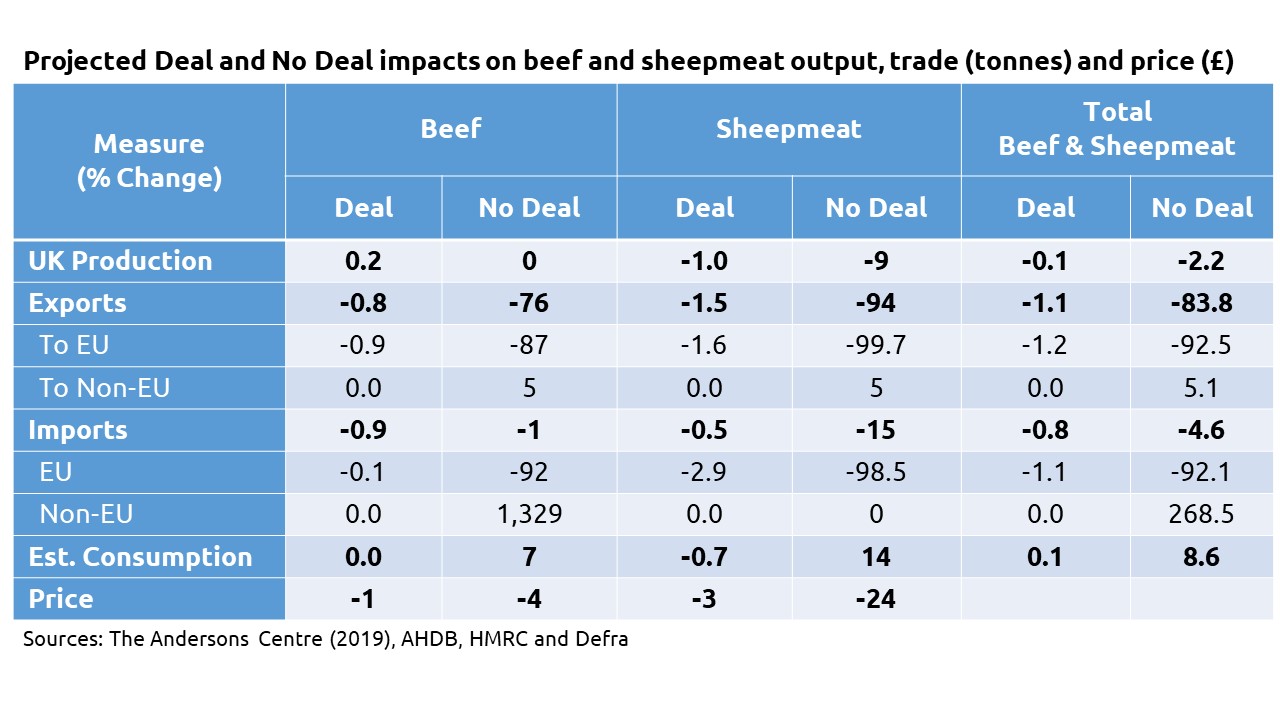

A No Deal Brexit will have a substantial impact on beef and sheepmeat trade, whilst the impact of a Brexit Deal is likely to be relatively minor. With either outcome still possible, the following article addresses how trade, output and price could be affected under each scenario.

Brexit Deal

The impacts of a Brexit Deal on beef and sheepmeat output and trade are projected to be relatively minor with total exports of combined beef and sheepmeat products forecast to fall by just 1.1% and imports to decline by 0.8%.

The main impact on trade will be the influence of non-tariff measures (NTMs), which are expected to result in tariff equivalent cost increases on both imports and exports. This will largely affect UK to EU trade and vice versa.

Trade with non-EU markets is not likely to change significantly, as any existing agreements that the EU28 has struck with other countries will be rolled over, and NTM effects are already a factor in the UKs trade with third countries. However, there may be an influence of exchange rates, with the potential for Sterling to strengthen, making UK exports less competitive on international markets.

UK beef production is projected to increase by a minimal 0.2%. Despite the imposition of NTMs rendering EU imports less competitive, a response in terms of increased domestic production is not likely to be proportional as consumption is forecast to remain relatively unchanged. With prices achieved for exports to the EU27 tending to be higher than for corresponding cuts on the UK market and reluctance to pass on any price increases to consumers, beef prices, particularly at the farm level, are projected to decline slightly.

Sheepmeat production is heavily reliant on exports to the EU and the opportunities to supplant imported produce with domestic production are more limited than beef, mainly due to seasonality and consumer preferences. As a result, any increased trade friction with the EU is expected to lead to some decreased sheepmeat production and price declines as the UK strives to grow its domestic market.

No Deal

No Deal Brexit will have a significant impact on trade with the EU27.

Exports of beef to the EU27 are projected to decrease by 87%, primarily due to the imposition of the EU Common External Tariff (CET) and as a result of restrictions on meat types eligible for exports via the proposed TRQ of 63,480 tonnes of beef. Exports to non-EU countries (projected to increase by 5%) will be unable to compensate for the lost EU trade, as UK prices are significantly higher than world market prices. The imposition of a 230Kt TRQ by the UK, which would be available to all beef suppliers worldwide provided they meet the UK’s sanitary standards, is projected to result in a dramatic rise (+1,329%) in imports of beef from non-EU countries. Conversely, imports from the EU are projected to decline severely, by 92%.

Meanwhile, exports of sheepmeat to the EU27 would be almost entirely wiped out, with the only exports being those via a TRQ of less than 400 tonnes. Non-EU exports are expected to increase, although the rise of circa 5% will not be enough to offset the loss of EU trade, resulting in a significant amount of UK product without a market. It is anticipated that imports from the EU would be almost non-existent, which could help to mitigate this issue somewhat. However, imports from non-EU countries (particularly New Zealand) are not expected to decline, due to seasonal availability and internationally competitive prices.

Whilst consumption of both beef and sheepmeat is projected to increase due to availability of previously exported product, production is forecast to decline by 2.2%. With a significant increases in domestically produced volumes on the UK market struggling to find a home, the scope for significant price erosion becomes more likely.

Overall, a Brexit Deal will likely result in some declining revenues posing challenges for the industry. The implications of a No Deal Brexit, however, are much more severe and could have stark consequences for many operators, with the sheep sector being the most severely affected.

For further details on the impact of the two Brexit scenarios on beef and sheepmeat, please refer to the report by The Andersons Centre, on behalf of the AHDB, HCC and QMS.