Impact of non-tariff measures to beef & sheep

Thursday, 25 July 2019

Summary

Non-tariff measures (NTMs) are a key aspect of trade, which are often overlooked. They have a financial impact that, in some cases, can be significant. Depending on different scenarios post-Brexit, the impact of NTMs could have on individual checked loads range from hardly any increase to as much as 25-30% in price. However, in reality, this would be averaged out over multiple loads, which could see an increase of 7% in the cost of exporting beef and lamb. For a number of products, a no deal Brexit is likely to increase the number of checks, certifications, etc. and thus increase the cost of trade. The following article goes into more detail as to what these NTMs are and how different scenarios could affect beef and sheep products. It is important to emphasise that the estimated impacts set out in this article compares the situation 9-12 months after Brexit with the current situation and, therefore, does not consider the upheavals that could ensue in the immediate aftermath of a no deal.

Full article

Tariff implications for trade tends to grab the headlines, as it is easier to see the effect on price. However, other challenges to trade are Non-Tariff Barriers (NTBs) and Non-Tariff Measures (NTM).

When it comes to trade, NTBs encompass every barrier that is not a tariff. NTMs are a subset of these, which are a lot more fluid. For example, you can think of NTBs as overheads (both fixed and variable) whereas NTMs are just variable overheads.

While this article focuses on NTMs faced by trading businesses, it is important to recognise that traders cannot simply import meat products from any country in the world. First, the country has to be an approved exporter. In addition, for companies undertaking processing activities, individual plants also have to be approved for export. In the absence of trade deals, this is the approach the UK would have to take to be able to export. This also needs to be considered by traders when importing from third countries. It is foreseen that post-Brexit, the UK will have a similar approvals process both for imports from the EU and from non-EU countries.

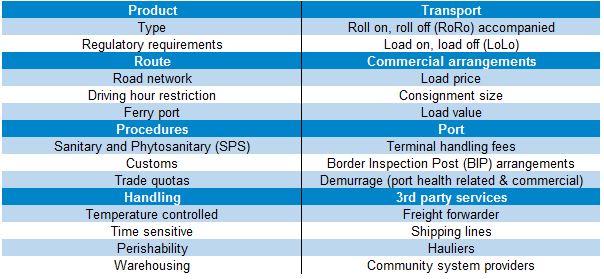

There are many types of NTMs to consider when trading, some of which are outlined below. They will all have a financial impact to trade, whether that be a physical cost or a time one.

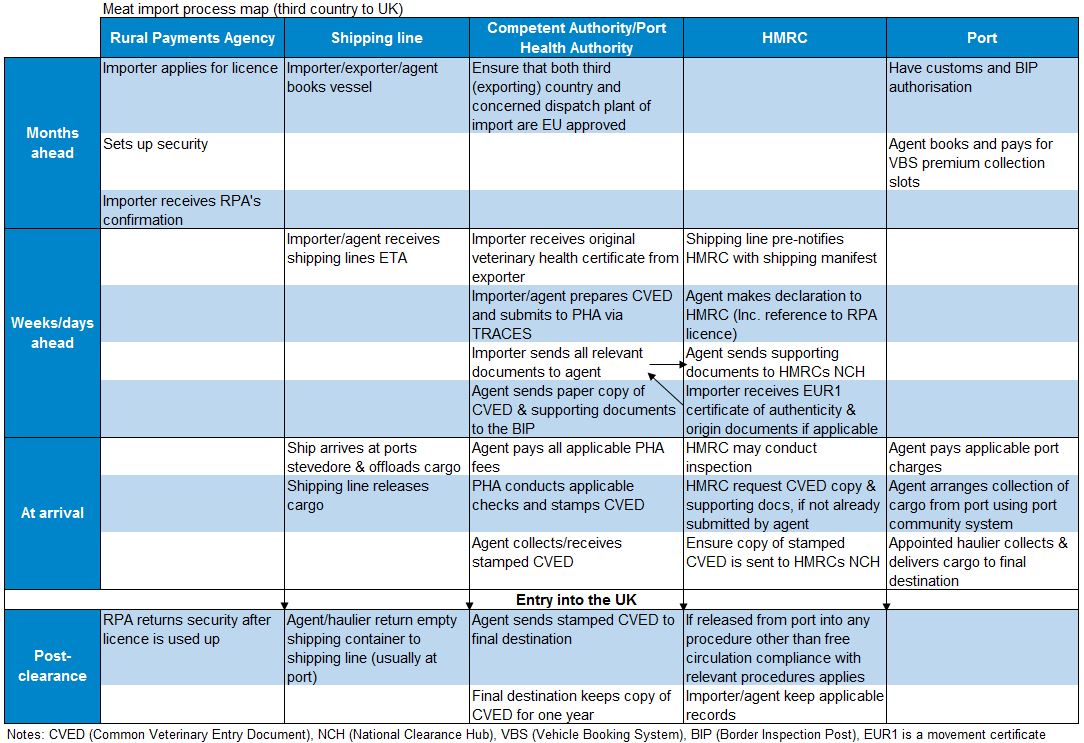

As well as the number of factors involved with NTMs, there is also a question of timeliness as there are a number of things that need to be done months ahead of trade.

Source: Derived from Grainger (2013) and the FSA; compiled by The Andersons Centre

Unlike tariffs and tariff rate quotas, NTMs would be applicable irrespective of whether there is a Brexit Deal or No Deal. However, there is still scope for the cost of NTMs to vary under different scenarios.

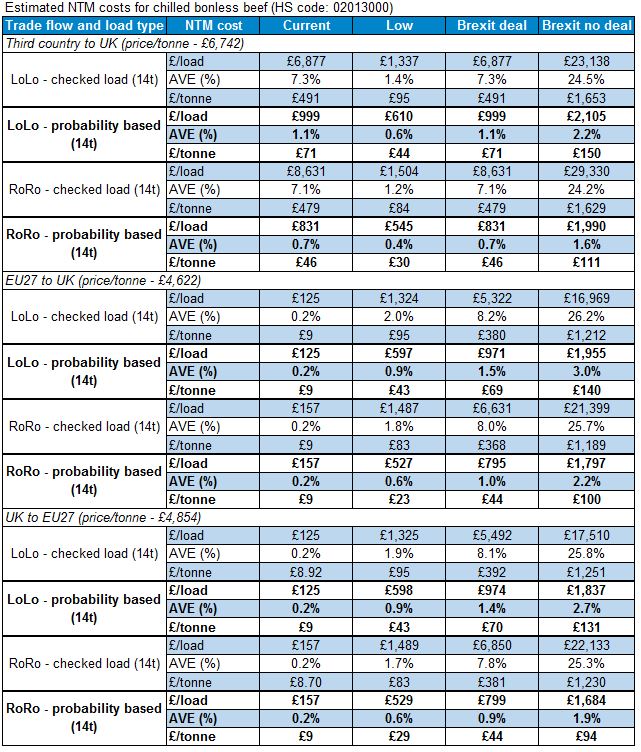

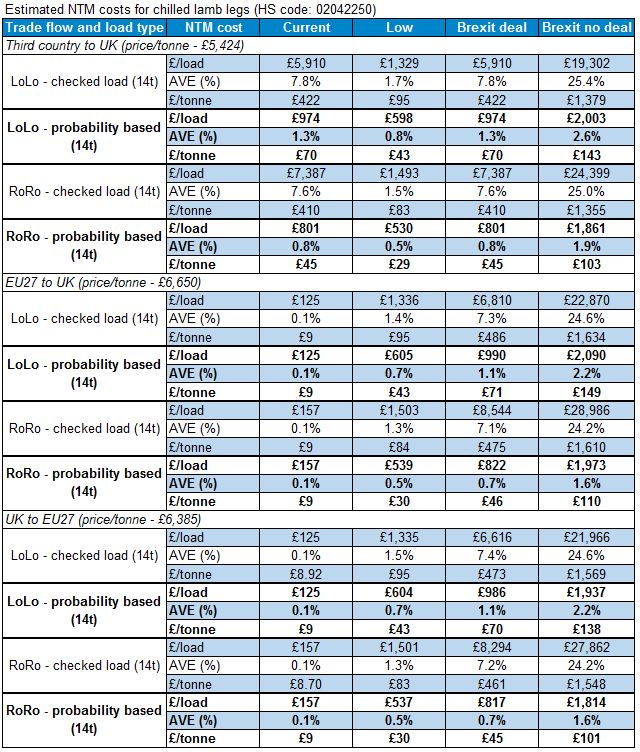

A report carried out by The Andersons Centre (Andersons), on behalf of GB red meat levy bodies assessed the impact NTMs could have on some beef & sheep products under different Brexit scenarios. As costs, check rates, etc. are variable, some assumptions have been made (which can be found from page 66). The scenarios are based on three scenarios, i.e. the current situation, no deal and some sort of deal. This piece of work also looks at the possibility of low-level checks, which would be the minimum level of NTMs that the UK could face with the EU.

The results are split into two sets of estimates.

1. Checked loads: this could be thought of as the cost applied to a single “unlucky load” that is subject to the full range of regulatory checks as well as sampling. Accordingly, the NTM estimates become substantial, especially in the “no deal” scenario.

2. Probability based: these project the NTM costs averaged out over 100 loads. Therefore, they are much lower than the checked loads and could be taken as a more realistic assessment of what NTMs are likely to be at a national level rather than individual load level. This could range from hardly any checks (current UK/EU status and low scenario) through to substantial checks (Brexit no deal).

This gives us a sense of the costs that could be attributed to a load, as well an average view.

As well as the different scenarios, the report looks at specific trade patterns too. These being goods coming from third countries into the UK, product from the EU into the UK and exports from the UK to the EU.

Source: The Andersons Centre (2019)

AVE – Ad-Valorem Equivalence

It is important for those trading/potentially trading with third countries that AVEs are not looked at in isolation but costs per tonne or load are also worth looking at, considering the influential role of value deterioration which may result from delays at ports as per the detailed report.

As seen in the example tables above, the costs can vary dramatically under the different scenarios. This highlights the potential “hidden costs” element of trading without a trade deal.