November 2024 dairy market review

Wednesday, 11 December 2024

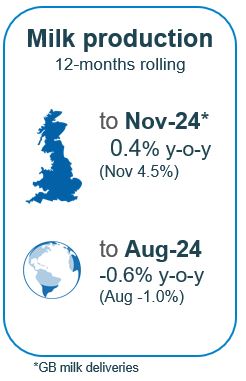

Milk production

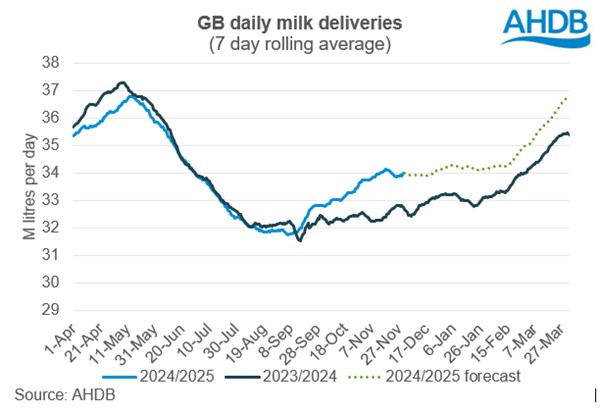

GB milk deliveries are estimated to have totalled 1,018 million litres in November 2024, a substantial rise of 4.4% compared to the wet November 2023. Daily deliveries averaged 34.0 million litres per day.

Production for this year’s milk season so far (April-November) sits at 8,279 million litres. After a steady start to the year, a surge in Autumn production has boosted overall output which is now up by 0.4% compared to the same period in 2023.

A combination of an attractive milk to feed price ratio, favourable weather keeping cows out longer and increases in Autumn block calving has benefitted milk volumes, pushing production well ahead of last year.

For the milk season so far (Apr-Oct), GB organic milk deliveries are estimated to have totalled 203.21 million litres, this is down by 9.3% compared to 2023/24 and down by a substantial 23.1% compared to 2022/23. In the week ending 02 November, deliveries averaged around 1.0m litres/day, back by 2.9% year-on-year. This is against a background of firming retail demand, with organic milk growing by 0.3% and yogurt growing by 9.8% in the 12 weeks to 5 October 2024.

The GB milking herd totalled 1.64 million head as of October 2024, the lowest October number recorded, and a 0.9% decrease compared to the same month the previous year. The GB herd total came to 2.55 million head, a year-on-year decline of 1.5%. A fall was seen across all age groups, with the exception of the 2–4-year age bracket.

Culling of older cows helped to maintain the average age of a cow in the GB milking herd at 4.55 years, very slightly younger than last year’s figure.

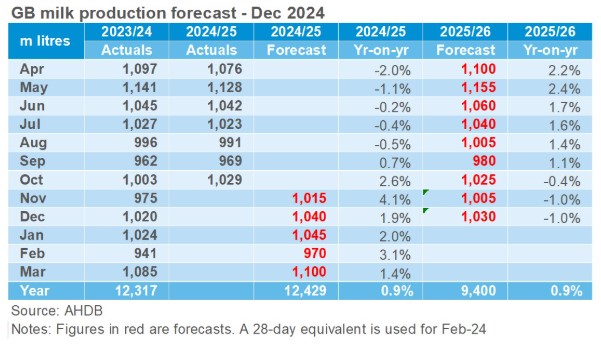

Expectations for milk production for the 2024/25 milk have been revised to account for the current market situation and the expectation is for the current milk year to end at 0.9% above the previous year. We expect milk production to stay elevated through the flush before falling back towards next Autumn.

Latin American milk deliveries have continued to decline in September.

Wholesale markets

There were weekly price fluctuations across all products during the November reporting period with industry sentiment mixed. Firmness in the market seems to have been driven primarily by actions on the continent with EU milk supply still weak and seasonal demand strong. However, there has also been pressure on prices as it was noted some buyers and sellers have been at an impasse. While there is news of growing milk supplies, inventory and availability is weak, particularly on fats. Important to note that average prices are reflective of the whole of the 4-week period.

Cream lost £40/t or 1% and mild cheddar lost £110/t or 3%. On the other hand, regained £130/t or 2%; SMP gained £10/t.

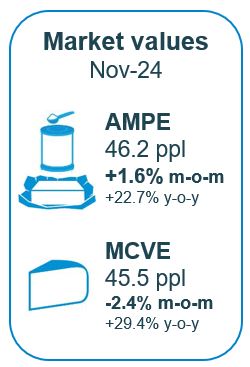

As of November, milk market values (which is a general estimate on market returns and the current market value of milk-based products on UK wholesale price movements) decreased to 45.6ppl, losing 0.7ppl. AMPE increased by 2%, MCVE lost 2%. AMPE is now ahead of a year ago by 23%, with MCVE up by 29%.

The outlook for prices is uncertain with some volatility in fats prices and growing milk supplies.

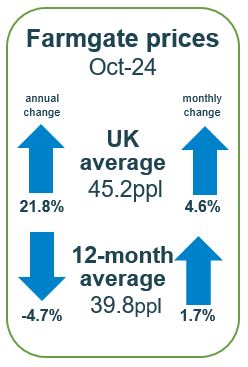

Farmgate milk prices

The latest published farmgate price was for October with a UK average of 45.2ppl, up by 4.6%, on the previous month. Latest announced farmgate prices for December were steady to firm for most and continue to maintain a high level.

Liquid contracts were more mixed, with aligned mostly steady, and only a couple of increases in non-aligned.

Looking to aligned contracts, Co-op Dairy Group, M&S, Tesco and Waitrose announced no change to their milk prices. However, Sainsbury’s announced a marginal decline of 0.15ppl.

On non-aligned liquid contracts, all members of the AHDB league table mostly held their prices meaning no change for Freshways, Muller Direct and Payne’s Dairies. Conversely, Credition Dairy and Pembrokeshire Creamery increased their prices by 1.25 ppl and 1.12ppl respectively. Pembrokeshire, which only came online this spring, announced its sixth consecutive month of increase and Credition Dairy announced their seventh consecutive month of increases.

Cheese contracts also mostly held steady with some notable exceptions. After increasing prices last month, Belton Cheese, Saputo, Leprino Foods, Parkham Farms, South Caernarfon Creameries, Wensleydale Creamery and Wyke Farms have made no change for the month of December. Meanwhile, Barbers Cheese increased their prices by 1.50ppl and this is the ninth consecutive month of increase. First Milk Manufacturing made a positive price announcement of 1.50ppl with prices increasing continuously from last six months while Lactalis announced their seventh month of consecutive increase and prices increased by 0.61ppl.

There were few and large announcements on the manufacturing contracts this month. Arla Direct Manufacturing made the largest announcement for the month, increasing their price by a substantial 2.56ppl. Arla UK Farmers upped their contract price by +0.89ppl. Pattemores Dairy Ingredients and Meadow held on to their price whilst Dale Farm made a positive announcement of 0.51ppl.

Trade

Total export volumes of dairy products from the UK for Q3 2024 were 274,300t, a decline of 7,100t (2.5%) year-on-year. This is the lowest quarterly volume recorded in the last two years. Exports of dairy products to the EU declined by 4,100t and that to non-EU nations declined by 2,900t during the period.

This was primarily driven by a sharp decline in exports of powders which fell by by 9,800t (30.7%). Milk and cream as well as butter also declined by 1,800t (1.0%) and 1,600t (13.3%) respectively, and yoghurt declined by a smaller 700t (7.2%).

In contrast to that, cheese and curd, whey and whey products continued to grow year-on-year. Cheese and curd saw the largest year-on-year increase, up by 4,700t (10.7%) mostly destined for EU nations. This was followed by whey and whey products which grew by 2,000t during the period. In EU, the largest chunk of the exports was to Ireland (9,800t) followed by Netherlands (6,000t). Increasing exports of cheese reflects increased efforts to boost British prospects overseas.

Retail demand

During the 52 weeks ending 2 November 2024, volumes of cow’s dairy declined by 0.6% year-on-year (NIQ Homescan POD, Total GB).

Growth in average prices (+0.5%) was not quite enough to balance volume losses as spend on cow’s dairy declined 0.1% according to Nielsen.

Spend on cow's milk continues to decrease (-6.3%) and volumes declined by 1.8% year-on-year (52 w/e 2 November 2024). Semi-skimmed cow’s milk accounts for 59.6% of volume sales but contributed most to the decline, while whole milk continued to see growth (+2.3%), driven by an increase in buyers as well as an increase in purchase frequency.

Cow’s cheese remains in growth with volumes up 3.8% year-on-year, and spend to rising by 3.2% (NIQ Homescan POD, Total GB). Cheddar saw a 4.1% increase in volumes sold driven by an increase in volume per shop up 2.9%. This drove cow’s cheese performance as cheddar accounts for 41.7% of all cow cheese sold. Cow cheese other also saw strong growth driven by cottage cheese.

Cow's butter saw a volume decline of 3.5%, despite a decrease of average prices (-0.2%). However, block butter saw volumes increase by 6.0%. Plant-based spread volumes increased, likely due to switching gains from cow’s butter as they were £2.06/kg cheaper.

Volume sales of cow's yoghurt, yoghurt drinks and fromage frais continue to grow, now up 6.4% and spend increased by 8.2%. Despite increasing prices, most of the cow’s yoghurt categories saw volume growth. Standard plain yoghurts grew the fastest, up 22.7% while healthy yoghurts saw the largest increase up 10.7 thousand tonnes year-on-year (NIQ Homescan POD, Total GB).

Cow's cream volumes grew by 2.5% year-on-year, primarily driven by existing shoppers buying more. Double, sour cream and crème fraiche all experienced volume growth.

See the full data and these insights visualised on our GB household dairy purchases retail dashboard.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.