New protein gap opening in China?

Thursday, 25 November 2021

By Rebecca Wright

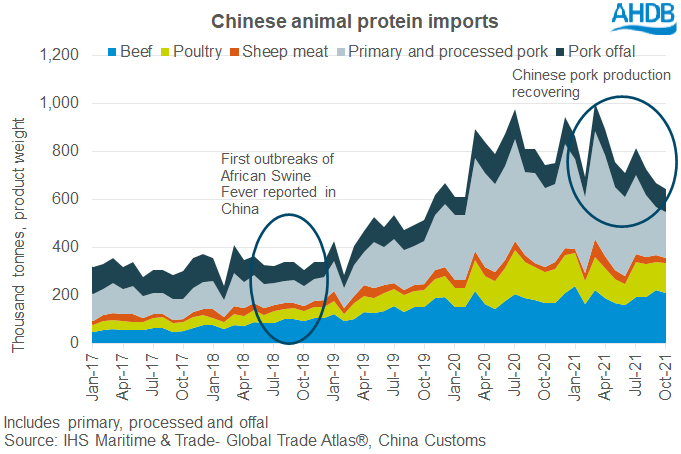

Just over three years ago China had its first outbreak of African Swine Fever (ASF). At the start of 2019, there was a large surge in Chinese import demand for protein as the market looked to fill the gap left by the decline in pork production. International beef and pork markets both benefitted from this demand. Over the last 12 months, Chinese pork production has been recovering which has reduced demand for imported pork.

However, despite any recovery in the pig herd, there could now be a new protein gap emerging – at least in the short term.

Brazil supplies over a third of Chinese beef imports but Brazilian beef is currently suspended from the Chinese market. In the year to October Brazilian beef accounted for around 12% of Chinese red meat protein imports, and 10% if we also included poultry meat.

Any beef which had left Brazil before the ban was put in place, has been accepted by China. The embargo came in September, but due to freight times the effect is not yet showing in Chinese import data. We can however begin to see it in Brazilian export data. This shows that most of the beef has not found an alternative outlet, although Russia has just a three-year long embargo on Brazilian beef. The domestic market in Brazil is unlikely to offer an attractive home for this beef, as demand is weak amid an uncertain economic climate.

For the UK beef (and sheep meat) market there is likely to be little impact. The UK beef market is relatively isolated, as the UK and Europe have only limited interaction with the global market (although this is changing with increased UK access to the US). The sheep market is already tight and having reduced interaction with New Zealand at the moment.

However, the UK pig industry could potentially benefit again, as it has before. It will depend upon abattoir staff availability which is currently challenging in our domestic industry, and a recovery in the number of plants with approved market access. Continental Europe currently has plentiful supplies of pork and China may also offer an outlet for some of this pork. European exporters have also been suffering from a downturn in Chinese import demand.

How this possible protein gap develops will depend upon how long the embargo on Brazilian beef is in place, and how sustained is the recovery in the Chinese pig herd.

Subscribe to our Cattle and Sheep Weekly newsletter and receive market updates in your inbox every Friday

Subscribe to our Pork Weekly newsletter and receive market updates in your inbox every Friday

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.