New crop UK wheat futures extend premium over old crop: Grain market daily

Thursday, 23 January 2025

Market commentary

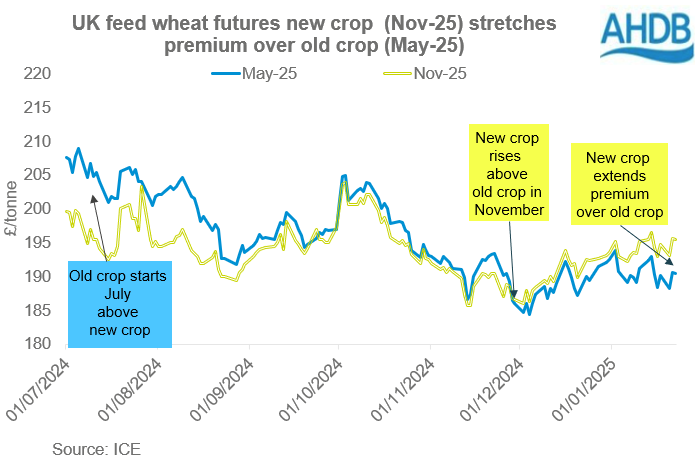

- UK feed wheat futures (May-25) closed yesterday at £190.5/t, down £0.15/t from Tuesday’s close. The Nov-25 contract settled at £195.50/t, also down £0.15/t over the day.

- Domestic wheat futures closed lower, following declines in Chicago and Paris markets, as traders assessed President Trump's comments on potential tariffs on US imports from the EU and China. However, concerns over US winter wheat conditions from low temperatures helped limit losses.

- Paris rapeseed futures dipped yesterday, pressured by Chicago soybean futures and uncertainties over President Trump's tariff plans. Selling by speculative traders also contributed. The May-25 contract fell €6.75/t to €527.00/t, while the Nov-25 contract dropped €5.50/t to €485.00/t.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

New crop UK wheat futures extend premium over old crop

Since 28 November, Nov-25 UK feed wheat futures have traded at a premium to the May-25 contract, with the price gap stretching to £5.00/t as of 22 January. This compares to an average discount of £7.57/t in July.

This could be partly due to pressure on old crop prices, driven by a disincentive to sell amid lower prices than recent years and a strong pace of wheat and maize imports. In addition, concerns about global supply and demand for 2025/26, including potential export declines from Russia, are likely supporting global and UK new crop prices.

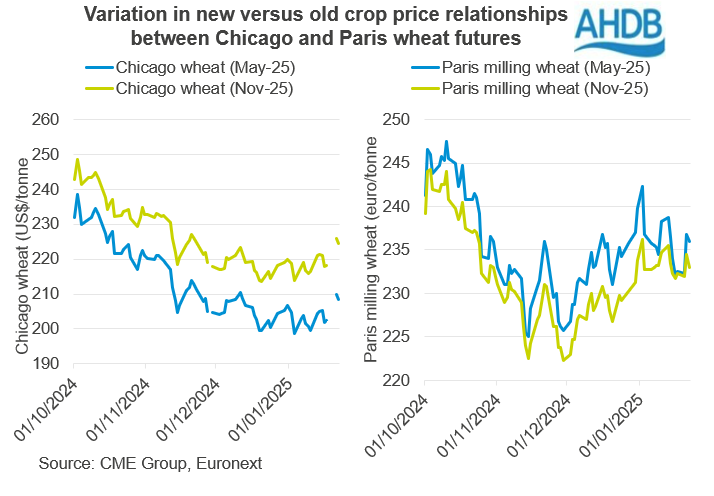

The US wheat market is showing similar trends, albeit with an even bigger spread between Chicago old and new crop futures prices. Yesterday, the premium between new crop (Dec-25) Chicago wheat futures and the old crop (May-25) contract stood at $16.17/t compared with average premium of $9.61/t in July. Chicago old crop prices are pressured by forecasts of larger stocks (USDA) and low demand this season (2024/25) with Soft Red Winter (SRW) export pace behind the five-year average. Also, concerns over winter weather kill offer support for new crop prices, as they raise uncertainties about future supply.

However, the Paris wheat futures market shows some variation. The benchmark new crop (Dec-25) contract was trading at a discount of €3.00/t to the old crop (May-25) contract yesterday, compared with average discount of €1.04/t in July. Old crop prices are supported by the smallest French wheat crop since the 1980s and a tighter supply outlook for the current season in the EU. Lower-than-expected yields and concerns over quality have led to low production and lower carryover for the EU. Meanwhile, both the French and EU wheat areas are expected to rise for harvest 2025, though the global concerns are limiting the price pressure.

Looking ahead

Global market conditions will remain a key driver of domestic price trends and will need to be monitored. But if the gap (or carry) between new and old crop UK feed wheat futures continues to widen, it could encourage more storage or forward selling of 2024 wheat for 2025 delivery. An historically large carry between May-24 and Nov-25 incentivised heavy stocks to be carried into the 2024/25 season.

However, AHDB’s Early Bird Survey shows a 5% increase in wheat area for the 2025 harvest, which points to a larger crop and potentially a lower year-on-year stock requirement. If confirmed, a larger crop could in turn start to pressure new crop prices, relative to world levels.

We will also need to watch both the old and new UK feed wheat price relationships to the world market for signs about if the grain import pace could slow or even start to encourage more exports.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.