Price carry into new crop stretching: Grain market daily

Tuesday, 23 January 2024

Market commentary

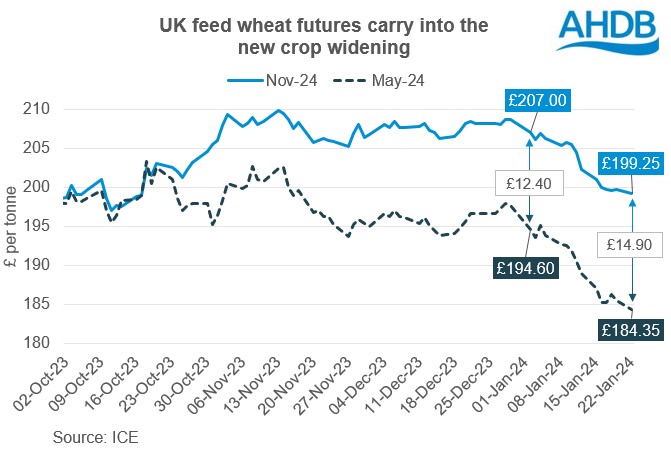

- May-24 UK feed wheat futures fell £1.10/t yesterday following loses in European prices to close at £184.35/t, the contract’s lowest price yet. The Nov-24 contract fell £0.50/t to £199.25/t.

- The European market again held a negative tone, with limited new export demand so far this week. There’s also reports of more competition from Black Sea wheat, which would usually pass through the Red Sea though shipments were limited by winter weather.

- Wet conditions continue to negatively impact 2024 winter crops across much of north-western, central, and eastern Europe according to the EU’s MARS report. There’s also likely to have been frost damage to crops in the Baltic states, after temperatures fell sharply in early January, though good snow cover likely protected crops in European Russia. In contrast, low rainfall is hampering crops around the Mediterranean Sea, with drought in Morocco.

- Paris rapeseed futures (May-24) fell €2.25/t to close at €431.50/t yesterday (approx. £369.50/t), while the Nov-24 contract lost €1.75/t to €431.75/t (approx. £369.50/t). Rapeseed declined due to lower palm oil and crude oil futures, though these both recovered in overnight trading.

- The Brazilian soyabean harvest was 4.7% complete by 20 January according to Conab, ahead of last year’s 2.0%. Planting of the Safrinha maize crop in Brazil was also 5.0% complete, compared to just 0.9% at the same point last year.

Price carry into new crop stretching

The gap or ‘carry’ from May-24 UK feed wheat futures to the new crop Nov-24 contract has stretched to nearly £15/t. The wider the price ‘carry’ between May and November, the greater the incentive to store or sell forward 2023 wheat for new season (2024/25) delivery to supplement the 2024 harvest.

A wider gap than in recent years is expected due to the higher interest rates and energy, increasing the cost of money and storage costs. However, the carry is the largest for the time of year in recent years. This points to the difference in expected UK supplies this (2023/24) and next (2024/25) season.

Wheat production in the UK is likely to fall in 2024 after the wet weather through the autumn disrupted winter planting. AHDB’s Early Bird Survey captured planting intentions as of early November and pointed to 3% drop in the wheat area. However, due to the weather remaining wet, AHDB is re-running the survey to provide insight into what the cropped area might be for harvest 2024. The results of this survey are due in the first two weeks of March.

Shifting relationships to Paris futures

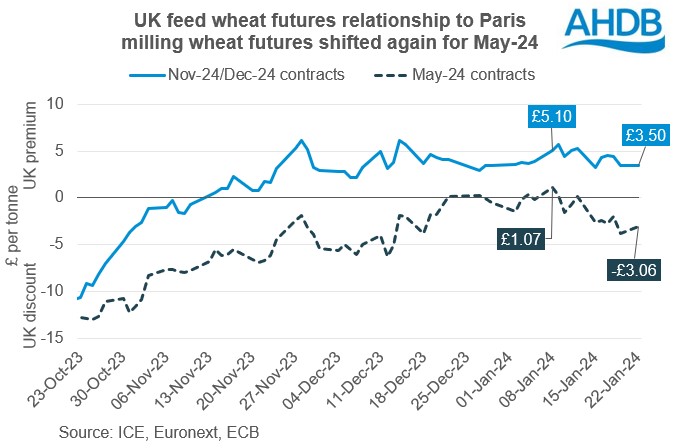

Due to the 2024 crop worries, new crop prices are supported relative to the global market. Nov-24 UK feed wheat futures are currently holding at around a £4/t premium to new crop (Dec-24) Paris milling wheat futures.

However, UK feed wheat May-24 futures have come under pressure recently, widening the carry to the new crop contracts.

While there’s been a general dip in global grain prices, UK feed wheat futures for May-24 have fallen by more. This may be linked to exchange rate changes, and/or UK 2023/24 supplies feeling heavier. e.g. slower demand or higher imports. Earlier this month, UK feed wheat futures for May-24 were at a premium to the Paris futures market, which would have made imported grain look more attractive than previously.

A marketing opportunity?

The carry offered in the futures market doesn’t always exactly line up with what’s offered in the physical market. So, it’s important to check with your local merchant(s) about the carry and what demand is there currently. However, if on-farm storage costs are less than the carry the market is offering, it could present a marketing opportunity. It’s worth noting though that the carry will continue to evolve as information on expected supply and demand in the rest of this season, and next season changes.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.