Old crop UK feed wheat at import parity following EU pressure: Grain market daily

Wednesday, 10 January 2024

Market commentary

- UK feed wheat futures (May-24) closed at £192.50/t yesterday, down £0.25/t from Monday’s close. While new crop futures (Nov-24) closed at £205.75/t, up £0.35/t over the same period.

- Both Chicago and Paris wheat markets were supported yesterday by strong global export business. Also, traders were monitoring a spell of cold temperatures in France, this comes after their rain-disrupted sowing campaign.

- It was announced yesterday by Egypt’s GASC that they had purchased 420 Kt of wheat in a tender, with the origin being Russian and Ukrainian wheat, which will be delivered between 29 February to 11 March.

- Paris rapeseed futures (May-24) closed at €432.25/t yesterday, up €4.75/t from Monday’s close. The new crop futures contract (Nov-24) closed at €424.25/t yesterday, up €4.00/t over the same period.

- Paris rapeseed futures gained with Chicago soyabean futures which were supported from technical buying and short covering. Further to that support, crude oil helped support the oilseed complex too. Nearby Brent crude oil closed yesterday at $77.59/barrel, gaining $1.47/barrel on Monday’s close.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Old crop UK feed wheat at import parity following EU pressure

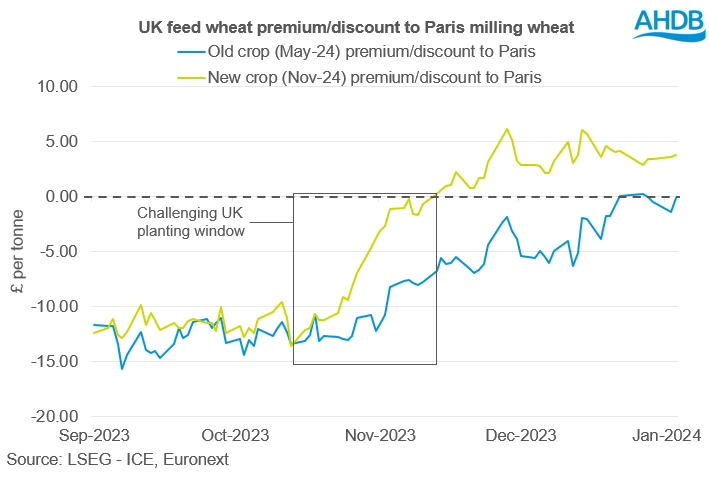

Throughout the months of September and October, both the May-24 and Nov-24 UK feed wheat futures were trading at a discount to the respective comparable Paris milling wheat futures.

However, as we progressed towards the end of 2024, the UK’s trading relationship with the continent changed. New crop (Nov-24) UK feed wheat futures are now trading at a premium to Paris (Dec-24). This premium is reflective of the wet Autumn in the UK which has led to a challenging sowing campaign. While old crop futures (May-24) are now trading at parity to the continent.

This changing relationship to the continent is due to pressure on the Paris milling wheat futures contracts. Since the start of November, UK feed wheat futures (May-24) have fallen 2.0%, while Paris wheat futures (May-24) have been pressured by 7.6%, in sterling terms.

What is causing this pressure on the continent?

There are multiple reasons for the pressure on continental prices over the last couple of months.

- The first is the euro strength against the US dollar. Since the start of October, the euro has strengthened 4.3% against the US dollar. This strong currency has meant that EU wheat supplies have not been as competitive on the global export market, hindering their export campaign. As at 07 Jan 2024, the EU has exported 15.8 Mt of wheat according to Eurostat data, 51% of total forecast exports (European Commission). This export campaign lags the last two years (2021/22 and 2022/23) when export progress was at 16.1 Mt and 17.8 Mt to the same week, respectively (Eurostat).

- Competitive Black Sea supplies continue to weigh, picking up global demand - Russia’s second consecutive bumper harvest at 90 Mt for 2023/24 bears significant influence over the global grains complex. Russia is expected to export a record 50 Mt during 2023/24 (USDA). Although some ag consultancies forecast this may be slightly under 50 Mt now.

- Another parameter weighing on continental prices is large imports of Ukrainian wheat into the EU. The EU Commission currently estimate Ukrainian imports (year to date) at 3.3 Mt, accounting for 66% of wheat imports for the EU so far this marketing year. Total EU imports (season to date) of wheat are at 5.0 Mt so far, with 58.6% of those imports going to Spain. Large Ukrainian supplies coming into the EU are causing pressure on Paris futures, which have to reduce to be more competitive, with the cheaper Black Sea origin.

What could we expect for UK feed wheat

The old crop UK domestic price is going to be even more reactive to price movements on the continent from the pressure on Paris milling wheat futures. The changing pricing relationship to the continent will limit any significant exports of UK’s old crop wheat.

As for new crop, futures are now at a premium to the continent which is signalling that the UK could possibly be in a wheat deficit for the next marketing year, with the prospect of a lower harvest 2024 production from a lower wheat area. The Early Bird Survey will be re-run early this year, when the weather allows, to gain further insight into possible changes in UK planting intentions.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.