Larger EU wheat and barley crops in 2025: Grain market daily

Friday, 20 December 2024

Market commentary

- UK feed wheat futures for May-25 lost £1.70/t yesterday to settle at £188.20/t under pressure from global wheat markets. US wheat futures all hit new contract lows yesterday due to competition in export markets with the Australian and Argentine harvests advancing, and a strong US dollar. Selling by speculative traders was also likely a factor. However, there was support for new crop UK feed wheat futures; the Nov-25 contract gained £0.30/t to close at £191.95/t.

- This morning Russia announced it has set its wheat export quota for 15 February – 30 June 2025 at 10.6Mt. This is slightly below the 11.0 Mt announced by the Eurasian Economic Union last month.

- Key oilseed futures markets rose yesterday amid technical trading and buying by speculative traders after falling sharply on Wednesday. The gains were led by Winnipeg canola and Chicago soyabean futures. But despite yesterday’s bounce, prices remain lower this week due to expected large South American soyabean harvests and demand worries.

- Paris rapeseed futures for May-25 gained €3.50/t yesterday to settle at €510.25/t (approx. £421/t). However, the Nov-25 contract gained €9.75/t to settle at €464.50/t (approx. £383/t).

Larger EU wheat and barley crops in 2025

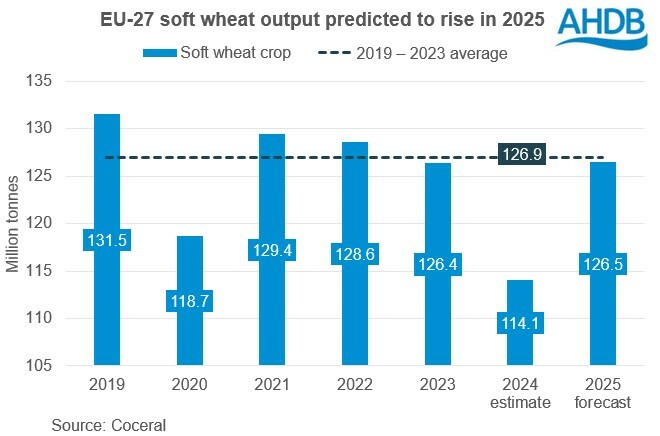

Both Stratégie Grains and Coceral predict an 11% larger soft wheat (exc. Durum) crop for the EU-27 in 2025. Private forecaster Stratégie Grains forecasts the EU-27 2025 crop at 126.6 Mt vs 114.2 Mt this year. Industry association Coceral is only 0.1 Mt lower for both its estimate of the 2024 crop (114.1 Mt) and its projection for 2025 (126.5 Mt).

The increased crop figures follow expanded areas due to improved weather conditions compared to the very wet conditions in autumn 2023. Data from the French government earlier this week reported a 8.7% rise in soft wheat area for the EU’s top wheat producer. Meanwhile, this morning data from the German government shows a 12.3% recovery in winter wheat area. Germany is closer than France, neither of these countries’ areas return to their 2019 – 2023 averages.

Despite this, at 126.5Mt, Coceral’s prediction for 2025 EU-27 crop would only just fall short of the 2019 – 2023 average of 126.9 Mt. This could keep pressure on prices.

This season, despite a smaller crop, nearby Paris milling wheat futures prices fell below year-earlier levels each month from July to November. They are only edging above in December so far. This follows slow EU exports amid competition from Black Sea origins and sluggish global demand. This pressure in European markets contributed to year-on-year falls in UK prices. So as we look ahead, Black Sea 2025 crop sizes will be important to the EU export level and prices, with implications for UK prices.

Differing views on barley

Stratégie Grains expects only a minimal rise (+0.3Mt) in EU-27 barley output in 2025 to 50.6 Mt. Area drops are expected to almost offset a recovery in yields. However, Coceral predicts a larger (+1.5 Mt) rise to take the crop to 51.9 Mt, with both the area and yield up from 2024. Winter barley areas are down again in both Germany and France, suggesting increased focus on spring barley areas.

The EU-27 recorded only a small recovery in barley output in 2024 from the 12-year low in 2023. However, like wheat, sluggish EU exports and global demand for barley have weighed on prices. Unless we see recovery in demand or smaller crops elsewhere in 2025/26, a larger EU barley crop could weigh on EU prices, with likely knock-on impacts for UK values.

Both forecasters also point to larger maize crops in 2025.

Christmas publications

This is the last Grain market daily of 2024; our next report will be on Thursday 2 January 2025. So, we would like to take the chance to wish you a very happy Christmas and prosperous 2025.

Our weekly Arable market report will resume on Monday 6 January 2025.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.