Analyst Insight: UK feed wheat prices set for another year of losses, but where next?

Thursday, 19 December 2024

Market commentary

- UK feed wheat futures (May-25) settled at £189.90/t yesterday, down £1.35/t from Tuesdays close. The Nov-25 contract also lost ground, closing at £191.65/t, down £0.85/t over the same period.

- UK wheat prices followed global markets down yesterday with both Chicago and Paris wheat futures closing down too. The fall in wheat prices comes, despite a possible cut in Russian output (see more below), due to the US dollar strengthening to the highest level since November 2022 against a number of currencies. Driving the rise in the US dollar was the US Federal reserve suggesting yesterday a slower pace to rate cuts in 2025 (LSEG).

- May-25 Paris rapeseed futures closed down by €11.75/t yesterday, to settle at €506.75/t. Rapeseed prices were pulled down by soyabean prices, with Chicago soyabean futures hitting new contract lows for all contracts yesterday. Again, the strengthening of the dollar pushed prices down along with further reports of bumper South American crops and concerns over slowing demand from China.

UK feed wheat prices set for another year of losses, but where next?

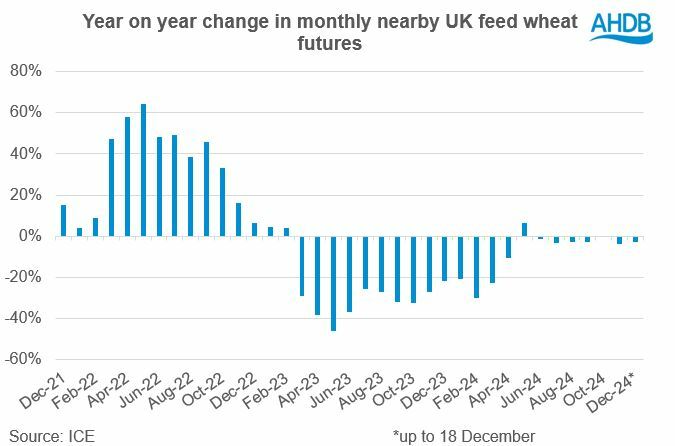

As it stands (up to 18 Dec), December is on track to be the seventh consecutive month that UK nearby feed wheat futures have been lower on the year. The monthly average nearby UK feed wheat price for December is currently £179.88/t, 3% lower than December 2023. Furthermore, the average nearby UK feed wheat futures price for 2024, as whole is currently £17.09/t lower than 2023 levels at £178.87 and a staggering £91.55/t lower than the 2022 average. In fact, the current 2024 average price is the lowest since 2020.

While globally, the supply and demand of wheat is somewhat finely balanced this season, there have been enough bearish factors to prevent a rally in prices. Firstly, Russia have been quite literally sending wheat out by the boat load, at an extremely competitive price, which has been putting a dampener on markets. We’ve also seen somewhat lacklustre growth in demand for cereals globally this season. Prospects for next season’s US wheat crop have improved too, with much needed rains advancing crop conditions and alleviating concerns there. Larger maize crops are also expected in 2024/25, weighing down on wheat markets.

Domestically, a below average size wheat crop this year, has meant we have needed to import greater quantities of grain, largely higher quality grain for milling. This greater reliance on imported milling wheat has led to UK markets being even more influenced by what is going on in global markets. Furthermore, sterling strengthening to multi year highs against the euro recently has capped any gains for UK commodity prices.

Looking ahead to the new year

As we move into a new year, what could 2025 hold for UK wheat prices? Obviously, with the lack of a crystal ball we cannot say for certain. Likewise, there are the big unknowns, such as any weather events globally or geopolitical events that could swing markets in either direction. What we do know currently is yes, US crop conditions have improved, and the market is expecting a bumper wheat harvest from Australia, along with large South American maize crops. On the other hand, while EU wheat production is expected to return to more typical levels next season (yield dependant of course), the balance of supply and demand is expected to be tight. Likewise, this week the Russian consultancy SovEcon have cut its projections for Russian wheat output in 2025 by around 3 Mt to 78.7 Mt, on the back of poor crop conditions. While obviously very tentative at this point, could this mean fewer exports from Russia in 2025/26 and even the back end of this season?

A massive watch point for early 2025 is going to be US policy changes following the inauguration of Trump in January. There have been some concerns that substantial changes to policies around trade, tariffs and energy under the new administration could have a negative impact on US agricultural markets and thus a watch point for global price movement. However, on Tuesday, a US government funding bill that was released suggested the use of E-15 gasoline all year round. Currently E-15 gasoline (15% ethanol) is banned for use from July to September. If realised, this policy change would mean greater demand for maize in bioethanol production and could have a knock-on positive impact on wheat markets.

On average, 2024 UK feed wheat prices are going to finish the year down on year earlier levels for the second year running. As it stands at the moment, the sentiment in the market is somewhat neutral – there are enough bearish factors to outweigh the bullish ones. That said, who knows what 2025 will bring? We cannot foresee the future. However, now is a good time to reflect on why decisions were made to sell or in fact not sell grain over the past year. Looking at the factors that led you to sell grain in a certain way can help develop your marketing strategy going forward.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.