How much grain are we carrying into the new season? Grain market daily

Thursday, 26 September 2024

Market commentary

- UK feed wheat futures (Nov-24) ended unchanged yesterday, closing at £182.00/t. The May-25 contract ended the session at £196.25/t, down £0.20/t from Tuesday’s close.

- Domestic wheat futures moved sideways yesterday as pressure from competitive Black Sea supplies was largely offset by adverse weather impacting winter wheat plantings in Russia. SovEcon said yesterday that the planting of Russia’s wheat crop is off to the slowest start in 11 years due to drought conditions.

- Nov-24 Paris rapeseed futures closed at €480.00/t yesterday, up €0.50/t over the session. The May-25 contract gained €2.50/t over the same period, to close at €487.00/t.

- European rapeseed prices followed support in the US soyabean market yesterday on the back of dryness in Brazil. More dry and warm weather is due over the Mato Grosso, the key soyabean producing region, in the coming week.

How much grain are we carrying into the new season?

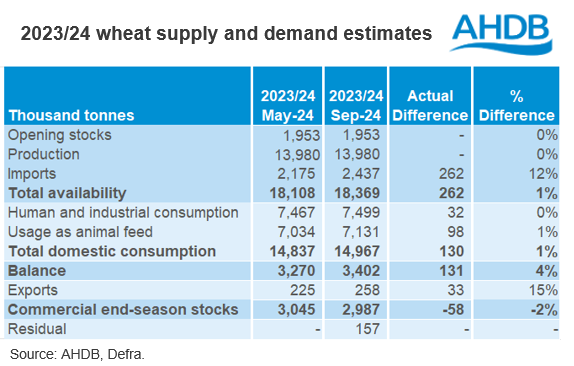

Earlier today, the final balance sheets for the 2023/24 season were published. The final balance sheets take into account full season official statistics. However, it is important to note that this year an adjusted figure has been used for the wheat and barley end of season stocks.

After reviewing last season’s data, and collecting anecdotal evidence from industry, it is clear that the unusually high level of imports last season were not fully accounted for across the stocks surveys. As well as some gaps in the merchants, ports and co-ops (MPC) data, an abnormally high volume of wheat was also held in futures stores as at the end of June. Both of these gaps have now been accounted for in the adjusted figure. In order to avoid any future misreporting in the MPC figures specifically, a review of this survey will be carried out, and actions implemented before the release of the February 2025 stocks data.

The end of season stocks for wheat and barley now sit at 2.987 Mt and 1.218 Mt respectively. For wheat, this closing stocks figure is the highest since at least 1999/2000, and just below the 3.045 Mt estimated in May.

This heavy wheat ending stocks figure will partially offset the forecast decline in wheat production this season (2024/25). However, if domestic consumption is to stay relatively in line with recent trends, the UK will still rely on firm wheat imports this season to cover the lack of domestic supply.

Why do the balance sheets not balance?

After the full season statistics were taken into account, residuals were identified for wheat, barley and maize, while a deficit for oats has been identified. While in theory, a balance sheet should ‘balance’ when all aspects of supply and demand are considered at the end of the season, as much of the data is collected through surveys, we can expect to be left with a residual or deficit on home grown grain.

Of course, while there will always be a margin of error in any survey, due to comprehensive coverage in the market, we can be fairly confident in the reliability of the trade data and cereal usage surveys. Despite the fed on farm figure perhaps being less reliable, we know that the figure is unlikely to see great fluctuations year on year, and it has been estimated based on market conditions last season. As such, as in previous years, we are left with the Defra production (2023) and on farm stocks figures.

For wheat, a residual of 157 Kt has been identified. While there is no available confidence interval for UK production, the confidence interval on England production (91% of UK crop) for 2023 is +/- 245.9 Kt. For on farm stocks in England and Wales as at the end of June 24, the confidence interval is +/- 206 Kt. As such, the wheat residual is more than accounted for within these intervals.

Similarly, for barley, a residual of 112 Kt has been identified. The England 2023 production figure (69% of UK crop) has a confidence interval of +/- 192.2 Kt. On farm barley stocks as at the end of June 24 in England and Wales had a confidence interval of +/- 80 Kt. Again, indicating that this barley can be accounted for within these figures.

Finally, for oats, a deficit of 35 Kt was identified. The confidence interval on England production (77% of the UK crop) in 2023 was +/- 53.3 Kt. For on farm stocks in England and Wales as at the end of June 24, that interval was +/- 30 Kt on the 16 Kt estimated.

As such, while there is some margin of error in survey results for usage, as well as some uncertainty in the fed on farm figure, we are confident that the majority of this season’s residuals/deficit sits within these production and stocks figures.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.