Market support from Ukraine-Russian relations: Grain market daily

Wednesday, 23 February 2022

Market commentary

- UK feed wheat futures (May-22) closed yesterday at £228.00/t. This is up £5.00/t from Monday’s close. The Nov-22 contract gained slightly less, up £3.30/t from Monday, to close yesterday at £208.30/t.

- Paris rapeseed futures (May-22) gained €13.50/t yesterday, to close at €729.50/t. Yesterday’s gains extended price rises to 3.7% since Friday’s close. The new crop contract (Nov-22) continues to gain at a slower pace, rising €6.25/t yesterday, to €632.75/t. Another contract high.

- Brent crude oil (nearby) gained 1.5% yesterday, to close at $96.84/barrel. This is the highest close since September 2014.

Market support from Ukraine-Russian relations

Grain and oilseed markets saw support yesterday, from rising Russian-Ukrainian tensions.

World leaders reacted to Russia’s recognition of the separatist held areas of Donetsk and Luhansk in Eastern Ukraine. As well as the deployment of troops to these areas. In response, Germany halted the natural gas pipeline, Nord Stream 2. This saw oil prices continue to reach highs last seen in 2014. Financial sanctions on Russia (from the EU, US, and UK) were also announced in a bid to prevent further escalation.

As a result, global wheat and maize futures rose, from concern to supply disruption from these key exporting countries.

Vegetable oil prices also gained support from escalating tensions. Sunflower oil supply is a key concern. On average, Russia and Ukraine account for 75.7% of global sunoil exports (2016/17-2020/21). Current forecasts peg their 2021/22 global share at 78.3% (USDA). There are already some reports of delayed shipments from Ukraine.

Demand for rival vegetable oils could rise as a result, supporting prices. Malaysian palm oil (May-22) gained 2.9% yesterday to close at 5,840MYR/t (c.$1,395/t). Also supported by curbed Indonesia exports.

Chicago soyoil (May-22) climbed 3.6% yesterday, to close at $1,544.54/t. Soyoil is supported by Black Sea tensions and continued South American production concerns.

South American weather

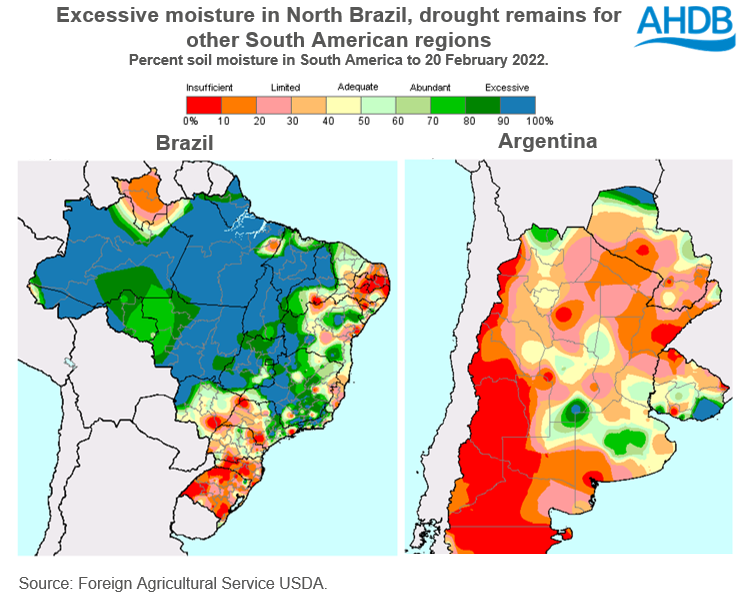

Brazilian soyabean harvest is 33.0% complete (to 19 Feb), up from 15.5% the previous year (Conab). Though Mato Grosso has been hit by excessive rain, bringing quality into question. Whereas the Southern Brazil and Northern Argentina continue to look dry.

Argentinian soyabeans are reportedly in a key yield forming phase, though crop conditions are worsening. Official data suggests 7.8Mt of the 42.0Mt* 2021/22 crop is already sold.

*Buenos Aires Grains Exchange forecast

What does this mean for UK prices?

For grains, Black Sea tensions provide short term support globally, as concerns grow for supply availability. Volatility will continue as news progresses, including for UK feed wheat futures. Though longer term, new season supply news will affect prices.

Oilseeds will see the same story, following developments between Russia and Ukraine. Though South American production is still a key market driver for soyabeans too, adding support to the wider oilseed complex. Combined, these will impact Paris rapeseed futures and in turn, domestic prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.