Market Report - 21 February 2022

Monday, 21 February 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

.PNG)

Maize

.PNG)

Barley

.PNG)

In the short term, tightness in old crop supplies and uncertainty over Black Sea exports supports markets. Major global exporter stocks could start to recover in 2022/23, which could pressure prices from current high levels.

The potential for smaller South American crops continues to support maize markets. The six-month outlook reflects the end of the 2021/22 maize marketing season, which could be tight, especially if there’s any delay to the US harvest.

Old crop global barley supplies remain tight. As a result, prices continue to follow those for other grains until more is known about the new crop picture.

Global grain markets

Global grain futures

Wheat prices fluctuated day-to-day last week on news about the political situation in the Black Sea but ended the week higher. Exports from the region are continuing but disruption remains a risk.

Old crop wheat supplies remain tight, though global wheat stocks could start to recover in 2022/23. The International Grains Council (IGC) project production and consumption at new records. Global ending stocks are expected to rise year-on-year, though exporter carryovers are still expected to be smaller than average.

Russian and French winter wheat crops continue to look good, but parts of the US remain dry. In Texas, crops are reaching ear emergence and so are more sensitive to adverse weather. The crops are in a poorer condition than last year, pointing to lower yield potential (USDA). New crop conditions will have a growing influence on prices in the weeks ahead.

The IGC’s first projection of the 2022/23 world barley harvested area is little changed year on year. So, yields will be key to production.

For maize, the impact of dry weather in parts of South America is still the focus. Early Argentinian yields have been poorer than expected (Rosario Stock Exchange), but there’s still a lot to harvest. Overall maize conditions also worsened week-on-week. The Buenos Aries Grain Exchange rated 19% ‘excellent/good’ as of 16 February. This is down 9 percentage points week-on-week. More rain is needed for later planted crops and although there is some forecast this week, the volume will be important.

Rain is also expected for southern Brazil. The Brazilian second (Safrinha) crop is being planted so this rain could prove timely to help support early development.

UK focus

Delivered cereals

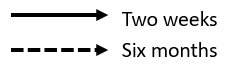

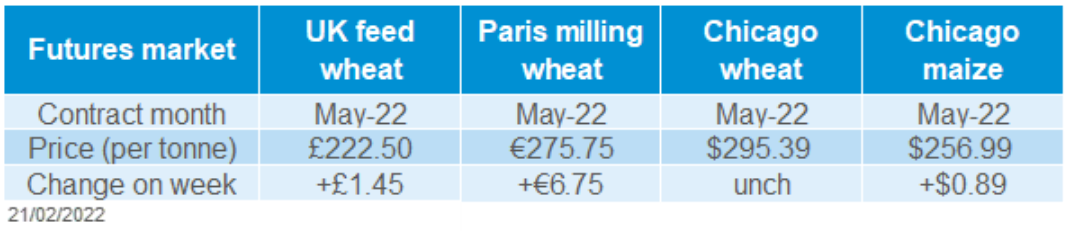

UK feed wheat futures gained last week (Fri-Fri) following the global trend, though new crop prices rose more than old crop prices. The May-22 contract gained £1.45/t to end Friday at £222.50/t, while the Nov-22 contract rose £2.85/t over the week to £204.00/t.

However, the uncertainty in the global market reportedly slowed trading, as it made managing risk through hedging more difficult.

Old crop delivered bread wheat premiums over May-22 futures continued to ease last week as mills acquired more cover. It also looks like UK prices are capped by the cost of importing grain. For example, on Thursday 17 February, bread wheat delivered to the Northwest in May-22 was £283.00/t. This equated to a premium of £65.00/t over May-22 futures, down from £66.50/t on 10 February and down from a peak of £70.00/t on 27 January.

Oilseeds

Rapeseed

.PNG)

Soyabeans

.PNG)

Rapeseed supply remains tight until the new season. Therefore, prices remain volatile to Black Sea tensions due to concerns around reduced availability. Longer term, fundamental support remains for vegetable oils.

Global supply and demand remains tight, with South American production cuts and Chinese demand. The long-term dial still represents the old crop market, with its tight stocks. New season US plantings are expected to be large.

Global oilseed markets

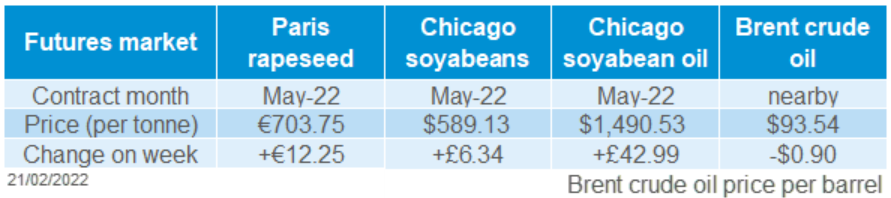

Global oilseed futures

Chicago soyabeans futures (Nov-22) closed on Friday at $537.78/t, up $7.25/t on the week. Gains were made on continued concerns for South American production and how this may narrow global availability. Support also came from strong US net export sales, including to China. US markets are closed today for Presidents Day.

On Thursday, the Bolsa de Cereales de Buenos Aires released its latest crop condition report. The proportion of Argentinian soyabeans rated as ‘excellent/good’ fell 6 percentage points from the previous week, to 31%. Argentinian soyabeans are in the critical phase for yield formation now. Heavier rainfall is due in these final days of February, though rain in some areas still looks less than average. Rain may benefit some soyabean crops, though damage may already be done in some areas.

Rain in Brazil too may delay the ongoing soyabean harvest.

Paraguay has also been badly affected dry conditions. As a result, production estimates have halved, to 5Mt (Soybean and Corn Advisor). Soyabeans in Paraguay are now reportedly 80% harvested and crushers are aware supplies are set to ‘run out’ by the middle of the year. This means that Paraguay may have to import soyabeans in volume for the first time, adding to a tightening global supply and demand picture.

Indian traders have reportedly signed deals to import 100.0Kt of US soy oil and 30.0Kt of Black Sea soy oil (Refinitiv). This US purchase is unusual for the major vegetable oil importer. Demand shifting to US soy oil comes as South American soyabean crop forecasts are reduced, Black Sea tensions cause concern for Black Sea sun oil availability, and strong palm oil prices.

In response, Chicago soy oil futures (nearby) gained up 3% week-on-week, to the highest point since July 2021.

Rapeseed focus

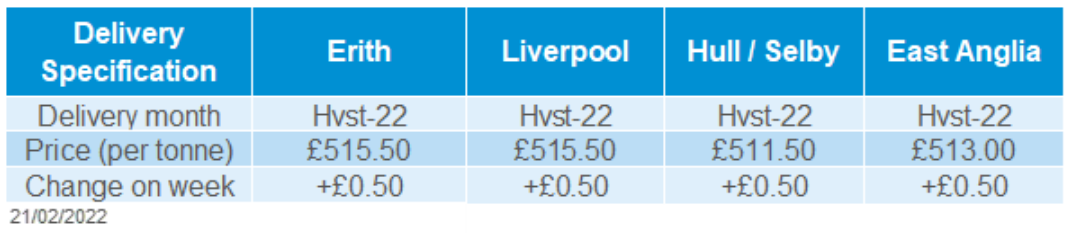

UK delivered oilseed prices

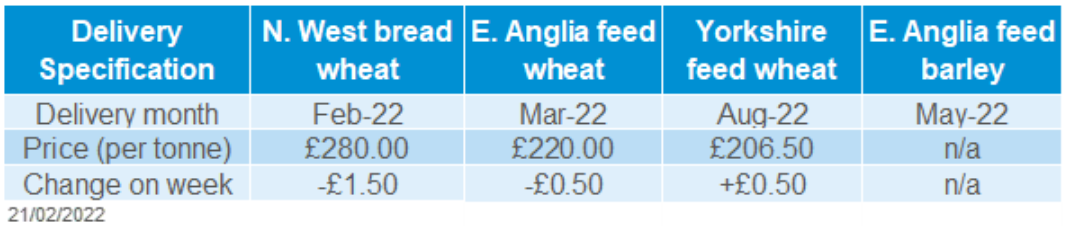

Paris rapeseed futures (Nov-22) gained €3.25/t last week, to close on Friday at €620.00/t. The global rapeseed supply and demand balance remains tight, and the market is sensitive to new news on availability. As a result, prices are following the Black Sea tensions closely and have seen volatility in recent weeks.

UK delivered prices followed Paris futures prices last week. On Friday, rapeseed into Erith for harvest delivery was up £0.50/t from 11 February to £515.50/t. For delivery into Erith in Nov-22, quotes on Friday were up £1.00/t on the week, to £524.50/t.

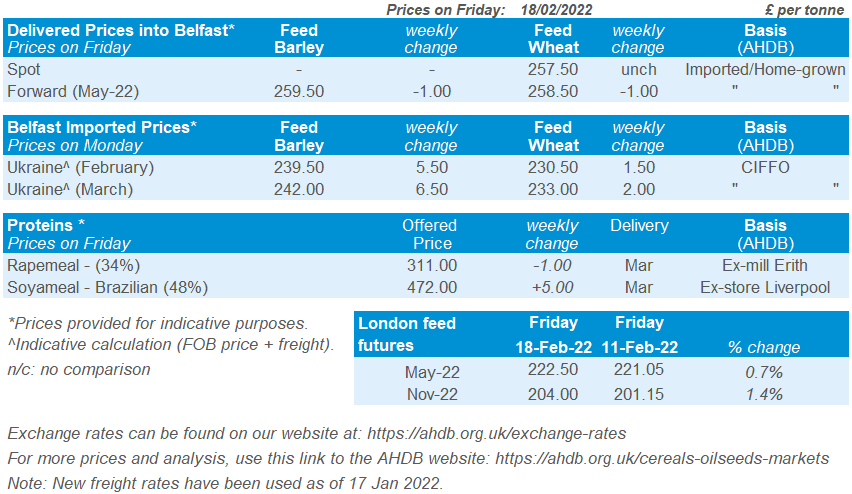

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.