Market Report - 07 February 2022

Monday, 7 February 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

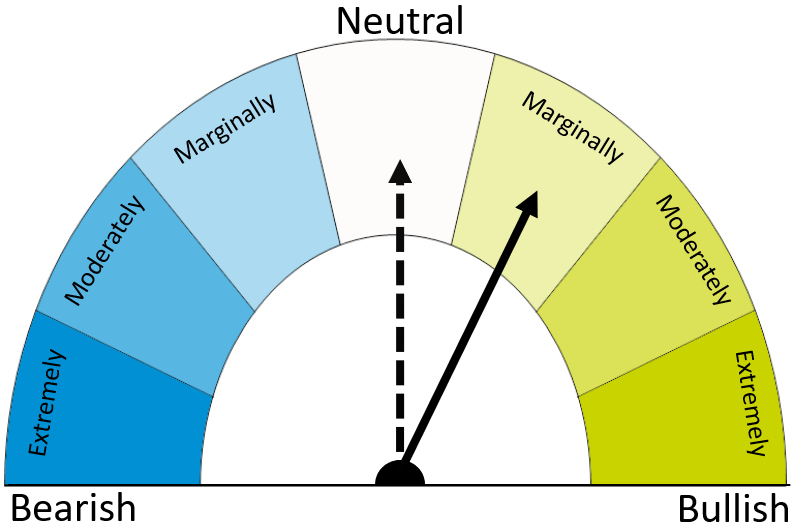

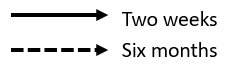

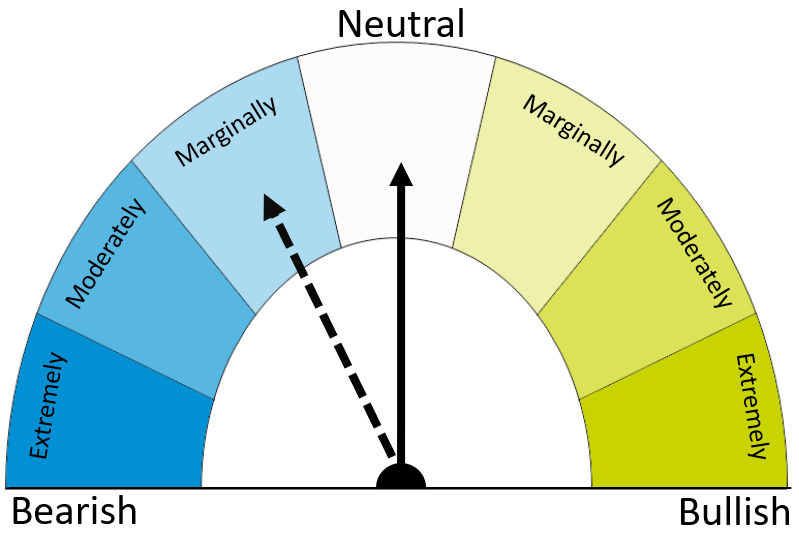

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Conditions for 2022/23 crops are starting to exert more influence on the market, with a rebound in production expected. But, low stocks and tensions in the Black Sea remain underpinning factors for now.

Maize

Confirmation of crop issues in South America keeps support in the market in the short term. Longer-term, the outlook depends on the size of the Brazilian Safrinha crop, US maize area, and whether higher prices reduce demand.

Barley

The global market will remain tightly supplied until the 2022/23 harvests begin. But, a rebound in production could bring prices down from their current high levels.

Global grain markets

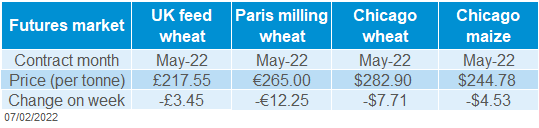

Global grain futures

Wheat prices fell again last week after Black Sea exports seemed to be continuing without interruption. Future price rises remain a possibility if trade comes under renewed threat. For now, easing trade concerns and rain in the US winter wheat areas (previously too dry) are weighing on wheat prices.

Wheat prices recovered some of the losses on Friday due to technical trading and buying by speculative traders. Traders reportedly began to square positions ahead of this Wednesday’s USDA report.

Meanwhile, concerns continue about South American maize supplies. AgResource cut 3.8Mt from its estimate of the first maize crop in Brazil following drought. The local USDA office also cut its Brazilian crop estimate to 2.0Mt below the official January USDA forecast.

However, the longer-term outlook remains uncertain. The Brazilian Safrinha crop is being planted and rain will be crucial in the coming weeks. Current prices could also incentivise farmers to plant more maize.

In addition, there are signs that prices could be starting to limit demand. US export sales were lower than expected and US ethanol stocks rose. China also cancelled 380Kt of maize shipments from the US. Cancellations aren’t uncommon once the South American harvests start but this was a particularly large cancellation. Export levels will be important this week as Chinese traders return to the market after the Lunar New Year.

Global barley production could rise 6% year on year to 154.0Mt in 2022/23, according to Stratégie Grains. If confirmed, this would still be below 2020/21 levels but in line with 2019/20. A rebound in production would mean pressure for prices, from the current high levels.

UK focus

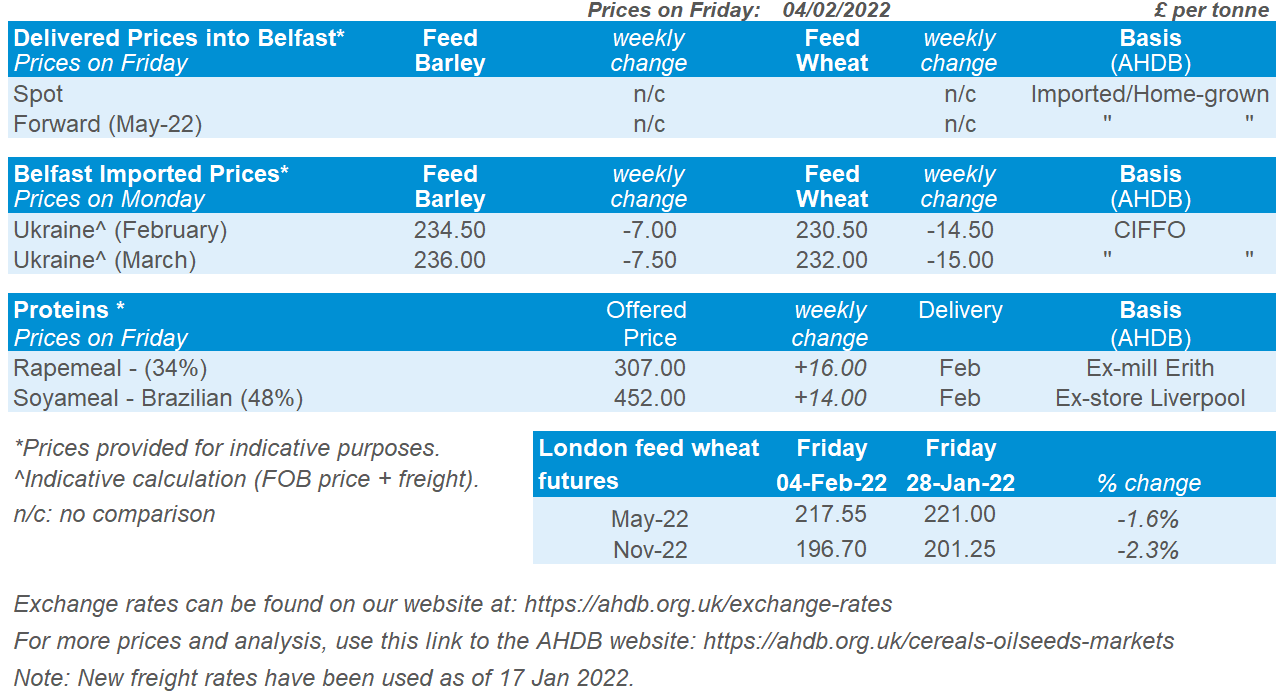

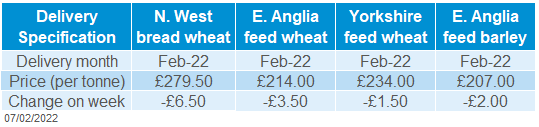

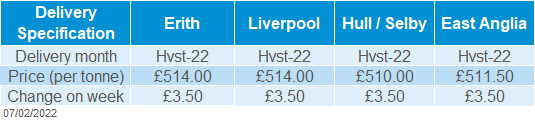

Delivered cereals

Both old crop (May-22) and new crop (Nov-22) UK feed wheat futures fell last week, following the global market.

Delivered feed wheat prices followed suit (Thu-Thu). The premium for old crop bread wheat over May-22 futures also eased slightly, as flour millers reportedly increased their supply coverage. On Thursday, bread wheat delivered to the North West (May-22) was £68.00/t more than the May-22 futures. This is down from £70.00/t a week earlier.

The latest cereal usage statistics show that brewers, maltsters, and distillers used 165Kt of barley in December. This is the highest monthly volume of barley so far this season and is 21% more than December 2020. We’ll need to see if the trend continues, but the numbers are encouraging given the tightening of COVID restrictions late last year.

In December, GB compounders used more wheat and oats, but less barley and maize in their rations than a year ago. This continues the trend of the first five months of this season (Jul-Nov).

UK oat millers used 122Kt of oats from October – December 2021, down 11% from the same period in 2020.

Oilseeds

Rapeseed

Rapeseed markets continue to be volatile and trade separately to soyabeans. The outlook for 2021/22 will remain tight until new crop harvest in July.

Soyabeans

Markets await this week’s USDA report, but there is scope for large cuts to production estimates, tightening the S&D picture further for 2021/22. Longer-term, northern hemisphere planting intentions will influence pricing.

Global oilseed markets

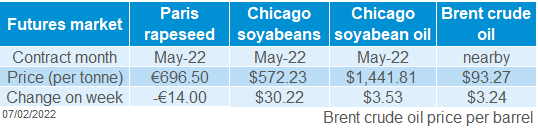

Global oilseed futures

There is a bullish sentiment in the air as markets await this month’s USDA world agricultural supply and demand estimates (WADSE), due out on Wednesday.

Money managers extended their net long positions in week ending 01 February to 18.8%. They added 41.4K Chicago soyabean futures contracts to their net positions, increasing it to 149.4K contracts. This is the most bullish view from money managers since May 2021.

Across the week (Friday-Friday) Chicago soyabeans (May-22) gained $30.22/t to close the week at $572.23/t. Yet another contract high was reached. Dryness in South America continues to be a driving force in soyabean markets, with little rain in the nearby forecast.

There is expectation that the USDA will cut its production forecasts this week. The current (Jan) Argentine estimate sits 4.5Mt above the latest Buenos Aries Grain Exchange estimate of 42.0Mt. As a result of reduced production, the trade anticipates greater demand for US soyabeans, leading to reduced US ending stocks (Refinitiv pre-report poll).

Nearby oil futures markets (soy and palm) continue to trade near historic highs. Crude oil futures (nearby) are also trading at high levels, closing Friday at the highest price since September 2014. Strong oil markets will continue to support oilseed markets.

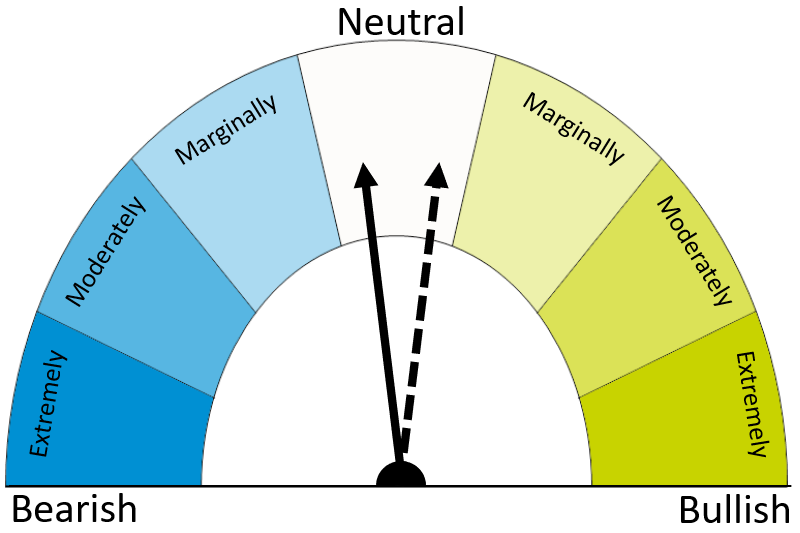

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (May-22) lost ground last week (-€14.00/t or 2.0%) to close Friday at €696.50/t. The contract is currently very volatile, with trading occurring in a €21.50/t range on Friday.

The euro strengthened 2.7% from Friday to Friday against the US dollar and 1.7% against sterling (Refintiv). When the euro strengthens it often makes commodities (from Europe) less competitive on a global market and pressures prices.

Because the pound weakened against the euro, the drop in rapeseed futures (May-22) was softer in pound terms, dropping £1.39/t or 0.2%.

New crop futures (Nov-22) are also trading in a large range, with Friday’s trade in a €11.00/t range. It closed the week at €600.00/t, down €13.00/t (2.1%) from the previous Friday’s close. Similar to old crop, in pound terms the contract only lost 0.4% or £1.98/t.

Physical delivered prices were quoted higher than a week before (28 Jan) for harvest delivery, but it is key to note that the survey was undertaken in the middle of the trading day.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.