The exchange rate impact: Grain market daily

Friday, 4 February 2022

Market commentary

- UK feed wheat old crop contract (May-22) closed down £0.50/t yesterday to £214.50/t. Whereas, the new crop contract (Nov-22) closed down £1.60/t yesterday to £194.55/t. This fall followed global wheat contracts.

- Argentina’s soyabean harvest forecast for 2021/22 has been trimmed by 2.0Mt by the Bolsa de Cereales, to 42.0Mt on lower yields and lower planted area because of drought.

- The latest US ethanol figures show production to remain strong, with 1041K barrels per day produced in the week ending 28 Jan 2022 (up 0.6% from previous week). Though stocks increased too (up 5.6% from previous week).

The exchange rate impact

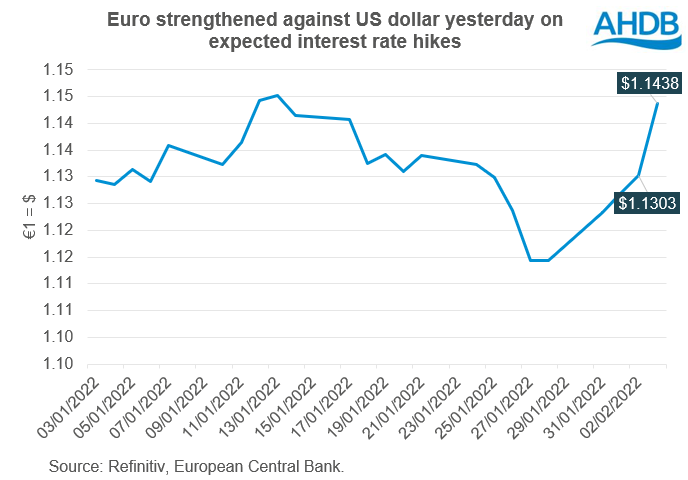

Yesterday, the euro gained considerable strength against the US dollar, with a recorded close of €1=$1.1438 (Refinitiv). This was a rise of 1.2% from the previous day.

Strengthening was a result of the European Central Bank raising concerns over rising inflation, causing thought that the timing and pace of interest rate hikes may be faster than expected (Refinitiv).

Why does this matter to grain and oilseed markets?

As result of a strengthening euro, the market reacted with increasing export concerns. This is because a stronger currency often results in exports becoming less price competitive and imports more price competitive.

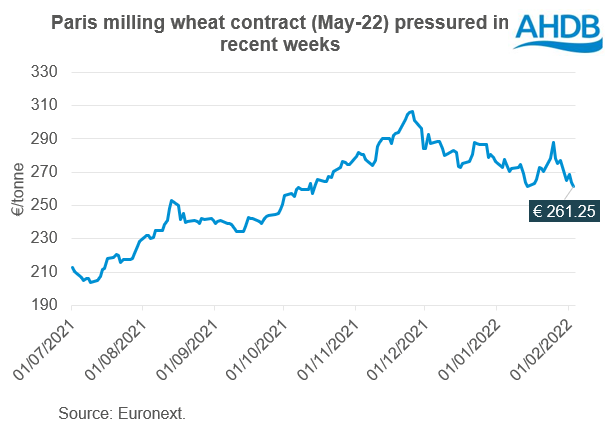

This concern, along with falling Chicago wheat (May-22) futures, saw Paris milling wheat (May-22) prices fall €2.75/t yesterday to €261.25/t.

With the UK trading at import parity, UK feed wheat also followed the price down. The May-22 contract fell £0.50/t yesterday to £214.50/t.

According to Refinitiv, price falls this week have meant that French wheat has now become price competitive for a Moroccan tender. Whereas in Germany, previous lack of farmer selling from falling prices and port premiums have meant exports have been difficult.

We also saw Paris rapeseed (May-22) futures fall €8.75/t yesterday, to close at €707.25/t.

Markets are currently sensitive to new news, especially considering Ukraine/Russian tensions. There remain hints the ECB are considering an interest rate hike sooner rather than later. Should this happen, and not be priced in already, we could see possible further euro volatility and possible volatility also for European grain and oilseed futures. Something to watch for UK old crop prices too.

UK focus

Yesterday, the Bank of England raised interest rates from 0.25% to 0.5%, due inflation concerns.

In response, we saw sterling strengthen by 0.1% to the US dollar to £1=$1.3595. Sterling has since traded down against the US dollar again this morning. Yesterday, sterling also weakened (down 1.0%) against the euro £1=€1.189, as the euro saw considerable strength.

According to a Refinitiv poll on 2 February, the median forecast expects sterling to weaken against the dollar to £1=$1.3500 in the 1-month and 3-month trajectory. Though to 6 months, forecasted to rise to £1=$1.3600.

Should performance of the euro remain strong too, in the short term (old crop) import and export attractiveness may be impacted. Though with the UK a global price follower, other factors may impact this.

Current competitiveness of imported grains to domestic grains can be followed using UK import parities.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.