Market Report - 01 June 2021

Tuesday, 1 June 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

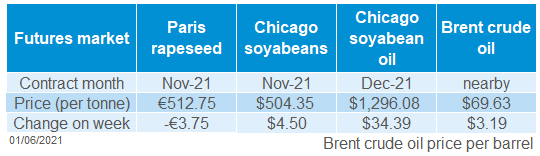

Paris rapeseed futures (Nov-21) followed a similar path to soyabean futures last week, falling early on before recovering ground towards the end of the week. Friday to Friday, Nov-21 rapeseed futures were down €3.75/t, closing at €512.75/t on Friday.

Rapeseed markets remain tight, and the balance of supply and demand through next season will likely keep rapeseed towards the top of the oilseed complex.

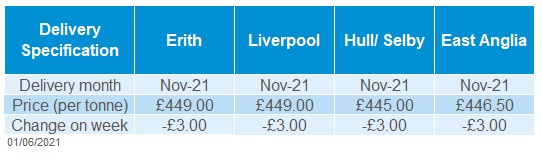

The AHDB delivered oilseed rape price survey pegged OSR, delivered into Erith (Nov) at £449.00/t, on Friday, down £3.00/t on the week.

Last week we provided an in-depth update of UK supply and demand by crop. On Wednesday, we focussed on rapeseed, concluding that markets will remain tight and leaving UK prices supported relative to global levels.

Wheat

Large crops are still expected in most major exporting regions currently and this has calmed market sentiment. The price relationship to maize is important to prevent too much demand switching from maize to wheat.

Global grain markets

Maize

Low stocks in major exporting countries keep an underlying level of support for prices. Market reaction to reduced Brazilian crops has been muted, so what size crop is priced in?

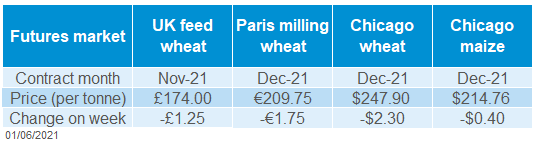

Global grain futures

Barley

Demand for barley as animal feed could slip back next season as UK wheat availability recovers. This is limiting the ability of new season barley prices to rise relative to other grains.

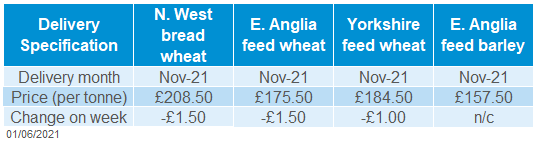

UK focus

Delivered cereals

Global grain prices fell slightly last week (Friday-Friday), but this hides a big variation. Prices slipped down in the early part of last week, due to better weather in the US. Also, the Kansas crop tour showed strong yield potential for wheat.

However, prices rose sharply on Thursday. This was due to more dry weather in US spring wheat areas, buying by speculative traders, and confirmation of big US maize export sales. The market eased back on Friday ahead of the three-day weekend in the US and UK.

Yesterday, Paris Dec-21 wheat futures rose €2.75/t, to €212.50/t, driven by potential EU export sales to Saudi Arabia.

The International Grains Council (IGC) cut 6.3Mt from the Brazilian maize crop to 98.5Mt. This is 3.5Mt below the most recent USDA estimate. The IGC estimate is still higher than private forecaster Safras and Mercado of 95.2Mt. This reduced the global maize end of season stock forecast, while higher animal feed demand, especially in China, led to cuts in global wheat stocks.

Parts of the US had colder weather over the weekend and into this week. This could negatively impact spring wheat and newly-planted maize crops. The USDA will release its first estimate of 2021 maize crop conditions tonight.

Conditions in Europe continue to look mostly positive. However, more rain is needed in Russia to maintain crop potential. SovEcon trimmed its forecast for the 2021 wheat crop from 81.7Mt to 80.9Mt. In 2020, Russia harvested 85.9Mt (inc. Crimea).

Oilseeds

UK feed wheat futures (Nov-21) ended the week slightly lower (Fri-Fri), following the global market.

AHDB published its latest estimates of UK cereal supply and demand on Thursday. They include the first estimates of 2020/21 end of season stocks for wheat and barley. There is a marked year-on-year drop in stocks of both wheat (-51%) and barley (-27%). Meanwhile, oat stocks are set to rise.

Animal feed rations are likely to feature more wheat next season, at the expense of barley. This, and the lower carry-over stocks, means that UK wheat supply and demand will remain tight next season.

For barley, how brewing demand recovers as COVID restrictions ease will be an important factor for supply and demand at the end of this season and into 2021/22. CGA report that 76% of licensed premises were open in GB, at the end of May. This is up from 67% on 17 May and 33% at end-April.

On Thursday, AHDB will release data on cereals used in April.

Rapeseed

Rapeseed supply and demand remains tight into next season. But, a relief of pressure in the soyabean market and wider oilseed complex is pulling out some of the rapeseed support.

Global oilseed markets

Soyabeans

At present there appears to be a lack of “bullish” news for soyabeans and good soyabean planting progress in the US has tempered prices. That said, stocks (excluding China) remain tight next season.

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

Global oilseed markets fell for much of last week, before recovering the lost ground. From Friday 21 May to Friday 28 May Chicago soyabean futures (Nov-21) gained 0.9%.

There has been pressure for soyabeans over the past couple of weeks as positive conditions in the US have allowed plantings to continue at a strong pace. Despite being behind industry expectations, 79% of US soyabean intentions were in the ground in the week ending 23 May. The latest figure pegs progress 21 percentage points (pp) ahead of the five-year average.

Tonight’s crop report from the USDA will give the latest planting and emergence update.

Managed money funds were sellers of soyabeans in the week to 25 May. The net long position as a percentage of open interest was trimmed by 1.4 pp to 16.6%.

Last Thursday, the International Grains Council (IGC) published its latest supply and demand estimates. The IGC pegged global soyabean stocks in 2021/22 at 50.6Mt, up 125Kt on the previous report. World stocks, excluding China, are pegged at 15.3Mt, down 190Kt on the last report.

One key watch point for oilseeds is the impact of coronavirus on palm oil processing in Malaysia. The country has seen cases spike in recent weeks. While nearby palm oil futures have fallen back from their recent peak (19 May) they remain at very elevated levels.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.