UK wheat to remain tight in 2021/22: Analyst's Insight

Thursday, 27 May 2021

Market commentary

- UK feed wheat futures (Nov-21) continued their losing run yesterday, dropping another £0.40/t, to close at £170.50/t.

- Chicago maize futures (Dec-21) have paused on their recent fall, gaining both yesterday and in early trading today. Demand from China is still a major watch point for maize markets.

- The market has seemingly gone quiet of any fresh weather stories, which had been the key driver in recent weeks. That said, conditions remain dry in South America, and concerns over maize crop size in Brazil are far from over.

- The latest UK cereal balance sheets have been published this morning, detailing estimates as at 1 May 2021.

UK wheat to remain tight in 2021/22

This week we have had a focus on the UK arable crop supply and demand. Our focus started with a view on barley on Tuesday, and continued yesterday with a look at OSR. Today’s piece focuses on wheat, rounding off the old crop (2020/21), before taking a look ahead to some of the key new crop drivers for UK supply and demand.

A tight end to 2020/21

The latest UK cereal balance sheets have been published this morning. This further highlights what has been an incredibly tight season for wheat. With exports now estimated at 180Kt, a deficit in operating stocks of 302Kt is estimated.

Essentially, this means that going into the new season, the market is short of 302Kt of wheat, and that will need to be made up either through a timely UK harvest, or new season imports. We have already heard talk of new season wheat being booked, and this is something that will need watching closely. A delay to UK or EU harvests could drive some short-term market volatility towards the very end of the season.

Production not enough to balance the books

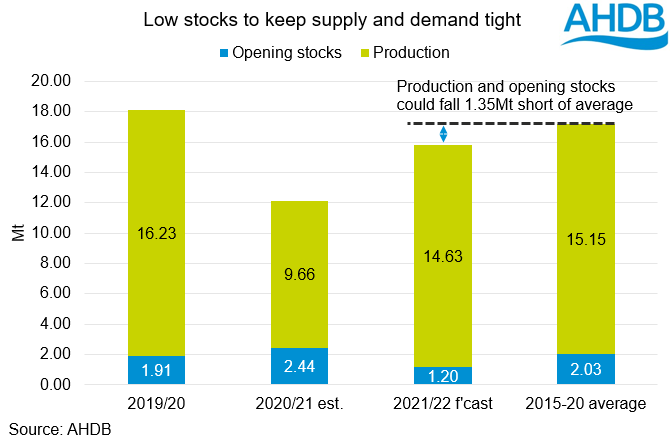

Looking ahead to next season and it is clear to see that production is highly unlikely to be enough to balance supply and demand. In a recent piece of analysis, I estimated GB wheat production at 14.6Mt. Adding an average Northern Irish wheat crop and the tight opening position for 2021/22, UK availability before imports would be 1.35Mt short of the 2015-20 average.

Since that analysis, we had an exceptionally dry April leaving many concerned for the impact on UK crops. However, a washout May has rejuvenated expectations of crops. That said, it would take a miracle for production to reach the 15.98Mt required to hit average levels of supply.

Demand uncertain as restaurants return

With supply remaining tight into next season, we need to think about the demand for wheat. A possible positive for the milling industry is the return of food service. This season has been rocked by coronavirus. However, demand for wheat by the human and industrial sector is only estimated to be down 5% on pre-pandemic levels. As such, the scope for increased milling demand is limited.

That said, developments in coronavirus and the Indian variant in particular need monitoring for future demand trends. At present, we can say that it is highly likely that we will see increased home grown wheat usage, although this will be dependent on yield and quality.

One area where we are likely to see increased wheat usage, either domestic or imported, is in the industrial market. The move to E10 increases demand for ethanol, and with the discount of maize to wheat very narrow, wheat looks like a favourable feedstock.

Another potential driver of increased demand for domestic wheat in particular is the reopening of Vivergo. This is likely to happen in early 2022, we have highlighted the potential impact of the move to E10 in previous articles.

Wheat back in the ration

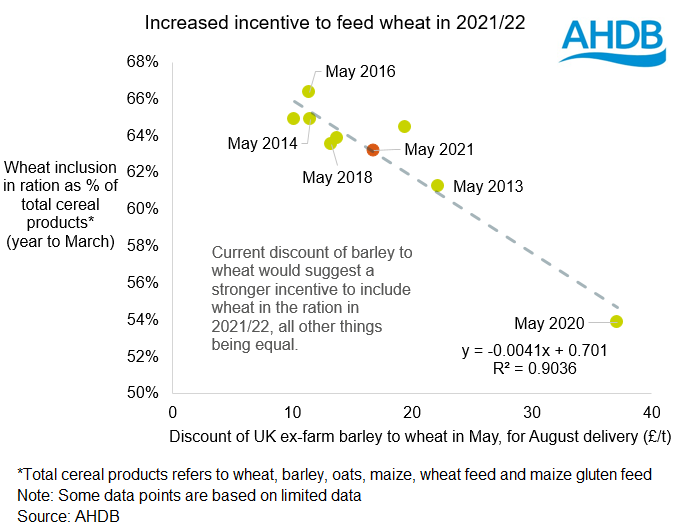

In the most recent balance sheet, we have highlighted the beginning of a return to wheat in the ration, driven by the collapsing spread to barley. In May 2020/21 ex-farm barley for August delivery was worth £40.10/t less than wheat. This discount; which grew across much of the season, drove a flurry of inclusions and exports, tightening the barley balance.

With barley now scarce and production likely reduced next season, the discount has narrowed. This reduction drives an increased interest in wheat inclusions in the ration.

The discount of barley to wheat (ex-farm United Kingdom, August delivery) in May, has narrowed in once more and now sits in line with five year average levels. This reduced discount of barley to wheat implies a reduced incentive to use higher volumes of barley in the ration as we move into the new season.

Of course, the actual volume used will depend heavily on how quickly diets can move away from the high inclusion of barley. This may mean we see lower than typical inclusions of wheat at the beginning of 2021/22.

The balance remains tight

Taking into account reduced availability of wheat, before exports, and a potential for increased demand, we are likely to see a strong incentive to import. This means that UK prices will need to stay towards the top of the global market.

In the short-term, with a deficit carried into the market we could see increased volatility depending on the timing of harvest in both the UK and the EU. Moving forward, we will need to pay close attention to yields in order to identify the volume of imports required throughout next season.

With the UK having a strong need to import next season, both global grain markets and currency will be key watch points for the UK market. We have covered the former at length in recent weeks, and will continue to monitor key global trends.

For currency, recent strength against the dollar has made imports cheaper, quashing prices. Ongoing pandemic recovery both in terms of global health, but also in terms of economic recovery for key states, will be vital to setting the direction of prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.