UK barley; what's changed domestically? Grain market daily

Tuesday, 25 May 2021

Market Commentary

- New crop UK wheat futures (Nov-21) closed yesterday at £172.10/t, losing £3.15/t on Friday’s close. Yesterday marked the opening day for the May-23 UK wheat contract, which ended the day at £171.45/t.

- An improving weather forecast for the US winter wheat crop saw global wheat prices decline yesterday as yield concerns for the crop are eased. A US crop tour forecast record yield potential for the Kansas winter wheat crop following beneficial rains. Kansas is a top wheat producing state for the US.

- Egyptian state grain buyer (GASC) bought 240Kt of all Romanian origin wheat in its latest tender yesterday. The lowest purchase price was at $254.00/t (£179.31/t) excluding freight. Romania will be a key wheat exporter next season with a bumper wheat crop expected.

UK barley; what's changed domestically?

This article is the first in a series this week on changes to crop fundamentals ahead of the third release of the AHDB balance sheet on Thursday.

Barley markets have turned increasingly tight in recent months, with prices rising as a result. This is reflective of the short supply of grains as a whole at present. In addition, with maize prices near record highs, there are few alternatives to pressure feed barley markets.

Barley supply

In our February estimates, the domestic supply balance of barley was cut 674Kt to 2.3Mt. This was 708Kt tighter year-on-year and largely a result of increased feed consumption levels and a reduced production figure by Defra. Production is estimated at 8.11Mt, the largest since 1988.

Next season, estimated production is 7.2Mt, down 900Kt from 2020/21, according to the USDA FAS. The vastly reduced spring barley area planted this season, down 30% according to our Early Bird Survey, is the main driver of this. Despite a lower production figure, the burden on barley from feed markets should ease if forecasted wheat production levels are achieved.

This season, 19% more feed barley had moved between January to week ending 13 May against last season, according to our Corn Return figures. Over this period, average feed barley prices have increased £29.40/t to £176.90/t, a clear prompt for increased movement off farm.

Barley demand

Feed consumption

Domestic feed markets have provided incentives for barley prices to increase. Gains in global maize prices throughout 2021 have lifted prices for feed markets as a whole.

In April, the domestic situation for grass growth was of concern with a sustained lack of rainfall. This increased the need for feed grains, with potential for fed on farm rates to rise. Since then, increased rainfall has returned grass growth levels to be healthily above the five year average.

Whilst we await animal feed manufacturing figures for April, the season to March numbers highlight the huge role barley has played this season for livestock feed markets. Barley usage in feed manufacturing is up 41.1% from last season. This was reflected in February’s balance sheet, with usage at 5.31Mt, up 423Kt on the November forecast.

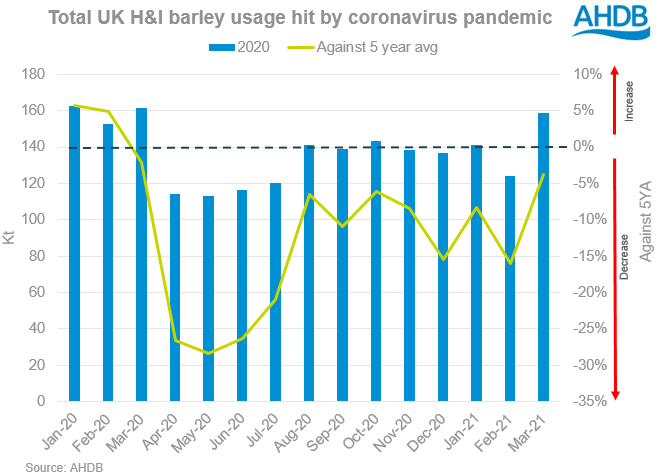

Human and industrial consumption

Barley usage for brewers, maltsters and distillers (BMD) has declined 12.6% from last season in data to March. As we know, the closure of the hospitality and events industry to a purely take-away basis (if businesses can offer this) has reduced demand.

Anecdotal comments state malt production has been improving since March, as the industry prepared for the easing of lockdown measures in April and beyond. Since April 12, when consumers were permitted to return to pubs, demand has reportedly ramped up. An estimated 32.9% of GB total licensed premises had traded by the end of April, according to the CGA.

Now that sit-in hospitality is permitted too, it is expected that demand will be on its way to a return to pre-covid levels before the end of the season, with more licensed premises re-opening. However, the event calendar will continue to feel lasting effects from the pandemic, with 26% of UK music festivals cancelled this year, according to the Association of Independent Festivals.

Exports

The front-loaded barley export schedule that took place this season ahead of the EU-exit has impacted on domestic availability. The threat of hefty no-deal tariffs saw 985.8Kt exported ahead of January 2021. Since then, only 159.6Kt has been shipped, in data to March - 40% lower than January - March 2019/20. Equally, as the domestic price has gained over this period, incentivising barley to remain on UK shores for feed availability.

Conclusion

The opening few months of 2021/22 should bring a better level of H&I consumption for barley markets. In addition, current forecasts point to sustained feed demand. Given the predicted lower production volumes, strengthening domestic demand factors could provide support for prices. However, feed barley prices in particular will also depend heavily on maize prices. Keep an eye out for the next instalment of this crop focus series tomorrow where Anthony will cover rapeseed, together with the release of our supply and demand estimates on Thursday.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.