Domestic rapeseed; from net-export to net-import: Grain Market Daily

Wednesday, 26 May 2021

Market Commentary

- New crop UK wheat futures (Nov-21) closed yesterday at £170.90/t down £1.20/t on Monday’s close.

- Pressure on the global wheat market is due to a strong U.S. winter crop harvest outlook and spill over pressure from maize prices, where fair weather in the U.S. is outweighing Chinese demand and drought in Brazil.

- Further to that, the latest European crop monitoring (MARS) report released yesterday raised its yield forecasts for most winter crops. Forecast soft wheat yields are expected to reach 5.91t/ha, up from 5.86t/ha projected in April’s report.

- The AHDB Planting and Variety Survey provides the only pre-harvest planting view of grain and oilseed crops. Play a part in creating accurate data for your industry by completing the planting survey form. Five minutes of your time can provide huge value to our great industry.

Domestic rapeseed; from net-export to net-import

This article is the second in a series this week on changes to crop fundamentals ahead of the third release of the AHDB balance sheet on Thursday.

In this article, I am going to discuss:

- The domestic outlook for OSR in 2021 – looking at production, imports and consumption.

- The supply & demand of OSR for 2021/22.

- A finish concluding that supplies are going to be tight domestically and globally going into 2021/22.

2020/21 outlook

For this marketing year the UK produced 1.04Mt of OSR, 41% down year-on-year. Also, significantly below the 5-year-average (2015-2019) of 2.05Mt.

With the UK processing industry geared towards crushing OSR for edible use, this means imports have significantly risen in order to fulfil the large deficit from our low domestic production.

HMRC data currently shows that the UK has imported 503.7Kt of OSR from July 2020 to March 2021, way above the 5-year-average of 221.9Kt.

Interestingly, over 70% of the UK’s OSR imports this year are from outside the EU, further displaying the tight continental supply which has supported domestic values. This is expected to continue into next year too.

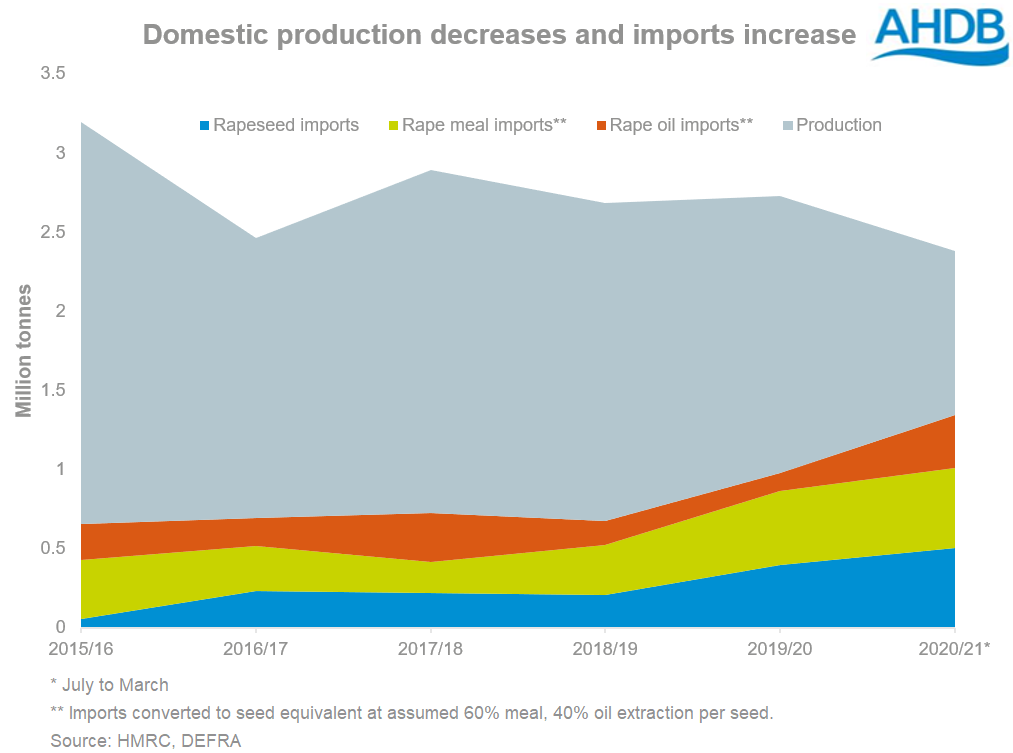

As displayed above, as the UK’s OSR production has reduced, imports of rapeseed, rape meal and oil have increased. I have converted the meal and oil into seed equivalent to show how imports of processed seeds are fulfilling our domestic deficit.

Rape oil and meal imports from July 2020 to March 2021 are up 71% and 55%, respectively on the 5-year-average. Accounting for over 840Kt of OSR if converted to the seed equivalent.

Despite the large imports of OSR, raw material into GB animal feed production has remained consistent for rape meal and cake. From July 2020 to March 2021, 542.6Kt has been used, near identical to the same period in 2019/20 where the figure was 541.5Kt.

OSR supply & demand

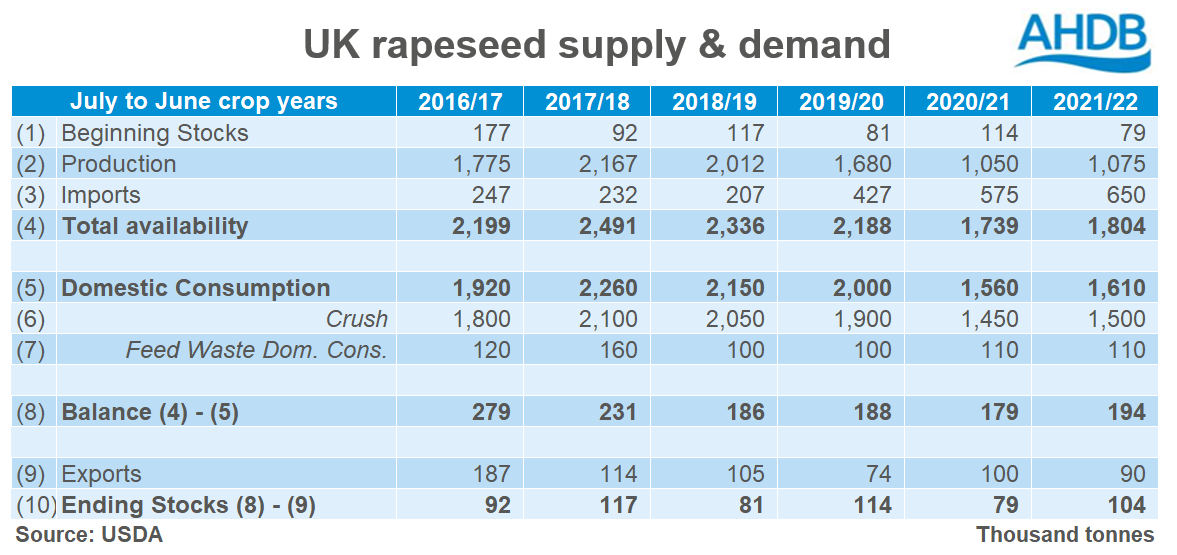

With the UK leaving the EU the USDA will now produce a supply & demand outlook for the UK. In May, initial estimates for the next marketing year were released.

At the end of the 2020/21 marketing year ending stocks are expected to tighten as low as 79Kt. However, for the 2021/22 marketing year there will be an increase in production (+25Kt) and an increase in imports (+75Kt) which will increase total availability for 2021/22 by 65Kt.

2021 production, crop conditions and prices

In the Early Bird Survey the 2021 OSR area was estimated at 312Kha, down from 380Kha in 2020.

Crop conditions and prospects are looking optimistic for better yields. As reported in the crop development report (conditions as of March), 41% of OSR is rated good to excellent, significantly increasing on the same time last year when that figure was 26%.

Further to that, the USDA’s preliminary estimates for harvested area for 2021 is at 315Kha with a yield of 3.41t/ha (up from 2.77t/ha in 2020).

We know that providing there is not any significant national pest damage to yield, our rapeseed crop for 2021 will be around the 1Mt mark, therefore we will require a significant number of imports again.

We have seen domestic prices significantly supported recently. Throughout May, rapeseed prices have been reaching record levels. On Friday 07 May, the AHDB delivered survey recorded Erith (Nov-21) at £477.00/t, surpassing the previous 2011 November high by £44.50/t.

Our domestic prices constantly trade at import parity to Euronext Paris rapeseed futures. However, as domestic supplies get tighter throughout the season our premium over Paris will increase.

For example, in July 2020 delivered prices (spot into Erith) were c. £5.00/t discount to Paris futures. But as of 21st May 2021, Nov-21 Erith delivered prices are at an £8.50/t premium to Paris Nov-21 futures.

With the supply of OSR expected to be tight both globally and domestically going into 2021/22 we could see significant support for the next marketing year. Furthermore, this support is currently incentivising OSR to be sown this summer for harvest 2022.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.