Rapeseed values to remain strong for 2021/22? Grain Market Daily

Wednesday, 24 March 2021

Market commentary

- Old crop UK wheat futures (May-21) closed yesterday at £199.00/t, gaining £1.25/t on Monday’s close. New crop (Nov-21) closed at £166.00/t, up £0.50/t from Monday’s close.

- Global wheat gained following soyabeans and maize values supported by rains across the U.S. Great Plains improving winter wheat conditions.

- Chicago soyabeans (May-21) closed yesterday at $522.96/t, up by $2.11/t, supported by strong soyoil demand. President Biden’s green energy policy push is seemingly increasing the appetite for bio-diesels.

Rapeseed values to remain strong for 2021/22?

It’s been well reported that for the 2021/22 marketing year, the UK and the EU will be in a deficit for rapeseed. As such, imports from third countries will remain critical.

Preliminary forecasts from the latest Stratégie Grains oilseed report shows that, while EU-27 production is predicted to increase (17.1Mt in 2021/22, up from 16.3Mt in 2020/21), imports are still to remain high at 6.2Mt and ending stocks forecast to be tight.

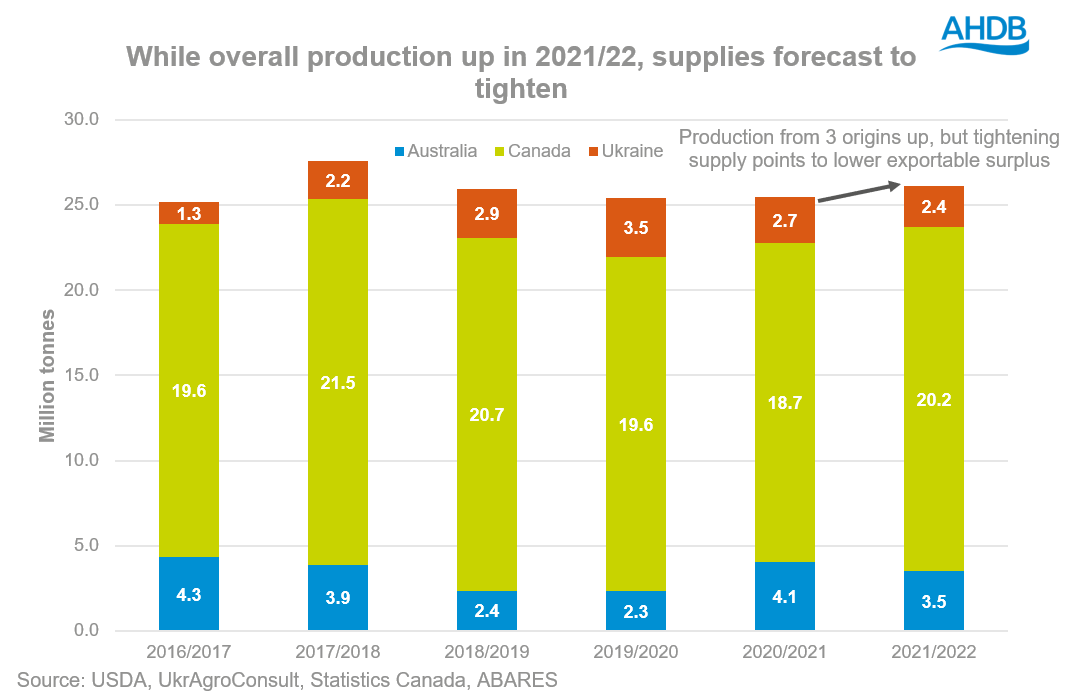

The three main suppliers for OSR into the EU are Australia, Canada and Ukraine. So far this marketing year, they have accounted for 95% of EU imports.

What’s the current outlook from these origins for rapeseed?

With the EU expected to rely on imports from these three countries for 2021/22, planting intentions and growing conditions in the areas could have a greater impact on the domestic price. With a tight domestic supply, both the EU and UK will be pricing near import parity to detract exports. Any potential supply concerns or opportunities from import origins will play a greater bearing on domestic prices.

Australia

Australia’s canola area is expected to increase. The La Niña rains this season alleviated the on-going drought, replenishing soil moisture levels for most. It is these moisture levels that will be a key watch point as we move into mid-April and the key sowing window.

Currently, soil moisture remains good in New South Wales. However, there are still pockets in the southern part of Western Australia with low moisture levels.

Canada

Despite increased production, total supply for 2021/22 is forecast to tighten to 21.0Mt from lower carry-in stocks, as Thomma detailed a few weeks back. Exports are predicted to fall by 5%, to 10.4Mt.

Soil moisture in the Canadian prairies will be the focus when planting commences in May, particularly the main growing regions of Saskatchewan and Alberta.

Ukraine

Crops are starting to emerge from dormancy in Ukraine now, so the temperature is key. Any snaps of freezing weather risk adverse crop effects.

Currently, the mean surface temperatures remain above 0°C coupled with slight precipitation deficits in the west. With the majority of OSR grown in central western regions, this is less of a risk.

The latest UkrAgroConsult report shows that 2021/22 production is at 2.44Mt, a slight increase on February’s estimate of 2.41Mt. This is from an increased revision in the seeded and harvest area.

Conclusion

Conditions in Canada, Australia and Ukraine will be key watch points for prices going forwards. While there is still plenty of the growing season ahead, swings in forecast production numbers either way could pressure or support domestic prices. Aside from the wider oilseed complex, crude oil and foreign exchange will be other key parameters in formulating domestic ex-farm values too.

More clarity will be available as the season progresses, with Statistics Canada publishing their planting and planting intention figures on 27 April and ABARES’s next Australian crop report due early June.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.