Analyst Insight: Green fuel, what could this mean for wheat prices?

Thursday, 25 February 2021

Market Commentary

- Old crop feed wheat futures closed at £206.75/t yesterday, up £1.75/t. New crop closed up also, gaining £0.45/t to close at £170.10/t. Feed wheat prices benefitted from both technical support and speculation surrounding the tight picture for old-crop EU grains.

- Chicago soyabean prices hit their highest level since 15 January, reaching $14.35/bu. This comes after heavy rains forecast for Brazil may cause further delays to harvest and planting of the second maize crop.

- With Brazilian harvest delays disrupting exports, analysts are expecting soyabean crushers in China to see a shortage which may see crushing reduced, inventories shrinking, and price rises until mid-April. Chinese soyameal futures prices rose 6% this month to $555/t.

- A study has been published on China’s new variants of African Swine Fever virus. Conclusions were that the strain causes milder disease in their pig herd, though this makes it harder to both detect and control.

E10 petrol set to launch in September 2021

Today, the government announced E10 fuel is to be available at petrol stations by September this year, as part of the government’s aim to meet net zero emissions by 2050.

The fuel is set to be compatible with 95% of petrol vehicles on the road, and all petrol cars manufactured since 2011. From summer 2021, you will purchase either E5 or E10 from your petrol station: E5 being available for those vehicles not compatible with E10.

E10 is a blend of up to 10% renewable ethanol with petrol and is reported to reduce carbon dioxide emissions by 750Kt a year, the equivalent to 350K less cars on the road.

Although new to the UK, E10 is already used in Australia, the US and Europe. China set out to implement E10 fuel by 2020, though last January suspended this plan due to tightening maize stocks and lack of capacity for production according to Refinitiv.

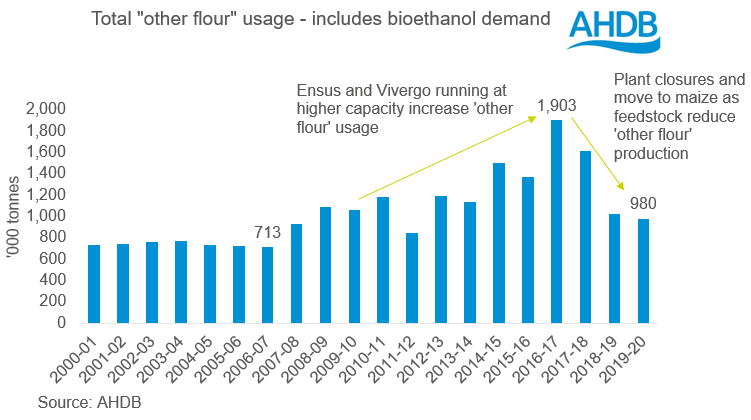

How will this impact on UK grains? Well, the E10 fuel is to be made from low grade grains, sugars, and waste wood that is produced and refined in the UK. Biofuel plants already running like Ensus are set for increased production. In the north east, Vivergo has now released a statement that it will open in early 2022.

What could E10 mean for the market?

A move to E10 could open up a more profitable avenue for bioethanol production increasing in the UK. With one plant currently mothballed and another running on maize, the incentive to move back to wheat (if competitively priced as a feedstock) to increase production is building.

So, let’s assume that we have two ethanol plants running building capacity in Q4 of 2021 and Q1 of 2022. Firstly, we must consider the overall supply and demand situation. We are likely to have the barest of wheat stocks as we leave the 2020/21 season, as outlined in the release of this week’s supply and demand estimates. Therefore, without a bumper 2021 wheat harvest, the supply and demand picture for 2021/22 is already looking tight. Add in more demand to the market and this tightness grows.

Regionally, this would manifest itself in greater delivered premiums for feed wheat in Yorkshire, and so lift the entire pricing complex of the east coast of England and even Scotland (assuming a tight market). So, there is the potential of good news in terms of ex-farm pricing for sellers.

We would also see a greater level of by-products being produced. Considering we are producing less rape meal due to a smaller crop, an increase in wheat-based distillers dried grains (DDGS) could replace rape meal in animal feed rations.

Given where we are today, an increase in wheat demand from bioethanol production in the UK would only be supportive to the market. Unless we see a significant increase in wheat production from harvest ’21 in both the UK and EU the market could face tightness for many months to come.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.