UK oat stocks to rise as exports drop off: Grain market daily

Friday, 28 May 2021

Market commentary

- Following a rise in global grain prices, Nov-21 UK feed wheat futures gained £4.50/t yesterday to £175.00/t. Global prices rose due to more dry weather in US spring wheat areas, buying by speculative traders, and confirmation of big US maize export sales.

- The USDA confirmed that China bought 5.8Mt of US maize last week in its weekly export sales report. The market had also expected that some large cancellations of old crop cargos, but this wasn’t the case.

- French wheat and barley crops are in better condition than last week (FranceAgriMer). For example, on 24 May 80% of soft wheat was rated good or very good, up from 79% the week before. The improvement follows rain in May.

- Paris Nov-21 rapeseed futures also rose €16.75/t yesterday to €512.75/t following a rise in soyabean and canola prices. This equates to roughly £440/t.

UK oat stocks to rise as exports drop off

We wrap up our week focused on the UK market with oats, the UK’s fourth largest combinable crop. We started with barley on Tuesday, covered rapeseed on Wednesday, and wheat yesterday.

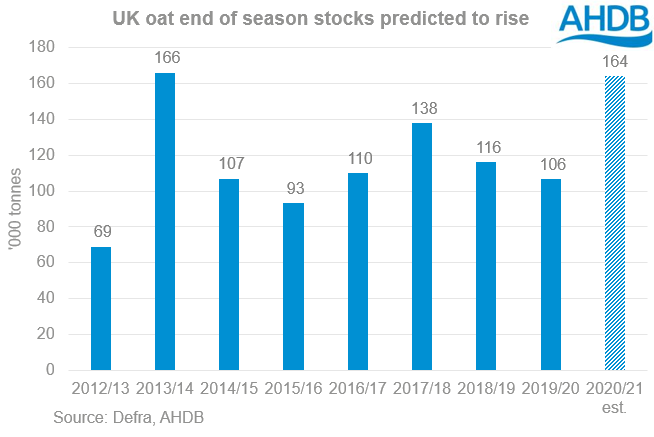

Total oat availability in 2020/21 is estimated at 1.16Mt. This is down 4% from 2019/20 due to smaller opening stocks and a slightly smaller (-45Kt) UK oat crop. Although availability is down year on year, we’re looking at higher carryout stocks. Stocks at the end of 2020/21 are estimated at 164Kt, 54% higher than last year’s low level and the highest since 2013/14.

The rise in stocks is largely because of a drop in exports. The total exportable surplus in 2020/21 is forecast at 40Kt. This is 10Kt less than was forecast in February, and 67% less than last season (120Kt). The reduction in the exportable surplus reflects the export pace to date (Jul-Mar) and larger domestic crops in import markets, such as Spain and Germany.

Mixed picture on demand

Total demand for oats is expected to rise 2% year on year to 954Kt. But, there are differing pictures between the milling and feed sectors.

- Milling volume eases back a little

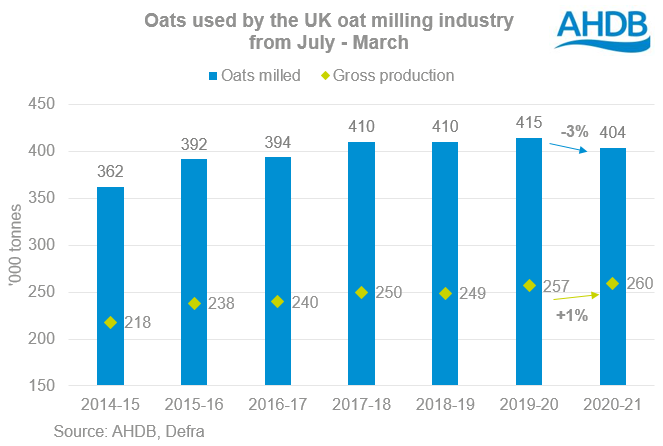

The amount of oats milled in the UK started strongly in Jul-Sep 2020, but it eased back in the Oct-Dec and Jan-Mar periods. The better quality of the 2020 crop means fewer oats result in the same gross production.

A total of 536Kt of oats are currently expected to be milled by the UK industry this season. This is 3% down year on year but in line with 2018/19.

- Animal feed usage remains high

Prices continue to give a strong incentive to use oats as animal feed wherever possible. As a result, total animal feed is expected to reach 384Kt in 2020/21. This would be the highest volume on records dating back to 1999/00.

In the week ending 20 May, the UK average spot ex-farm feed oat price was £131.90/t. This is £50.80/t below the spot feed barley price and £69.80/t below the spot feed wheat price. For wheat, the discount is similar to a month earlier (week ending 15 April). But, the discount to feed barley is far larger than last month’s £32.60/t, due to the rise in feed barley prices.

Higher stocks and a bigger crop in 2021/22?

AHDB’s Early Bird Survey of cropping intentions showed a small (+2%) rise in the UK oat area for harvest 2021. Using this area (214Kha), and the five-year (2016-2020) UK average yield of 5.4t/ha points to a 2021 crop of around 1.16Mt.

The five-year high yield of 5.9t/ha (2019) and five-year low (2020) yield of 4.9t/ha give a range of 1.05-1.27Mt.

With the discount of oats to other grains through spring, it is possible that we will see a reduced area planted. The results of the Planting and Variety survey will give more insight into the final area. They are usually out in July.

But, the information we have at present points to an oat crop in 2021 at least as big as the 2020 crop. If the crop size is similar or larger, the total supply before imports will be higher. So, it’s likely that UK free market oat prices will be under pressure into the new season.

However, it is important to draw a clear distinction between the price of oats for export and animal feed demand and the price of oats going into mills. The milling market, particularly in England, is heavily geared towards contracted supplies. These contracts will have been agreed 12 to 18 months ago, in line with wheat futures markets.

The value of contracted oats will likely be supported in line with the sentiment of the global grain market. So, they will likely see more support than “free market” oats.

More wheat is expected to come back into animal feed rations in place of barley, as the crop rebounds. Oats will need to keep competing for animal feed demand next season, to help to balance the market. Price is likely to be an important part of this competition.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.