Lower Chinese demand weighs on East Asian sheep meat imports

Friday, 2 December 2022

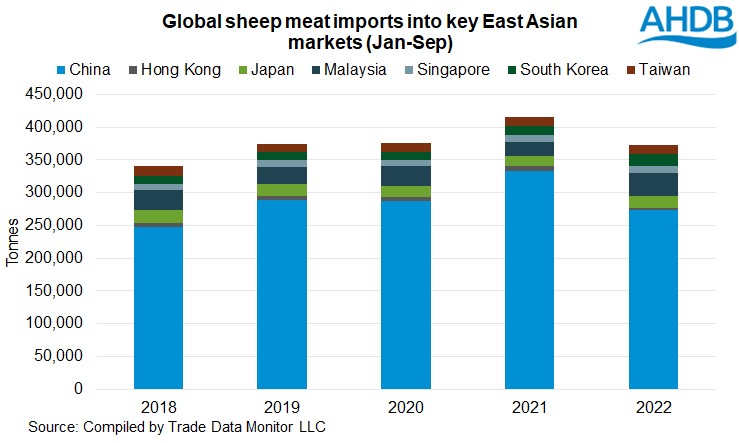

Demand for sheep meat in key East Asian markets has fallen overall so far in 2022 compared to the same period a year ago.

This has mainly been driven by lower Chinese imports, where stocks of sheep meat have reportedly built up due to an escalation of COVID restrictions. These restrictions have caused a rapid reduction in food service demand, where the majority of imported sheep meat is sold.

However, China remains the key market for sheep meat in the region, importing 273,200 tonnes of fresh and frozen product during the 9 months to September 2022. Although, this was back 18% year-on-year, closer to the volume imported over the same period in 2020.

Declines were seen in other markets, including Hong Kong and Taiwan, but from much lower bases.

By comparison, other nations have seen imports grow, particularly Malaysia (+13,300 tonnes, +60%) and South Korea (+4,500 tonnes, +32%). Malaysia depends heavily on sheep meat imports due to low domestic supply capacity, and with increasing appetite for red meat in this predominantly Muslim country, sheep meat is a popular choice. Other nations that have shown growth in sheep meat imports include Japan and Singapore.

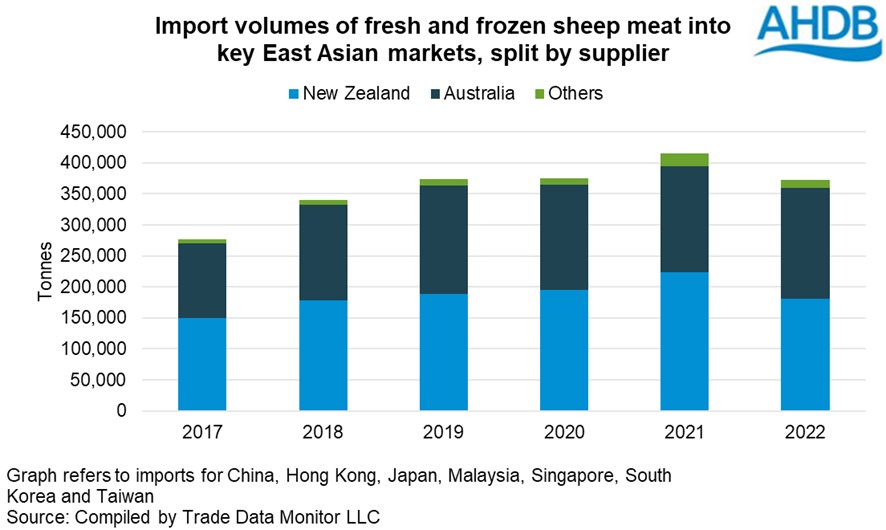

New Zealand and Australia remain key suppliers of sheep meat into East Asia, predominantly serving the Chinese market. New Zealand is China’s key supplier of sheep meat (56% of the market by volume in the 9 months to September 2022), thus feeling the largest impact from lower demand in the country. By contrast, Australian shipments have stayed relatively stable into China through this time (around 110,000 tonnes).

For Australia, the largest annual export volume growth in the region has been in shipments to South Korea, Malaysia and Japan, in which Australia is the dominant supplier. For New Zealand, shipments have grown the most to Malaysia, taking some market share from Australia in 2022.

The UK context

By comparison, the UK exports relatively little sheep meat to East Asia. In the 9 months to September, the UK exported 54,000 tonnes of fresh and frozen sheep meat globally; 93% of this went to the EU. Looking to East Asia, the UK supplies Japan, Hong Kong, and Singapore with sheep meat; for context nearly 600 tonnes was shipped to these countries combined over the same 9-month period. Work is ongoing to broaden the UK’s access of red meat to key Asian markets, to maximise value and returns to industry.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.