Less wheat milled to start the new season: Grain market daily

Friday, 6 September 2024

Market commentary

- Nov-24 UK feed wheat futures ended yesterday at £181.55/t, a £1.35/t decline from Wednesday's close as global prices eased back. Attention returned to the competitiveness of Black Sea grain, after markets rose earlier in the week on technical trading and cuts to European crop estimates. Selling by speculative traders was also likely a factor.

- Nov-24 Paris rapeseed futures gained €7.00/t yesterday to settle at €473.50/t as Canadian canola futures steadied after losing ground earlier in the week. This is the contract's highest price since the end of July. The Canadian futures lost ground after China announced an antidumping investigation into canola exports on Tuesday, which could reduce Canadian exports of the oilseed.

- Variable yield and quality results are being reported so far in Saskatchewan, the top grain and oilseed producing province in Canada. This follows high temperatures at flowering and drier conditions in some areas. The barley harvest is most advanced at 52% complete, with oats (32%), spring wheat (28%) and canola (16%) at earlier stages.

Less wheat milled to start the new season

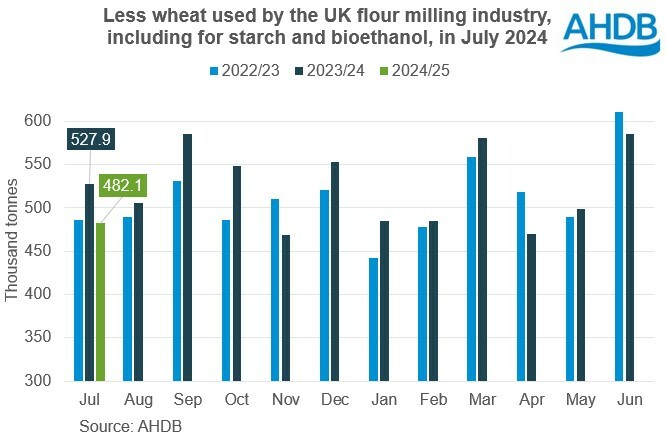

The UK flour milling industry, including for starch and bioethanol production, used 9% less wheat in July 2024 than in July 2023 shows data from AHDB. In July 2024, the first month of the 2024/25 season, the industry used a total of 482.1 Kt of wheat.

Usage of home-grown wheat fell 12% compared with July 2023, while there was a 9% rise in the amount of imported wheat used year-on-year. However, when compared to June 2024, as a proportion of the total wheat used, imported wheat lost a little ground. In July, imported wheat accounted for 20% of all wheat used by, down from 24% in June, though still ahead of July 2023 (17%). The proportion of imported wheat used increased through last season, reflecting both the quality of the 2023 crop and expectations for tight wheat supplies this season.

Last season’s strong wheat import pace is expected to continue this season; HMRC releases data for July next week. The EU Commission reports that the UK is the fifth largest export destination for EU common wheat so far this season. From 1 July – 2 September, the EU shipped 277.7 Kt of common wheat to the UK, up from just 93.2 Kt in the same period last season.

Starch and bioethanol usage drives the drop

The pull back in wheat usage was led by lower ‘other flour’ production, which declined 22% year-on-year in July to 88.5 Kt. ‘Other flour’ production can be used as a rough proxy for demand for wheat from the starch and bioethanol industries. This fall suggests that less wheat was used to produce starch and bioethanol in July, continuing the trend from the end of last season. Towards the end of 2023/24, maize was expected to feature more heavily in usage by the sector due to its price competitiveness against wheat.

Though it has softened a little of late, wheat continues to hold a larger premium over maize than throughout last season. If this price relationship persists, this could dent demand for wheat from the sector. There’s also a risk to demand for home-grown wheat from this sector from the uncertainty over the UK’s future recognition under the EU’s Renewable Energy Directive (RED II).

The UK is expecting a much smaller wheat crop this season following the reduced area, with an increased reliance on imports. However, the level of imports needed will depend on domestic demand and the final crop size so it will be important to monitor the data and policy developments. Defra is scheduled to release the final English crop areas on 26 September and provisional English production estimates on 10 October. The Scottish government usually releases production information in mid-October.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.