UK wheat imports remain firm: Grain market daily

Wednesday, 19 June 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £198.40/t yesterday, down £0.05/t from Monday’s close, and tracking global markets.

- Winter wheat harvest in the US is progressing rapidly and conditions have improved. The Black Sea region also received welcomed rains, easing concerns over the effects of adverse weather in the region.

- Paris rapeseed futures (Nov-24) closed at €470.25/t yesterday, up €3.25/t from Monday’s close.

- The European futures gained support from the wider oilseeds complex, reversing direction after a two-day slide. A downgrade to the US soyabean crop condition by the USDA, resulting from heat waves across the corn belt added support to markets.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

UK wheat imports remain firm: Grain market daily

The most recent UK trade data, including information on imports and exports up to the end of April, indicates that grain import pace remains firm. This is largely due to limited availability of high-quality domestic grain. Meanwhile, exports of wheat and barley from the UK are marginal due to our comparative price to the global market.

Wheat

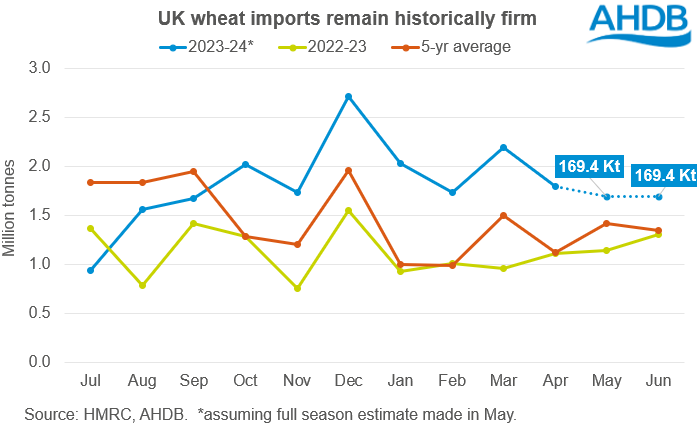

From July to April, UK wheat imports (including durum wheat) totalled 1.84 Mt, up 65% on the year, and up 25% on the prior five-year average. As well as limited high-quality supply from harvest 2023, concerns over the upcoming harvest has meant pace has remained strong as of late.

In May, we released our latest UK cereal supply and demand estimates for the 2023/24 season, with full season wheat imports expected to reach 2.175 Mt, an uptick of 815 Kt (60%) on the year. To reach this figure, the UK would need to import on average 169.4 Kt a month for the rest of the season. Given the current rate of imports, and with two months remaining in the season, if imported wheat continues to price competitively, we could even slightly surpass this figure.

Maize

Maize imports are also firmer on the year. From July to April of this season, maize imports have totalled 2.24 Mt, up 21% compared to the same period last year, and up 7% on the five-year average. This aligns with expectations that maize imports would accelerate due to more competitive prices against wheat as of late. More specifically, usage of maize in the bioethanol, brewing/distilling and animal feed sectors is expected to drive an increase in domestic demand for maize for the season remainder.

Barley

Imports of barley totalled 147 Kt so far this season (Jul-Apr). This is more than double the level at the same point last season and the five-year average. For the rest of the season, the majority of barley imports are thought to be feed quality, mainly going into Northern Ireland.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.