Wheat usage for bioethanol and starch steadies: Grain market daily

Thursday, 15 August 2024

Market commentary

- UK feed wheat futures (Nov-24) ended yesterday’s session at £188.65/t, down £1.35/t from Tuesday’s close. The May-25 contract fell £1.45/t over the same period, closing at £200.05/t.

- Despite some support in US wheat markets, domestic wheat futures fell in line with European prices. Pressure from cheaper Black Sea supplies outweighed support from disappointing harvests in western Europe.

- Nov-24 Paris rapeseed futures closed yesterday at €457.00/t, up €4.25/t from Tuesday’s close. The May-25 contract gained €2.75/t over the same period, ending the session at €459.25/t.

- European rapeseed prices firmed yesterday, tracking US soyabeans up. Chicago soyabeans found support from technical trading, bouncing back after hitting another four-year low on Tuesday.

Wheat usage for bioethanol and starch steadies

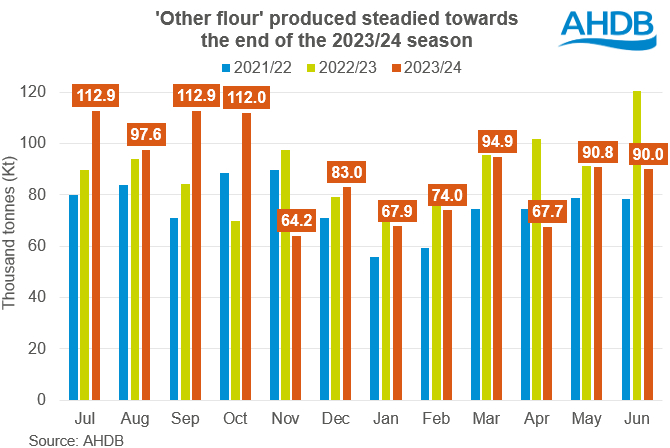

Last week, the latest UK human and industrial cereal usage figures were released, providing a look at data for the entire 2023/24 marketing year. The ‘other flour’ category of the UK flour miller’s dataset is largely made up of output from the starch and bioethanol industries, meaning we can use this figure as an indication of wheat demand for the sector.

In the month of June (2024), ‘other flour’ produced was down 25% or 30.6 Kt on year earlier levels, at 90.0 Kt. For the full season (Jul-Jun), 1.068 Mt of ‘other flour’ was produced, down slightly (0.3%) when compared to the previous year. Despite a strong start to the year, consistent year-on-year declines in usage for each month of the second half of the season resulted in the decline.

As highlighted in AHDB’s May balance sheet, this decline in wheat usage by the sector was expected. It was anticipated that as a result of imported maize starting to price competitively against wheat, maize would feature more heavily in bioethanol and starch production than estimated earlier in the year.

The fact that imported maize priced competitively towards the end of last season is unsurprising given the global market conditions at the time. Towards the end of May, nearby Chicago maize futures fell to a discount of $75.95/t against nearby Chicago wheat futures.

Looking ahead

As we progress into the new season, the availability and price of imported maize will be key to wheat demand for this sector. The discount of maize against wheat on the global market has shrunk somewhat more recently, though remains relatively significant. Expectations of smaller domestic wheat supplies will also likely lead to more imported maize than in a ‘typical’ year.

Another factor to consider for wheat usage in this sector is regarding the recognition of biofuel produced from UK wheat towards the EU’s Renewable Energy Directive (RED II). The European Commission had previously announced that it would no longer recognise the national accreditation body which assesses assurance schemes, which in turn allow growers in the UK to supply wheat for biofuel production. While assurance schemes remain able to assure growers for RED II access currently, the European Commission is expected to announce how the recognition will be implemented by 01 January 2025.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.