Lowest English cereals and OSR area in over four decades: Grain market daily

Thursday, 29 August 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £181.30/t yesterday, rising £1.40/t from Tuesday’s close. The May-25 contract gained £1.55/t over the same period, to close at £193.30/t.

- UK feed wheat futures found support yesterday as FranceAgriMer reported that the average specific weight and protein content of the French wheat crop are both still well below the five-year average. Also, Germany’s Agriculture Ministry forecasted German wheat production down 12.7% on the year to 18.8 Mt.

- Paris rapeseed futures (Nov-24) closed at €461.25/t yesterday, falling €2.50/t from Tuesday’s close. The May-25 contract lost €1.75/t over the same period, to close at €464.75/t.

- Paris rapeseed futures were pressured yesterday as this year’s first model-based estimate from Statistics Canada forecast canola (rapeseed) production up 1.6% on the year to 19.5 Mt. Higher yields offset a marginally smaller area. In addition, milder temperatures and rainfall forecast over the US Midwest alleviated concerns regarding recent dry weather and its impact on the soyabean crop, weighing on the oilseed complex.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Lowest English cereals and OSR area in over four decades

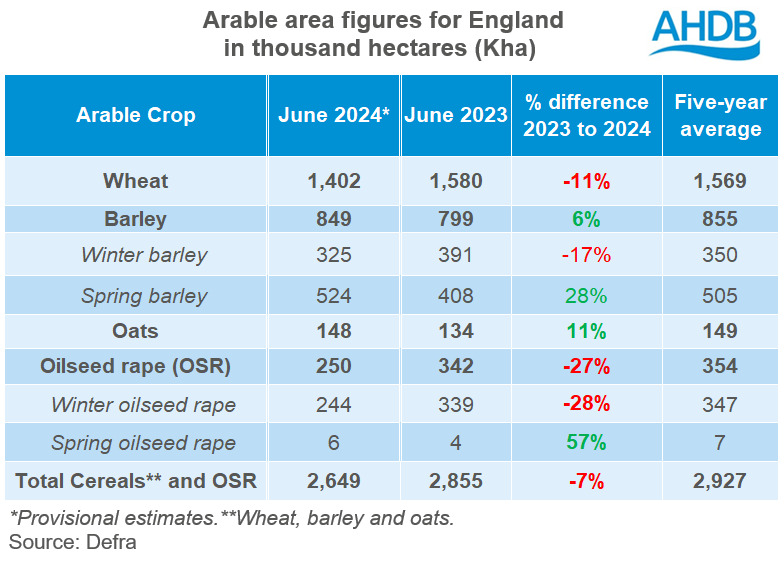

This morning, Defra released its provisional estimates for the cereals and oilseed rape (OSR) areas in England on 1 June 2024. The cereals (wheat, barley, oats) and OSR area for England is notably lower this year at 2,649 Kha, making it the lowest area since at least 1983. The extremely difficult planting conditions, as a result of record rainfall, played a considerable role.

The areas for wheat, winter barley and oilseed rape are estimated down by 11%, 17% and 27% respectively. These falls are only partly offset by the areas of spring barley and oats, which are estimated to increase on the year by 28% and 11% respectively.

While we don’t yet have official area statistics for Scotland, Wales and Northern Ireland, these Defra statistics show a similar pattern to AHDB’s 2024 Planting and Variety Survey (PVS). Analysis of the PVS pointed to a tight domestic wheat supply in the 2024/25 marketing year. Although the elevated ending stocks offers some support, we’re still looking at greater reliance on imports.

The larger English barley and oats areas could support availability, though Scottish areas and yield information are needed for the full picture.

With a notably lower OSR area this year, the UK’s dependence on OSR imports is likely to continue into the 2024/25 marketing year.

While these 2024 area estimates are provisional, the finalised estimates are due to be released on 29 September. The provisional cereals and OSR production figures for England are due to be released by Defra on 10 October.

Wheat

The 2024 wheat area in England is estimated at 1,402 Kha, 11% down on the year and the five-year average. While the 2024 wheat area remains above the 2020 area of 1,265 Kha, this falls as the second lowest English wheat area since at least 1983. This markedly small wheat area is unlikely to come as a surprise to many given the extremely challenging weather conditions experienced during key planting months in 2023/24.

Regionally, the greatest area reduction on the year was in North West and Merseyside, down 16%, while the least was South East, down by 8%.

Barley

The considerable rise in spring barley area (up 28% on the year) offset the substantial fall in winter barley (down 17%). The total barley area at 849 Kha is up 6% on the year. As seen in the PVS, spring barley planting rose drastically as many did not have the opportunity to complete their winter planting. Also, some of the winter crop that was drilled, by spring time, it was in too poorer condition to continue.

Regionally, for winter barley, the greatest fall in area on the year was in East Midlands by 20% while the least fall in area was in South East by 15%. For spring barley, the North East saw the largest increase in area on the year by 39% while South West saw the lowest increase of 20%.

Oats

The English oat area also rose on the year by 11% to 148 Kha, but falls just short of the five-year average. The increase in oat area on the year is likely to have been supported by increased spring planting.

Regionally, the largest increase for oats area on the year was in East Midlands by 24%, while the lowest increase was 4% in the North East.

OSR

After the modest recovery of OSR area in England for 2022 (323 Kha) and 2023 (342 Kha), the area for 2024 fell back considerably to 250 Kha. This would be the lowest OSR area since 1983 (218 Kha) and 29% less than the five-year average. While OSR was also impacted by the challenging planting conditions in autumn 2023, tighter profit margins during the 2023/24 marketing year and pressure from cabbage stem flea beetle particularly impacted the area.

Regionally, the falls in area on the year ranged from -18% in Eastern England to - 35% in the North East.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.