Lamb market update: production and trade in the first half of the year

Thursday, 29 August 2024

Key points:

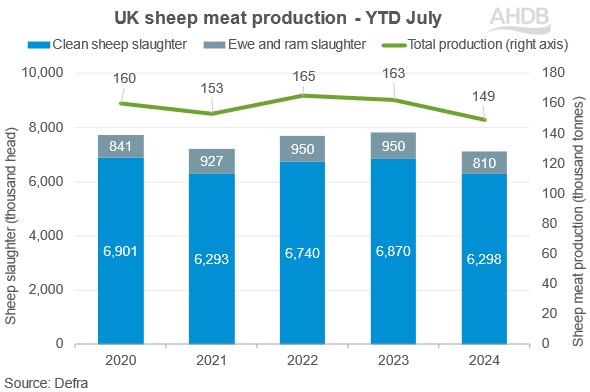

- UK lamb production has fallen by 8% so far this year, as clean sheep kill and carcase weights have dipped

- Imports from New Zealand continue to be elevated at a higher level seen compared to last year, making up 64% of our sheep meat imports

Production

The first seven months of 2024 has been marred by a number of factors that have limited the volume of lamb produced.

Defra statistics show that clean sheep kill up to July has fallen by just over 8% from the same period in 2023, down by 572,000 head. This brought total kill for 2024 to fractionally under 6.3m head, the lowest year to date figure since 2021. No month in 2024 thus far has broken over 1m head. Insight shows that the new season crop has been slow to come forward, hit by a combination of poor weather and disease impacting on mortality.

The wet weather and poor forage quality similarly hit carcase weights, as industry reports from both producers and processors highlight that some lambs coming forward are lighter and leaner than expected. This is reflected in the Defra statistics, which show a marked decline in carcase weights from April onwards.

Both of these factors have contributed to a low level of production in July, which sat at 18,900 tonnes, a fall of 10% from June, and a 12% fall from 2023. Production so far this year has totalled 149,000 tonnes, down 8% from 2023.

AHDB’s outlook for 2024 forecasts that number of lambs coming forward have shifted later on in the season, as the new season crop has been slow to market. However, this will depend on the impact of unknowns, such as Bluetongue virus, the scale of which remains incredibly uncertain.

UK sheep meat production - YTD Jan-Jul

Source: Defra

Trade

Given that our domestic production has fallen, our capacity to export has reduced, and import requirements have increased.

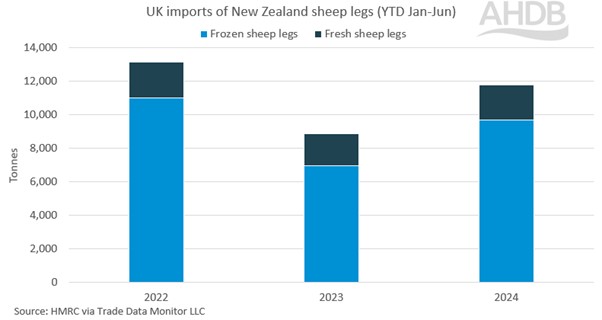

Imports of fresh and frozen sheep meat have totalled 33,750 tonnes so far this year to June, an increase of 10,300 tonnes from 2023. Both March and June saw volumes nearing 7,000 tonnes, as June saw a near 1,400 tonne increase from May.

Volumes imported from New Zealand, our largest supplier, have grown year-on-year as production in 2023 was hit by poor weather. Imports from New Zealand sat at 21,500 tonnes up to June 2024, making up 64% of total imports. Frozen sheep leg imports peaked in March before dipping but have since grown again to 2,350 tonnes in June.

UK imports of New Zealand sheep legs (YTD Jan-Jun)

Source: HMRC via Trade Data Monitor LLC

Exports of fresh and frozen sheep meat sat at 6,180 tonnes in June 2024, an increase of 850 tonnes from May, bringing the total so far this year to 37,400 tonnes. Export volumes up to June currently sit 8% lower than the same period last year, as our lower production has limited the volumes available for export. The European Union remains our largest market for sheep meat, with countries such as France, Germany, and Belgium taking in the vast majority of this product.

What does it mean for GB prices?

Current and future forecasted domestic supplies of lamb in the UK are set to keep the price supported from a supply side. This will depend on the size and scale of numbers of new season lambs that come through, and hinge on quality. Quality of lambs coming forward should be monitored to ensure the most appropriate sales point.

Imports will also play a factor moving forward, with southern hemisphere production having slowed down providing strength to global prices, incentives for imports over the next few months may weaken. This could further provide strength to domestic pricings as the market is less supplied on an international level.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.