Lamb market update: Lowest October slaughter figures on record

Friday, 29 November 2024

Key points:

- UK sheep meat production has fallen by 7% YTD.

- Lowest October clean sheep kill on record of 1.09m head.

- September’s imports have continued to rise and exports have fallen to compensate reduced domestic production.

Production

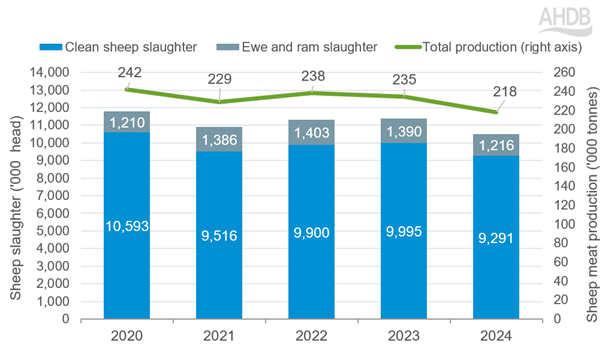

UK sheep meat production has fallen significantly since 2023, currently at 7% lower for the period of January to October. Production has totalled 218,000 tonnes so far this year, with October’s volumes at 25,000 tonnes. A decline in adult and clean sheep slaughter, 12.5% and 7% year-to-date reduction respectively, has contributed to this overall decline in production. This is likely an influence of both difficult growing conditions this year and smaller breeding numbers illustrated by 2024’s lower female breeding flock in England, down 5.6% as of 1st of June compared to the same time in 2023 with figures for the UK set to be released in the new year.

Clean sheep kill has totalled 9.29m head to October this year, a fall of 704,000 head compared to this time last year. October kill sat at 1.09m head, an increase of 133,500 from September’s figure but 18,000 head behind 2023. October is the first month of 2024 to exceed 1m head slaughtered, yet this figure remains the smallest October slaughter on record continuing to demonstrate the constraints on supply this year.

UK sheep meat production YTD Jan-Oct

Source: Defra

Trade

Imports

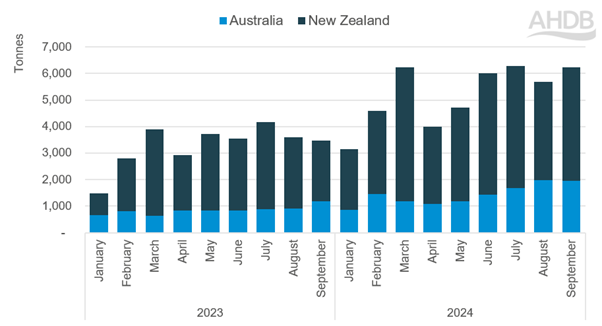

For the year to September, imports of fresh and frozen sheep meat have totalled 54,200 tonnes, a growth of 16,700 tonnes (44%) from the same period in 2023. Monthly imports have continued to be noticeably higher than last year, between 1,000 and 2,600 tonnes higher each month.

Volumes imported in September totalled 7,000 tonnes, an increase of 700 tonnes from August and 2,500 tonnes higher than September 2023. This increase in volume is likely driven by a combination of lower domestic production this year, and a comparison to 2023, when imports were reduced partly due to limited production in New Zealand, the UK's largest overseas supplier of sheep meat.

With regards to Oceanian trade, in September, the UK imported 4,300 tonnes of fresh and frozen sheep products from New Zealand and 1,950 tonnes from Australia. This marked an increase of 600 tonnes from New Zealand compared to the previous month and an increase of 2,355 tonnes from September 2023’s figure. Imports from Australia remained similar to August’s quantities. However, this represents a 64% increase compared to September 2023. This has already made 2024 a record year for Australian imports of lamb with three months yet to record. Owing to lower UK supply that has increased demand for imports, as well as increased comfortability with the new trade deals, Australian imports will remain a key watch point moving forward.

UK monthly sheep meat imports from Australia and New Zealand

Source: HMRC via Trade Data Monitor

Exports

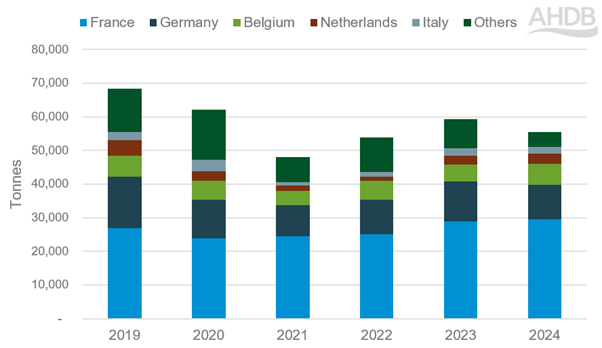

UK exports have declined this year driven by reduced domestic production, currently sitting 7% lower than in 2023. In September, export volumes reached 6,568 tonnes, an increase of 360 tonnes compared to August, but a decrease of 283 tonnes compared to September of 2023.

The primary export remains lamb carcasses sent to the EU for further processing, totalling 43,300 tonnes from January to September. Outside the EU, notable export destinations include Ghana, Kuwait and Canada with volumes ranging between over 750 tonnes to 475 tonnes so far this year.

Although January to September exports have decreased, exports to several EU countries have increased, notably the UK’s main export destination for sheep meat, France, an increase of 1.8% and to both Belgium and the Netherlands, an increase of 23%. This has further contributed to an increase in the proportion of sheep meat exported to the EU from the UK vs the rest of the world growing steadily with an increase from 93.5% of exports from January to September of last year to 94.3% for the same period this year.

UK sheep meat exports by destination (YTD Jan-Sept)

Source: HMRC via Trade Data Monitor

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.