Key trends to watch out for in 2020 for lamb markets

Friday, 3 January 2020

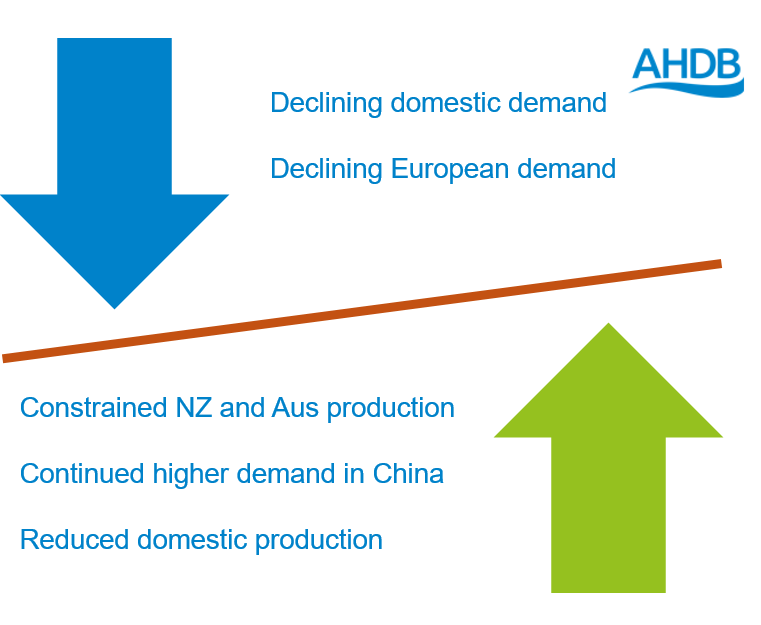

As ever, there are some conflicting forces in the sheep market at the moment.

- Brexit uncertainty dominated much of 2019, although December did bring some clarity as the withdrawal agreement was agreed in parliament. The bill, once passed into law, means the UK will leave the EU on 31 January 2020. There would then be an 11 month transition period. Negotiations on a long-term free trade agreement will take place during 2020. Under the terms of the bill, the transition period would not be extendable. As part of previous negotiations, the EU and UK agreed that the WTO tariff-rate import quotas (TRQs) will be spilt based upon historic usage. For the sheep industry the key one is the New Zealand sheep meat quota, which will be spilt 50/50 giving the UK and EU each 114,000 tonnes.

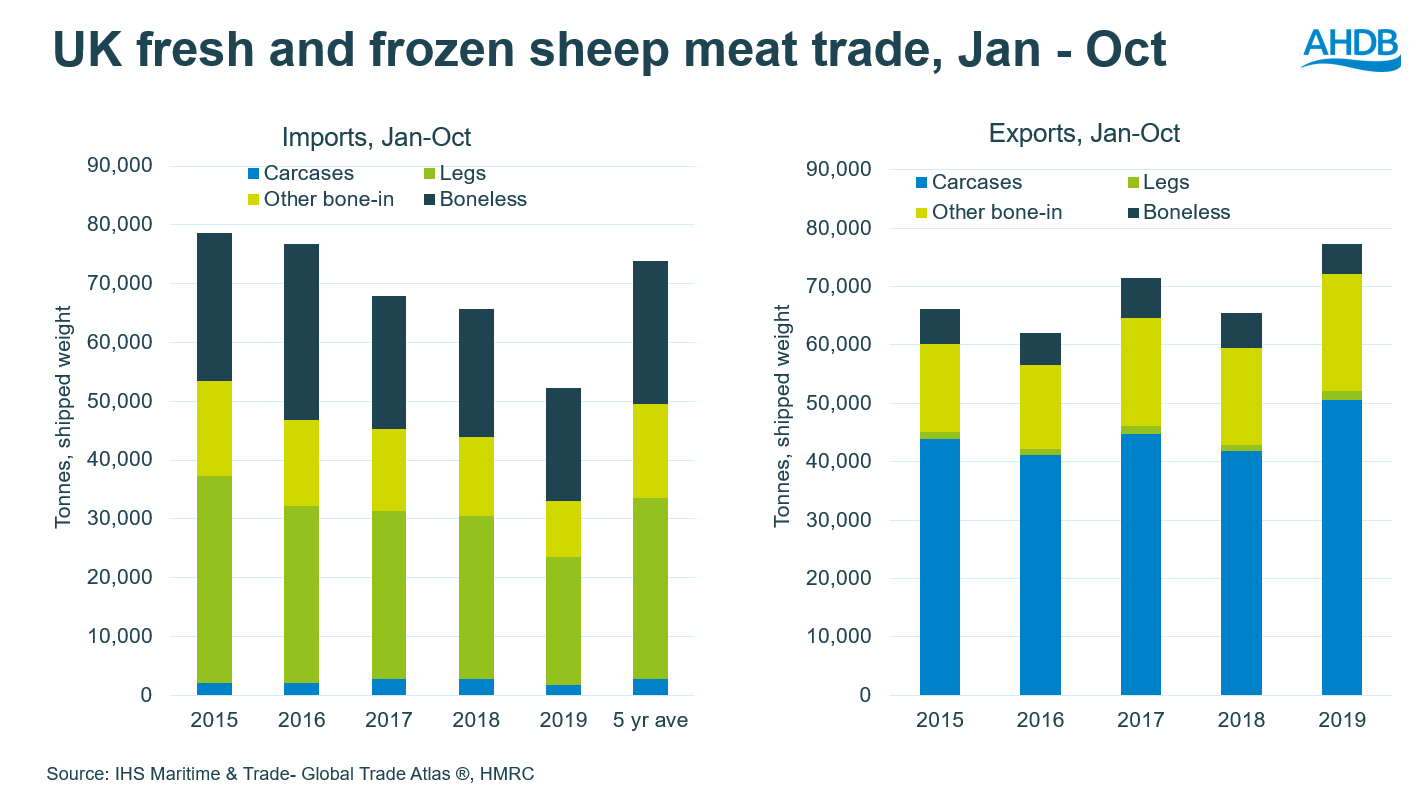

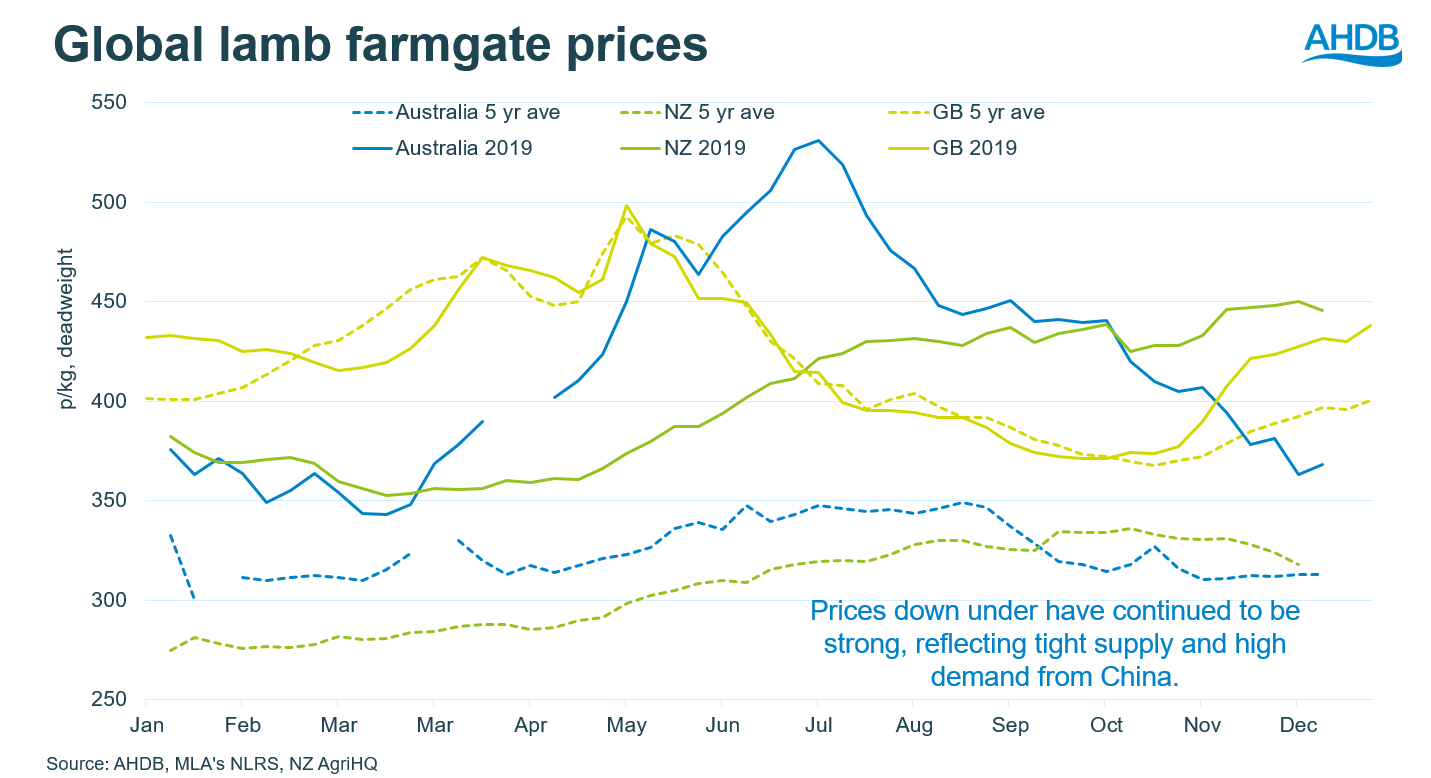

- Global sheep meat supplies are tight compared to demand, especially with soaring demand in China. Australia continues to suffer from drought and the supply situation there is unlikely to change in 2020. New Zealand has more market access to the EU than Australia, however developments in Australia will still impact the UK and the EU via New Zealand. This is the reason behind the reduction in UK imports of sheep meat in 2019.

- African Swine Fever (AFS) in China continues, suggesting the strong Chinese demand is unlikely to ease. Many forecasters agree Chinese recovery from ASF is likely to be a least a few years away.

- EU demand for red meat continues to be lacklustre, although due to reduced availability of New Zealand lamb in Europe the UK has been able to gain some market share.

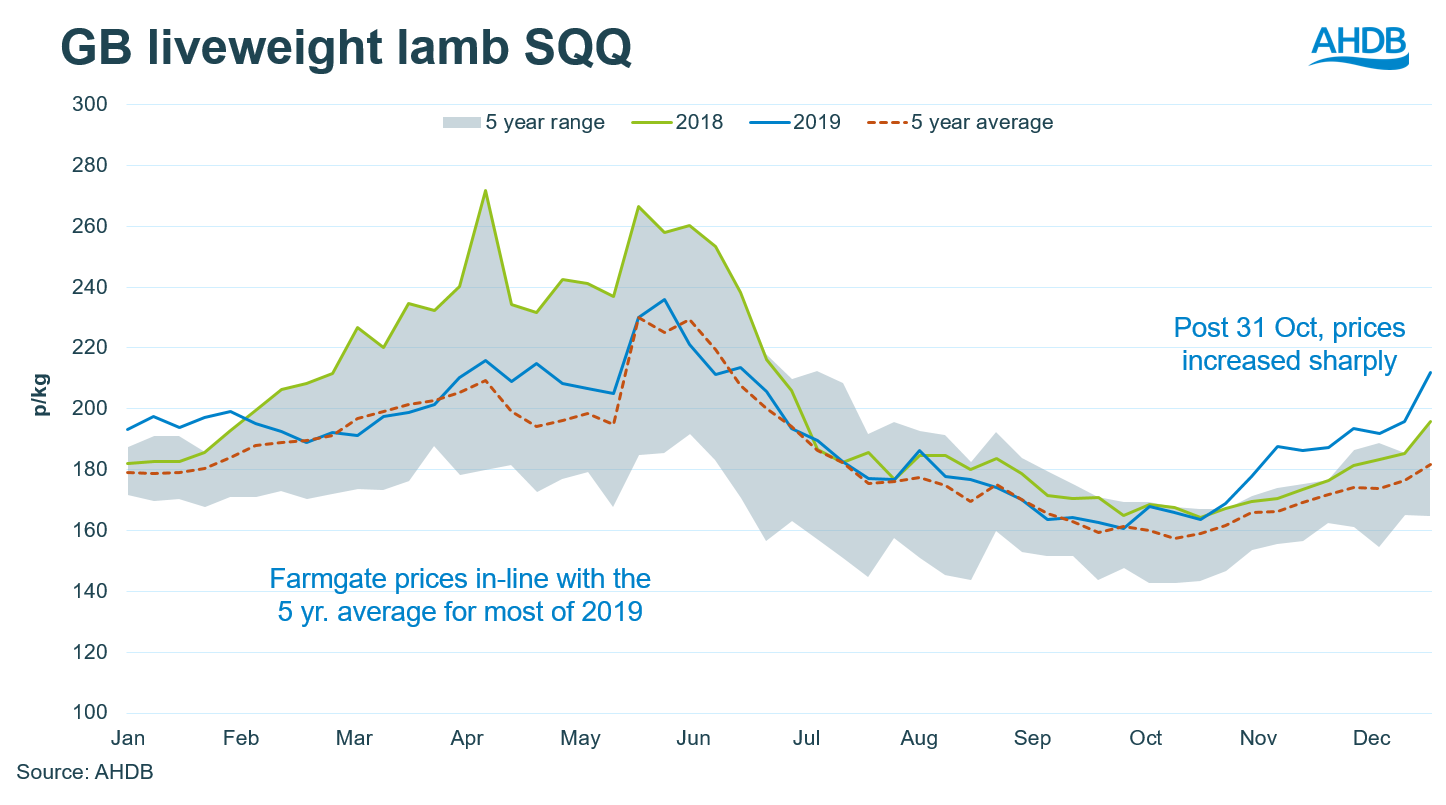

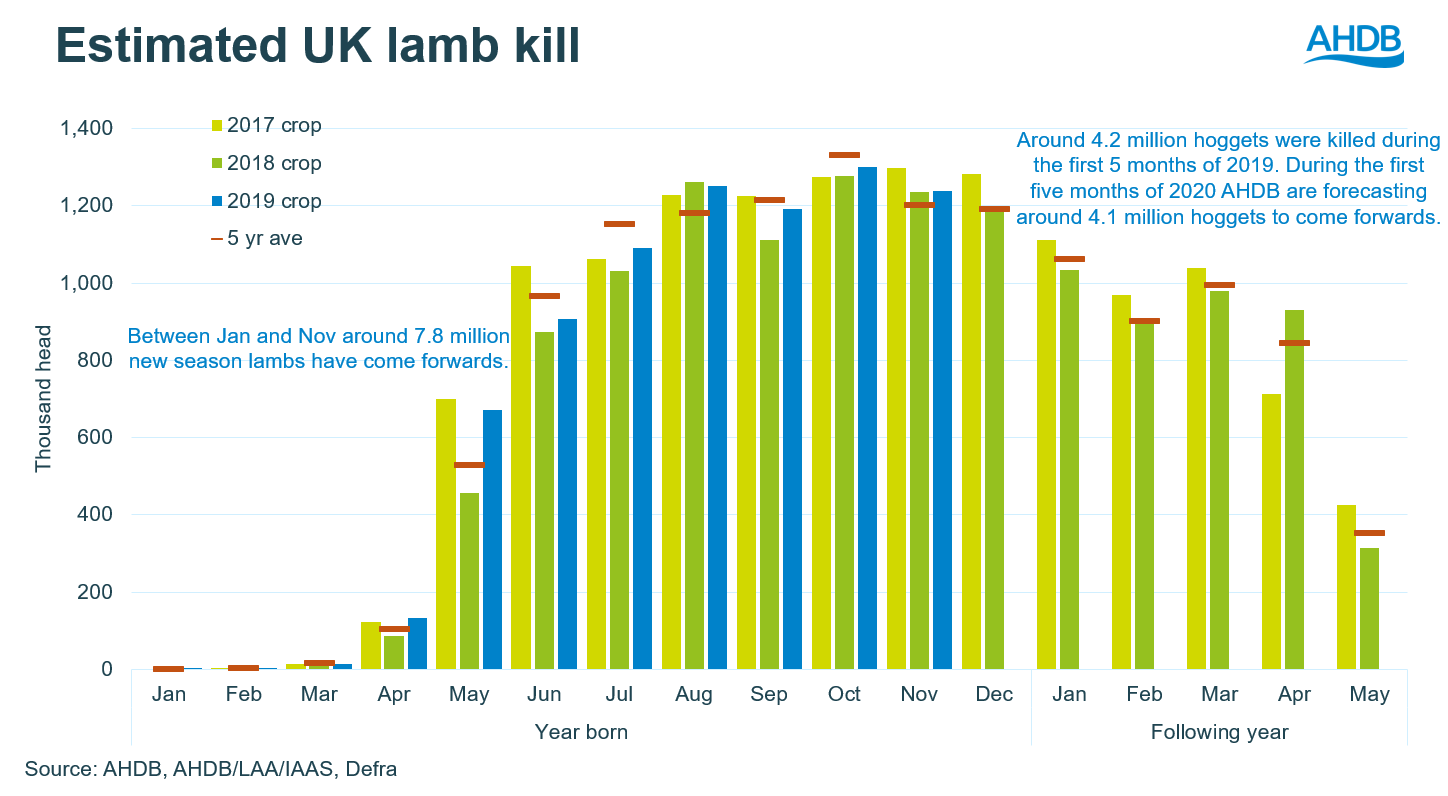

- UK domestic production, has been higher. Carcase weights have been up, supported by good finishing conditions during the summer. Once autumn came though, there was more than enough rain which slowed down finishing. Numbers coming forwards were also higher.

Outlook

Many of key watch points of 2019 are likely to remain during 2020. However, next year we are forecasting domestic production to drop back by 5%, driven by a decline in the size of the breeding flock. Global supplies are expected to remain tight; we expect that imports will fall further in 2020, by around 6%. Meanwhile, we expect exports to drop by around 15%, due to the reduction in domestic supplies. There is scope for exports to be higher than forecast however, especially if domestic demand is weaker than expected.

2019 in charts

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

Topics:

Sectors:

Tags: