July cattle outlook... Where are we now?

Thursday, 22 October 2020

Back in July, we expected that 2020 UK prime cattle slaughter and beef production would fall year-on-year. We also expected that trade flows would be dampened as a result of the pandemic. In reality, so far in 2020 we’ve seen cattle slaughter and beef production increase in comparison to last year. Trade flows have been dampened, although more severely than we had anticipated. Let’s take a look at what has happened in a little more detail.

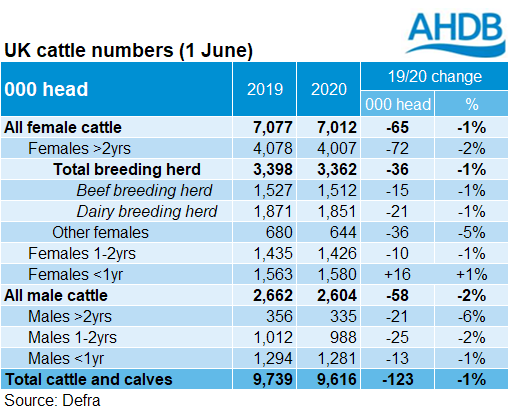

In July we forecast that UK prime cattle slaughter in 2020 overall would fall by 2% from last year to around 1.96 million head. This was based on several factors. Firstly, cattle population data showed that there were fewer prime animals on the ground close to slaughter age. Indeed, UK population estimates at 1 June since published by Defra supports this, with fewer cattle recorded in all categories apart from females under 12 months.

The forecast also factored in expectations of reduced domestic beef consumption, due in part to the COVID-19 pandemic limiting foodservice demand (in line with scenario A - the most optimistic of our scenarios for lockdown exit). We also expected export demand to be reduced, as COVID-19 caused similar supply chain problems in other countries.

For the first nine months of the year, UK prime cattle slaughter has totalled 1.52 million head according to Defra figures*, which is currently 3% more than the same period last year.

There are a few reasons that may explain the rise in prime slaughter. The switch of demand from out-of-home to in-home will have impacted demand for UK produced beef (see later). Strong cattle prices of late may have encouraged more animals forward. Reported average carcase weights would support this, having run slightly lighter than last year for the past few months. In addition, contraction in the suckler breeding herd has allowed heifer slaughter to remain elevated, while the increasing use of sorted semen in dairy inseminations has reduced the share of prime slaughterings that are male.

Cow slaughter between January and September (inclusive) stood at 485,300 head, up 3% year-on-year. This has likely been due to a combination of strong prices and potentially increased culling by those dairy producers having to curb their milk production in response to the pandemic.

In our July forecast, we expected that UK beef imports and exports for 2020 overall would fall by 1% and 2% year-on-year, respectively. This was in line with our expectations of lower consumption and lower production. From January to August (inclusive), trade data shows that imports were actually down 8% from last year. Exports for the same period were down 7%**.

The drop in imports could be due to a number of reasons. One explanation could be to do with the different sources of beef sold via retail and foodservice. Beef destined for retail in the UK is more likely to be home-produced, whereas imported beef can often be destined for foodservice. Therefore, the shift from foodservice to retail due to the pandemic has likely driven demand for UK-grown beef, but reduced import requirements. In addition, UK imports are heavily reliant on Irish production, which has been constrained somewhat this year. The larger fall in exports is likely due to COVID-19 disrupting trade flows and demand in other countries, considering the rise in UK production.

Due to an anticipated fall in slaughter, lighter carcase weights and lower consumption, UK beef production in 2020 overall was forecast to fall 4% year-on-year. So far, however, the latest Defra statistics show that actual beef production between January and September (inclusive) was up 3% on the year, at 694,100 tonnes.

Looking ahead, cattle slaughter typically sees some uplift in the Autumn in comparison to the rest of the year, as producers consider their winter housing costs, and as processors look to secure supplies ahead of the typically busy Christmas period. It is likely that cattle slaughter and production will end the year higher than we anticipated back in July. However, uncertainty remains over markets in the short-term, considering the lower cattle inventory, higher-than-expected slaughter so far this year, and rising COVID-19 cases.

Increasingly stringent coronavirus measures are currently being implemented in various regions of the country to try and stem rising cases. Some areas are even heading back into ‘circuit-breaker’ lockdowns, with similar restrictions to those of the national lockdown in March. How such restrictions might affect demand will be a key watch point going forward, both domestically and for export, with COVID-19 cases reportedly rising again on the continent.

Our forecasts will be reviewed in the New Year.

*Defra have advised that its survey response has been lower than usual over the last few months, due to the increased strain COVID-19 is having on the livestock industry. To compensate, Defra has made greater use of the Food Standards Agency throughput data to maintain coverage. This may affect how livestock numbers are split amongst their classifications, such as how cattle are split between prime and adult cattle.

**Trade data in this analysis has been converted to carcase weight equivalent, and so may differ from figures reported elsewhere.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.