Is UK wheat still export competitive? Grain market daily

Friday, 25 March 2022

Market commentary

- UK feed wheat (May-22) closed lower by £0.60/t yesterday, to £310.40/t. Though contract trading was at very low levels, with only 23 contracts traded (Refinitiv). The new-crop contract (Nov-22) fell by £0.55/t yesterday, to close at £266.45/t.

- Paris rapeseed futures (May-22) continues an extremely volatile week, settling €51.50/t up yesterday to €978.00/t. Some strength was also mirrored in the Winnipeg contract (May-22).

- Brent crude oil (nearby) fell $2.57/t yesterday, to $119.03 per barrel.

Is UK wheat still export competitive?

The UK wheat supply and demand balance remains tight - ‘on a knife edge’.

In our balance sheet release yesterday, forecasted wheat imports this season were increased from 1.45Mt to 1.50Mt. Will this ease the tight supply and demand balance this season? Likely not, as we continue to see strong domestic consumption as well as increased forecasted exports.

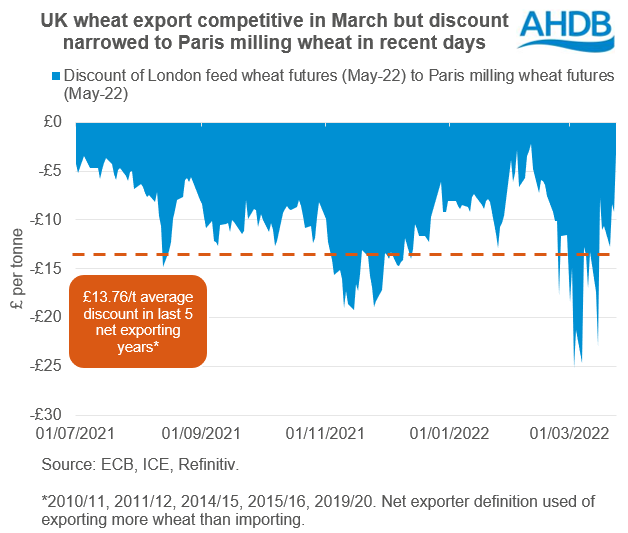

Season to date (Jul-Jan), the UK has exported 261Kt of wheat (including durum). This is up 61% from the same period in 2020/21. Anecdotally there have been reports that UK wheat is competitive. Over the past month, we have seen the discount stretch between UK feed wheat futures (May-22) and Paris milling wheat futures (May-22) to as high as £25.16/t (3 Mar). A sign of export competitiveness.

To reflect this, we increased the wheat export forecast for this season to 500Kt in this week’s balance sheet release.

Will this continue?

In recent days, the discount of UK feed wheat futures (May-22) to Paris milling wheat futures (May-22) has narrowed. Yesterday this settled at £3.18/t, almost parity.

Volatility on global wheat contracts will continue with the war ongoing between Russia and Ukraine. With such volatile markets, large price movements on contracts are expected.

We have seen signs of some demand rationing from high prices in the US, with reduced wheat export sales. But EU wheat exports are expected to be strong, considering restricted trade in the Black Sea region. The International Grains Council (IGC) recently upped their EU export 2021/22 forecast by over 1.0Mt to 35.8Mt.

Should the EU face strong export demand, the discount of UK feed wheat futures to Paris milling wheat futures may widen once again. Though India may also look to fulfil some demand in major importer Egypt, alongside France, Argentina, and the US.

UK balance remains tight

In the UK, domestic wheat supply and demand remains tight. Barley demand too is strong, and likely cannot take more demand switching from wheat. Therefore, we face another year of tight ending stocks as we head into the new season.

Some watch points for domestic wheat demand include the bioethanol industry (considering the difficulty in sourcing maize currently) and weather for livestock turnout. With feed costs high, livestock farmers may look to turn out as quickly as they can.

All these factors will play into how tight UK supply and demand looks, and if we continue trading nearer parity to Europe.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.