Analyst Insight: UK wheat and barley on a knife edge

Thursday, 24 March 2022

Market commentary

- UK feed wheat futures (May-22) closed up £3.90/t on the day, to settle at £311.00/t. Nov-22 gained £3.05/t, closing at £267.00/t.

- May-22 Paris rapeseed futures closed at €926.50/t yesterday, down €68.00/t. This was after trading as high as €1021.75/t earlier in the day.

UK wheat and barley on a knife edge

Today two significant releases were published, the latest UK cereal supply and demand estimates and the 2021 BPS area data.

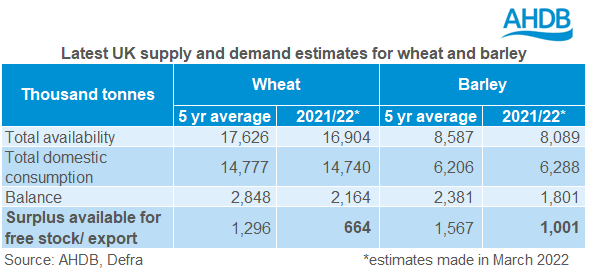

Earlier today, the AHDB released its latest 2021/22 UK cereal supply and demand estimates. This includes estimates for wheat, barley, maize and oats. To no surprise, the current volatility in Ukraine has impacted forecasted trade for all commodities, while rising feed costs is impacting animal feed demand.

Below is a roundup of the major changes in the latest balance sheet release for all cereals.

While the supply and demand balance is revised up from previous estimates to 2.164Mt on the back of increased imports and a reduction in bioethanol demand, it remains the third tightest on record. This estimate is 51% higher than last season. However, exports are forecast to more than double on the year, at 500Kt. UK wheat has priced very competitively of late due to the price difference between Paris and UK futures. From July to January, 261Kt of wheat was exported, with reports of a strong export pace since.

Closing stocks are forecast at 1.664Kt and with an operating stock requirement of 1.5Mt, this would leave just 164Kt of free stock to be carried over into next season. The latest forecasts confirm what is already known, the wheat balance this season is on a knife edge.

There are a few key watch points which may affect UK wheat supply and demand going forward:

- Demand by the bioethanol sector

- Spring weather conditions for turning out livestock

- The impact of the war in Ukraine on trade

Demand for barley by the brewing, malting and distilling (BMD) sector is expected to return to near pre-pandemic levels this season. While remaining down on the year, demand for barley in animal feed is expected to increase from previous estimates on the back of slightly higher fed on farm usage.

With significantly lower availability year-on-year, and demand not retracting to the same extent (due to higher BMD usage), the balance of barley supply and demand is forecast at 1.801Mt. If realised, this would be the tightest balance since 2012/13. Similar to wheat, we have seen UK barley pricing very competitively for export, leading to full exports estimated at 750Kt. End-season stocks are now forecast at 1.051Mt. With an operating stock requirement of 800Kt, the amount of free stock left to be carried into next season is estimated at 251Kt.

Maize has fallen out of favour this season with animal feed producers due to its relative price compared with wheat. This was accelerated at the end of February, after Russia invaded Ukraine. In the latest estimates, Maize imports are forecast 31% lower than 2020/21, at just under 2.0Mt. . Domestic consumption is also expected to fall on the year driven by higher prices. With Ukraine taken out of the equation, the global supply of maize is very tight. However, if tensions subside in Ukraine, as well as a suspension on the US maize tariff as of 1 June, we could see more maize available.

As reported earlier in the season, the 2021 oat crop hit record levels (1.1Mt). However, some question whether this figure may be too high? For the purposes of the balance sheet, the official Defra production figure is used. Given the large availability of oats this season and the relatively inelastic demand domestically for the grain (there is only so much that can be fed on farm), oat exports are now forecast to reach 100Kt. End-season stocks are currently forecast at 175Kt, the highest level on records going back to 1999.

BPS data broadly in line with Defra area for wheat, but out for oats

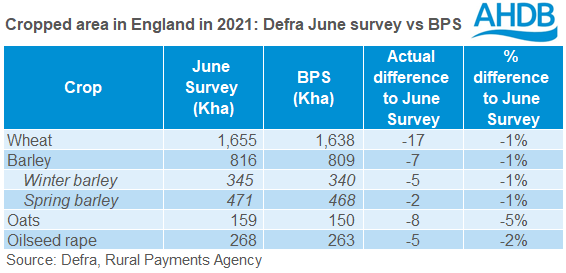

Today, the Rural Payments Agency (RPA) released the total area of land claimed under the Basic Payment Scheme (BPS) in 2021 for England.

Since the RPA started publishing this information back in 2018, there has been a question around which area information to ‘believe’ – the Defra area collected via the June survey, or the BPS area data? It has been argued that the BPS area is more accurate as it has a higher uptake. However, it is worth noting there are limitations and differences between the area collected by both sources. It is understood that following industry consultation, Defra now use the BPS data to inform the June Survey.

The table below shows the latest BPS area data from the RPA, compared with Defra’s June survey area.

It is worth noting that for wheat, the difference between the two surveys is the smallest it has ever been, at 17Kha lower. The largest difference in percentage terms is the difference between the two oat areas. As mentioned in the section above, the size of this season’s oat crop is under question. Is it too high?

If you take the BPS area for England and multiply it by the Defra UK average yield for oats (2021), it would give an English production figure of c.847Kt. Add that to the production figures for Wales, Scotland and Northern Ireland and you would get a total UK oat production figure of 1.073Mt. The official Defra figure is 1.123Mt, almost 50Kt more. These are rough calculations using the Defra yield, which is derived from the June survey, but it gives an indication of a possible production scenario.

With oats being a smaller crop in comparison with wheat and barley, what looks like small differences in area, can have a much bigger impact.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.