Market Report - 21 March 2022

Monday, 21 March 2022

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

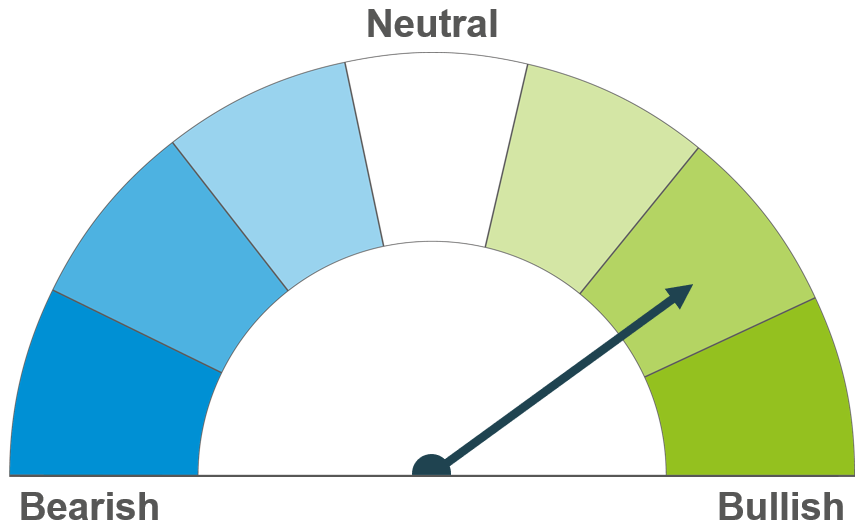

The dials in this report reflect the analyst’s view of the possible direction in markets. The two-week (solid line) and six-month (dashed line) outlooks are based on the best available information at the time of writing. Please note, these views do not constitute trading advice and direction of markets may change due to new information since the time of writing.

Wheat

Maize

Barley

Wheat markets continue to fluctuate and follow news on the war between Russia and Ukraine. Longer term, the market awaits news on the size of major exporter’s new crops, and how much will be available from the Black Sea region next season.

Currently there is disruption in trade, with demand switching from Ukrainian to other origins. US export sales remain strong. Longer term, Brazilian plantings are progressing with no new major weather concerns currently.

Barley continues to track the wider grain market. Though with a tight supply and demand balance this season, barley may not be able to take further shifts in demand.

Global grain markets

Global grain futures

Global grain markets continue to react to news on the war between Russia and Ukraine, causing volatility in prices. On Friday, peace negotiations pressured prices across the board. Volatility is expected to continue in the near term. Though the fundamental picture for global grains continues to look tight, keeping prices at historical highs.

Last week, the International Grains Council (IGC) reduced their global trade projections for wheat (down 3.0Mt) and maize (down 6.0Mt) for this season due to the conflict between Russia and Ukraine. With high prices, demand rationing is expected too. Large cuts were made to Ukraine’s maize exports (down 10.8Mt).

As at mid-March, most of Russia’s ports were reportedly operational. Though there are some restrictions on the Azov Sea, as well as financial restrictions (IGC).

Looking to new season, focus increasingly looks to drought in the US southern Great Plains and what this may mean for US winter wheat. Despite an ongoing wet spell, most of April is forecasted dry (Refinitiv).

USDA export sales were mixed to the week ending 10 March. US net sales for wheat totalled 145.9Kt for 2021/22, primarily to Colombia and Mexico. This was below trade expectations and may be a sign of demand rationing. Whereas US maize exports totalled 1.84Mt for 2021/22, primarily to Japan and unknown destinations. For 2022/23, net sales were made of 204.0Kt to China. Both above trade expectations.

UK focus

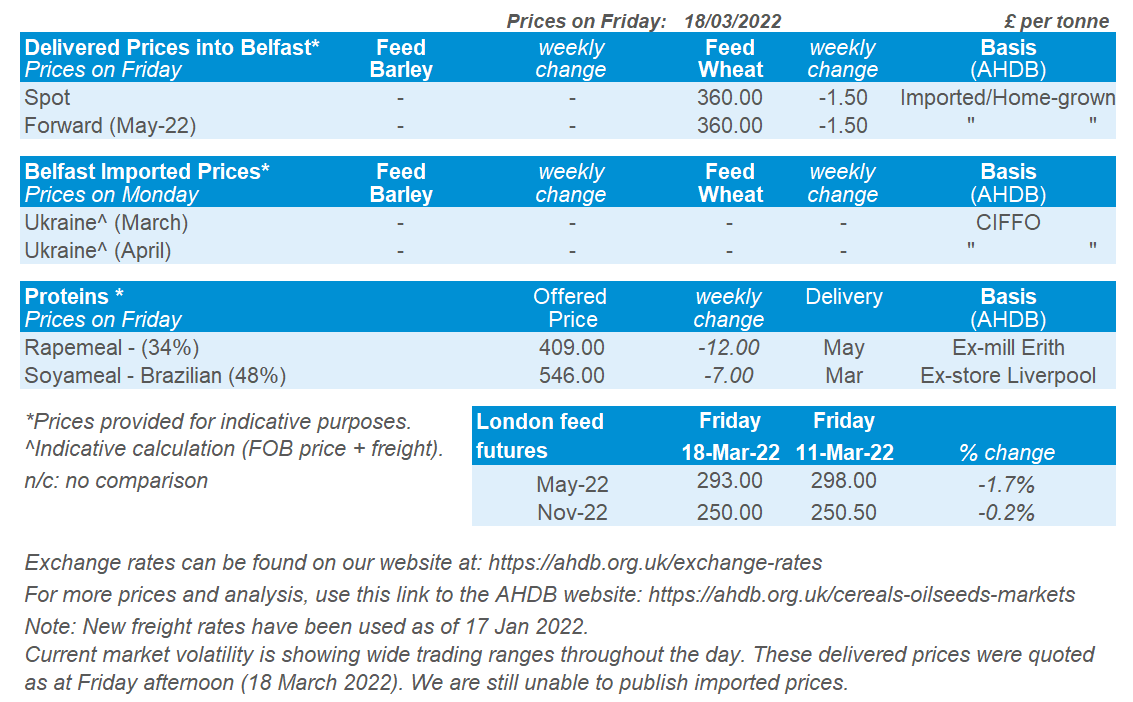

Delivered cereals

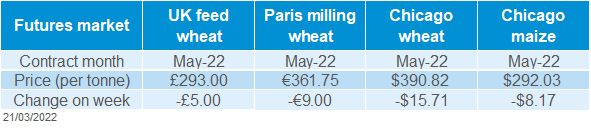

UK feed wheat futures (May-22) saw volatility last week, following global market reactions to the Russian and Ukrainian conflict. The contract closed on Friday at £293.00/t, down £5.00/t from last Friday after some gains mid-week. There were relatively low volumes of contracts traded last week, with such high prices.

New-crop UK wheat futures (Nov-22) closed on Friday at £250.00/t, down £0.50/t week on week. Though volatility saw prices close at £255.00/t on Tuesday. The contract is trading up at £255.50/t today (13:00 GMT).

UK delivered prices followed futures movements (Thurs to Thurs). Feed wheat into East Anglia (March delivery) increased £6.50/t to be quoted at £300.00/t. New crop (Nov-22) was quoted at £251.00/t for this location.

New-crop bread wheat prices were also available last week. Northamptonshire bread wheat (for Nov-22 delivery) was quoted at £290.50/t.

Oilseeds

Rapeseed

Soyabeans

For 2021/22 global rapeseed supplies are tight. For next season, the size of oilseed crops will be key to sentiment going forward. This includes Ukraine’s planting progression of their sunflower crop.

Short term some Brazilian states near harvest completion, boosting available supplies. However, harvest is only just commencing in Rio Grande do Sul (the state impacted by the drought). Longer term, next week’s US planting data will set sentiment for 2022/23 marketing year.

Global oilseed markets

Global oilseed futures

Volatility persists in oilseeds markets as the Ukraine-Russia war continues. Markets over the past week have been assessing how long this conflict will last.

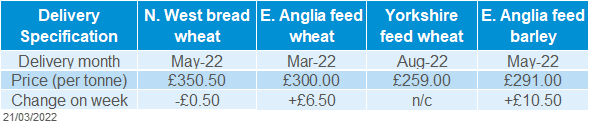

The oilseed complex saw pressure across the week, shadowing pressure in crude and soy oil. Chicago soyabeans futures (May-22) closed down 0.48% across the week, at $612.82/t on Friday.

Over the weekend, Argentina’s government announced an increased export tax rate on soy oil and meal until the end of the year. This export tax rate has been increased from 31% to 33% to combat food inflation.

Furthermore, the Rosario Grain Exchange’s latest report announced that Argentina could face a third successive La Niña weather phenomenon this year. This could impact the 2022/23 grain and oilseed production.

Malaysian palm oil futures (Jun-22) dropped 16.07% (1,078 MYR) across the week. This came as key global producer Indonesia abandoned restricted volumes on exports, increasing global supplies. This outweighed news of Indonesia increasing their maximum palm oil export levy.

Latest data showed that Malaysia’s palm oil exports in March fell from a month earlier. From 1 - 20 March, exports fell 8.4% to 755.98Kt from 825.19Kt shipped during 1 - 20 February (according to Intertek Testing Services).

Rapeseed focus

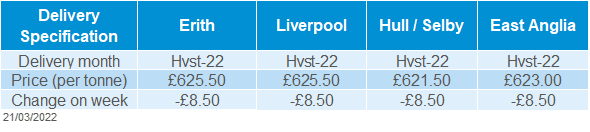

UK delivered oilseed prices

Paris rapeseed futures (Aug-22) closed Friday at €753.00/t, down €6.00/t across the week. Following market movements, UK delivered rapeseed (into Erith, Aug-22) was quoted Friday at £625.50/t. This is down £8.50/t across the week.

In foreign exchange, sterling weakened (-0.2%) against the Euro across to week. Closing Friday trade at £1 = €1.1919.

Please note that Friday’s delivered rapeseed survey was conducted around mid-morning therefore price movements may not reflect futures market close due to the rapidly changing market.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.