How is milk utilisation trending in the UK?

Tuesday, 4 June 2024

Raw milk availability for processing has declined marginally since 2015. We discuss trends in utilising milk during this time and how the market is developing.

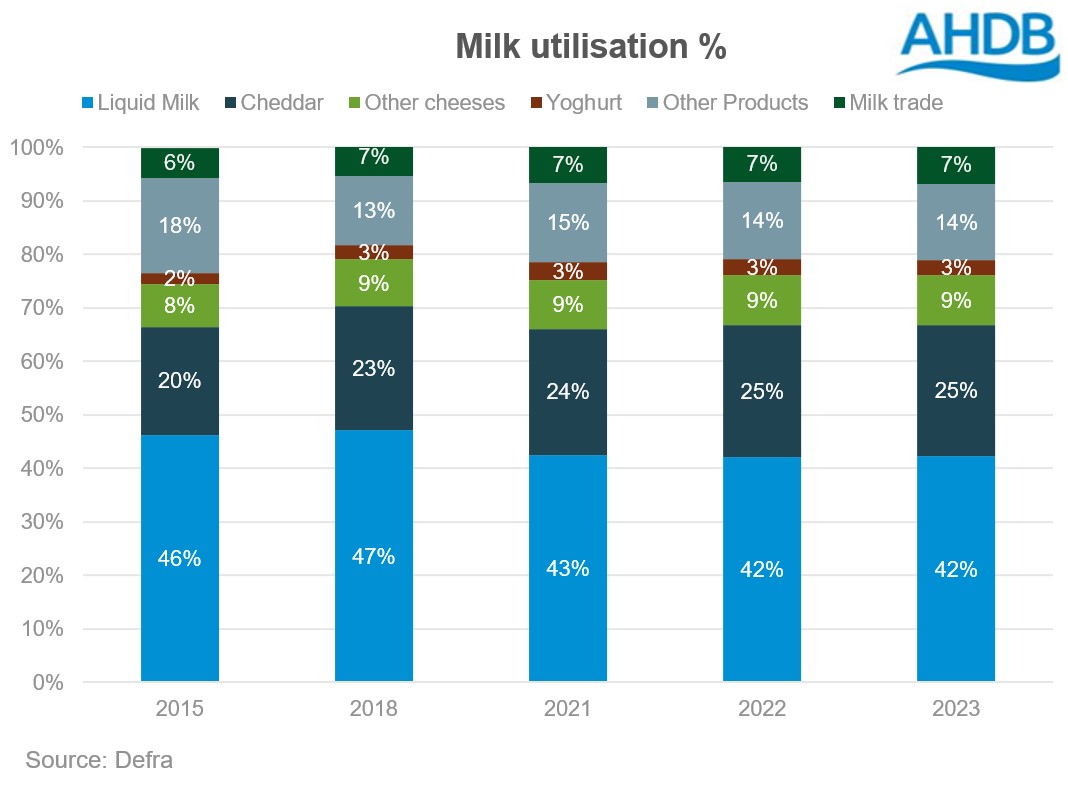

Between 2015 and 2023, raw milk availability for processing in the UK declined by 1% to 14.15bn litres in 2023. Over this period there have been shifts in the types of products produced. For instance, the proportion of raw milk processed into liquid milk reduced by a disproportionate amount. In 2023, milk utilisation under the liquid milk category declined to 42% from 46% in 2015, see graph below.

*Other products include milk powders, cream, butter and condensed milk.

*Other products include milk powders, cream, butter and condensed milk.

In contrast to liquid milk, there has been a significant growth in the cheese category, which accounted for 34% of the milk utilisation in 2023 compared to 28% in 2015. Within the cheese category cheddar is by far the largest variety produced, accounting for 25% of total milk utilisation, and over 70% of cheese production. There are a whole variety of ‘other cheeses’ produced which fall into categories such as long-life territorials and blue vein varieties, with the overall mix of production changing relatively little over the period.

Of the remaining categories yogurt has also seen growth and it now accounts for 3% of milk utilisation. There have also been small increases in milk trade – which is a category used to capture the exports and imports of raw milk (mainly reflecting trade between Northern Ireland and the Republic of Ireland).

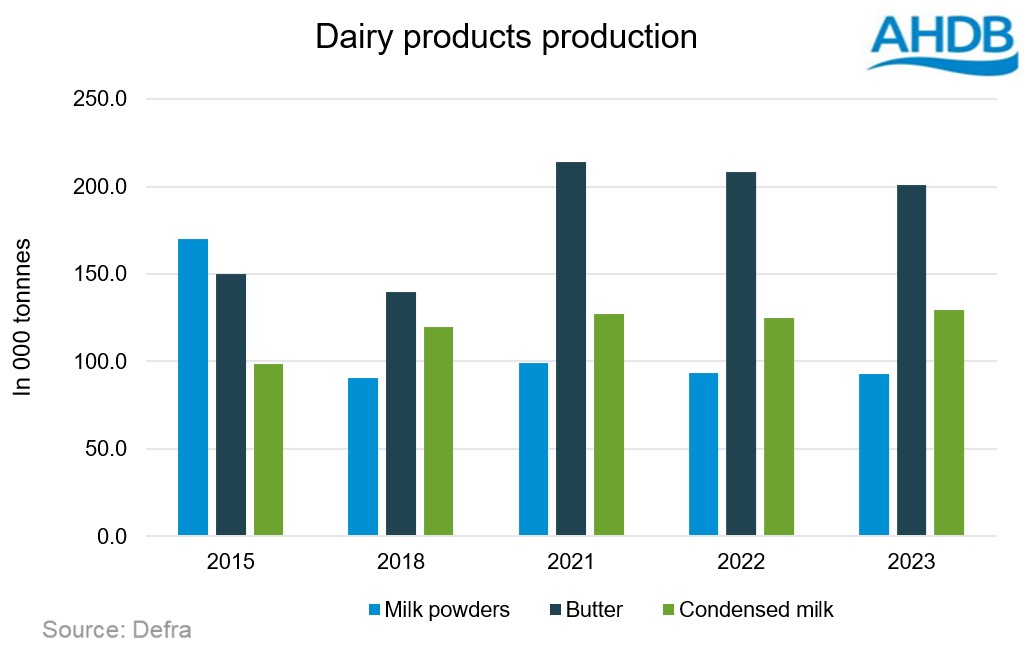

Other dairy products have seen a decline, this includes milk powders, cream, butter and condensed milk. Milk powders were the main contributors to the decline and recorded a remarkable decline of 43%. Milk utilisation for butter and condensed milk increased by 34% and 32% respectively during the period.

What has driven these changes?

Almost all dairy products have registered growth in milk utilisation between 2015 and 2023 except liquid milk and milk powders. For milk powders, utilisation could be lower due to it being a less profitable commodity, with rising energy costs a likely factor.

It is also likely that processors have changed milk utilisation to reflect changes in consumer demand. Since 2015, retail demand for liquid milk has fallen. The latest Defra Family Food Survey shows per capita consumption of liquid milk per week in the UK declined by 19% since 2015. This will have been partially offset by a rising population – but compares to an increase in per capita cheese consumption of 20% over the same period. In other categories like cream and yogurt there has been an increase in retail demand as seen in the latest data available.

Export markets are also increasingly important, and this has been focus for value-added products like cheese recently. This has resulted in the UK returned to an overall trade surplus in dairy products (in terms of total dairy tonnage) in 2022 and 2023.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.