- Home

- News

- How has volatility in key input costs such as fertiliser and feed impacted the dairy market?

How has volatility in key input costs such as fertiliser and feed impacted the dairy market?

Tuesday, 12 March 2024

Milk and input prices have seen a period of volatility over the last few years. We take a look at the relationship between the milk price and the costs of key inputs, fertiliser and feed, over time and dig into the detail of these interactions.

The relationship between milk price and fertiliser price

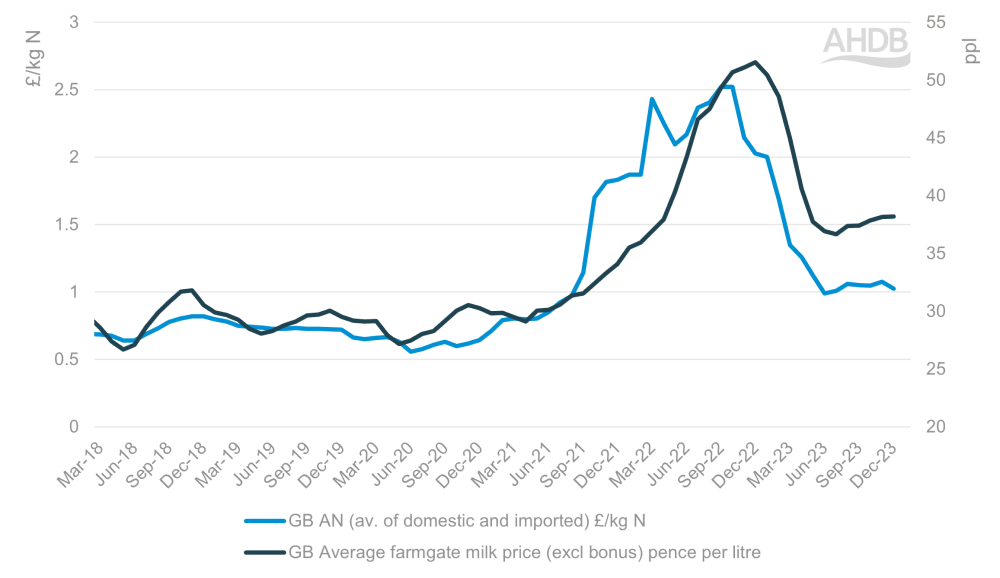

It is interesting to examine the interaction between milk price and fertiliser price over the last few years, a period that has seen some real volatility. Through 2018 up to the end of 2020, we saw relative stability for fertiliser prices, with milk price following seasonal trends to fluctuate around, and mostly above, the five-year average, driven by market conditions.

Moving into the second half of 2021 we saw a steep increase in fertiliser price, with the cost of a tonne of imported 34.5% AN increasing by 49% on the month between September and October. The fertiliser price continued to rise in a stilted manner over the following year to a peak of £870/kg N in September/October 2022. During this period, we saw the farmgate milk price rise, but at a much steadier rate, and delayed behind the fertiliser price.

The increase in milk price indicates a shift in market dynamics, wherein the milk price was forced to respond to an unprecedented increase in input costs at the farm level in order maintain production. This was alongside other factors, such as a tight supply and the threat of milk shortages, which also contributed to the milk price increases.

The dependency between fertiliser and milk prices was further shown as we saw the relatively sharp fall in fertiliser prices in the following few months reflected across to the milk price.

Farmgate milk price versus fertiliser price

Source: AHDB

The value of milk in relation to key inputs

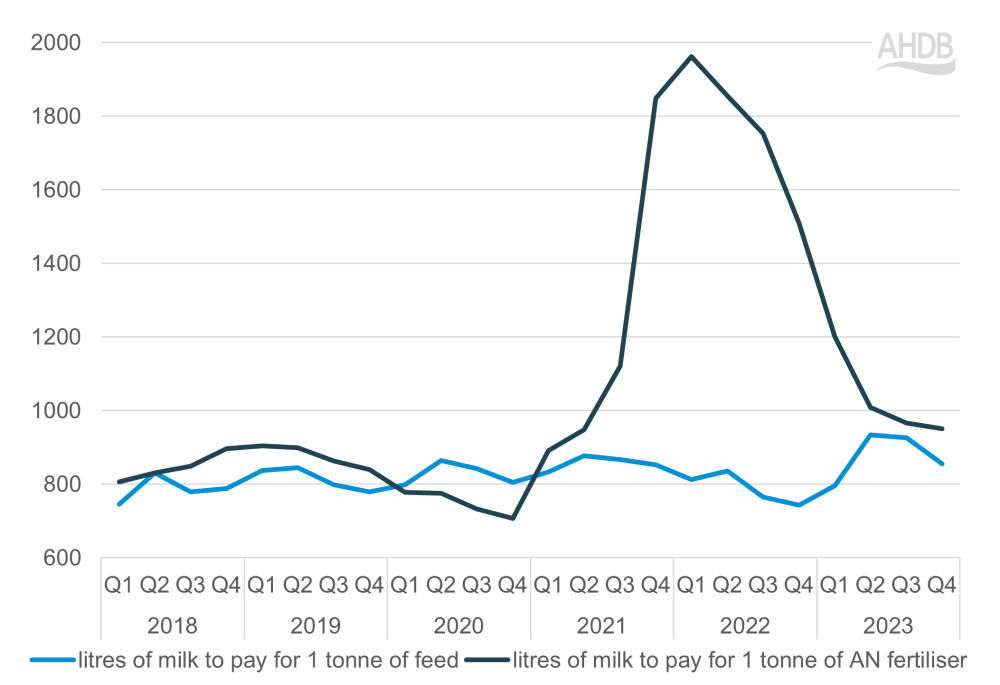

The value of dairy relative to key inputs can be measured by assessing how many litres of milk it takes to buy a tonne of input.

Defra quarterly prices for cattle compound feed have been used in this analysis. Following the fallout from the war in Ukraine, these prices peaked in the first quarter of 2023 at £382/t, but by quarter four had fallen to £326/t. This however is more than 37 up on the 2019 average – an indicator of pre covid / inflation normality. With falling grain prices more recently, feed prices should be expected to fall further and farmers are advised to shop around to find the best value deals.

Relating these feed prices back to the milk price, in the first quarter of 2018, it would take 746 litres of milk to pay for a tonne of fertiliser. We saw this fluctuate between 743 and 877 litres of milk for a tonne of fertiliser between 2018 and the end of 2022. Despite volatility in feed prices following the conflict in Ukraine, the relationship between feed price and milk price remained reasonably stable. This was likely a reflection of feed producers changing raw materials in order to swallow some of the increased costs, combined with a supported milk price that eased the pressure on dairy farmers.

In contrast, dairy farmers were very exposed to the volatility in fertiliser price. Illustrating this point, at its height in Q1 of 2022 it took 1,962 litres of milk to purchase a tonne of fertiliser. This is more than double the average for 2018-2020 of 824 litres of milk per tonne of fertiliser, clearly showing the extreme volatility and challenge for dairy farmers. As input costs fell in the latter part of 2023, we saw this relationship between milk and fertiliser price ease, albeit to levels that remain higher than before the spike.

The value of milk versus key inputs feed and fertiliser

Source: AHDB, Defra*

*AHDB GB average farmgate milk prices, Defra cattle and calf compound feed prices, AHDB GB 34.5% AN price (av. of domestic and imported).

Conclusions

Following a volatile period, we saw the relationship between key inputs, feed and fertiliser, return to more stable levels at the back end of 2023, albeit higher than those seen historically.

Looking forward, volatility in feed and fertiliser prices will prompt dairy farmers to assess strategies on farm and adapt to a more dynamic approach. An example of this may be seen in looking at the relative value of home-grown forage, versus buying in feed. Farmers will need to weigh up market factors each year to assess the best approach with their nutritionist and advisors.

The changing fertiliser landscape may also prompt conversations on strategy. With traditional, go to products potentially no longer offering the most competitive price, farmers will need to look at these alongside alternatives to ensure they are maximising efficiency.

Volatility in the fertiliser market will also impact the relative value of manures, which is particularly important for the dairy farmer. Dairy farmers in mixed farming areas may be able to collaborate with nearby arable farmers in order to cycle muck and forage, essentially capturing the benefits of a mixed farming system whilst maintaining specialism in their individual commodities.

For more details on these key input markets through 2024, our Agri Market Outlooks cover fertiliser, animal feed and straw, for the first time this year.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.