- Home

- Animal feed production outlook

Animal feed production outlook

September 2025

Key points

- Compound feed demand is expected to grow, supported by tight forage availability following a dry spring and summer. Recovery in pig and poultry sectors, alongside strong margins in dairy, will likely sustain upward pressure on feed volumes

- Cereal inclusion in rations is set to remain firm, with maize and barley continuing to displace wheat due to favourable pricing and availability. Depressed global cereal prices and better barley yields reinforce this trend

- Soya meal usage may rise, as rapeseed meal remains constrained by limited UK and continental supply. Competitive soya bean pricing and increased imports position soya as a key alternative in compound formulations

Animal feed demand

Compound feed demand rose last season. This increase was driven largely by a rise in cattle feed production and, to a lesser extent, sheep feed. The climb in demand by these sectors outweighed the decline in pig and poultry feed demand. There are also signs of some potential recovery for these two sectors.

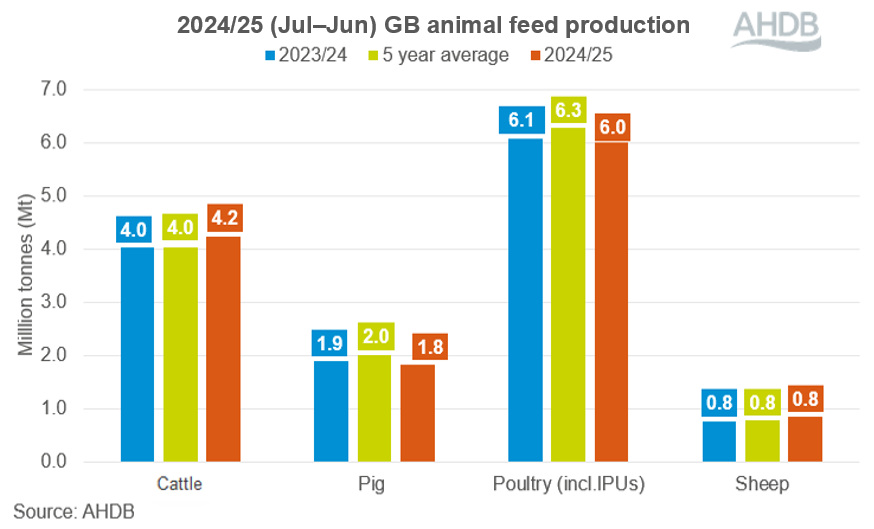

Figure 1 shows cumulative GB compound feed production for each sector for the full 2024/25 season (July–June).

The sheep sector saw the greatest change (in % terms) in compound production last season. It was up by 12%, with particularly strong demand for growing and finishing compounds and blends. However, the greatest change in volume terms was cattle feed production, up 215 thousand tonnes (Kt) year-on-year.

Settling agricultural input costs, as well as strong deadweight prices, are a contributing factor to the increases in production in the cattle and sheep sectors. Easing feed and energy prices have led to a more positive margins outlook on the dairy side. The milk-to-feed price ratio is also encouraging increased milk production.

On the other hand, there are continuing concerns regarding avian flu – but there are signs of recovery for poultry numbers.

Declines in the female breeding pig herd seen in the last three years are expected to reverse this season (2025/26).

The cattle and sheep sectors have been hit with limited access to forage this season. This resulted from the dry weather in spring taking hold throughout the summer, which impacted grass growth rates significantly. This will have implications going into winter and next spring, as forage stocks are significantly reduced for some.

This may force livestock producers to somewhat substitute other feed alternatives, including compound feeds.

Cereal inclusion likely to remain firm

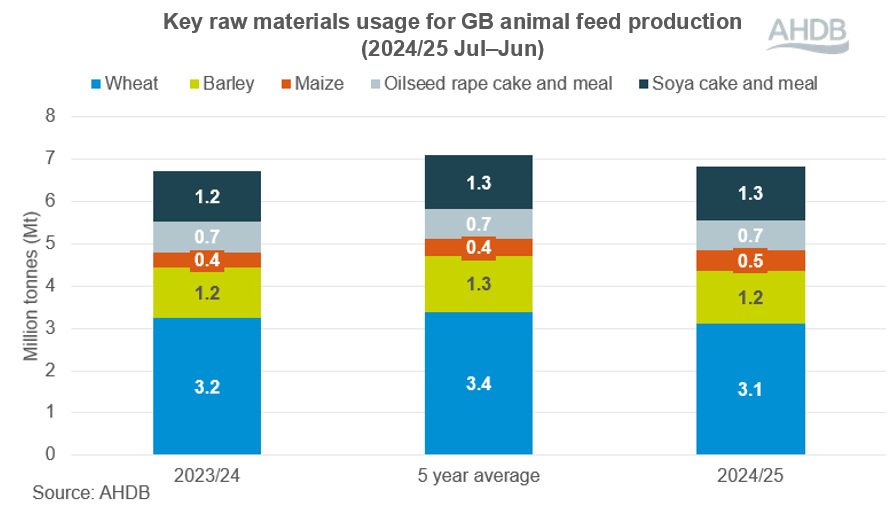

The split of raw materials in 2024/25 changed somewhat on the year.

Cereal inclusions last year shifted notably, with wheat largely replaced by maize and barley, while oat usage remained steady. The price advantage of maize over wheat made it more economically viable to increase the ratio of maize in rations.

This season, with cereal prices depressed and forage tight, cereal inclusion is likely to remain firm.

Figure 2 shows the split of the key raw materials used in GB compound feed production for the full 2024/25 season. The greatest percentage change in raw material usage is for maize, up by 35% (Jul–Jun). The greatest decline was for wheat, down by 4% on year earlier levels.

Over the 2024/25 season, a drop in usage of oilseed rape cake and meal is perhaps unsurprising given the limited supply this season, both domestically and on the continent. However, a spike in oilseed meal usage in May and June occurred due to a significant drop in sunflower meal, which saw increased concern over supply.

This season, rape meal inclusion may remain low due to limited UK supply. However, soya meal inclusion may increase this season as a cheaper alternative, with an uptick in imports towards the end of last season.

Barley inclusion in feed is expected to remain high, at the expense of wheat, as the current premium of wheat over barley incentivises greater use of the latter. Poorer barley quality this season will see barley that would have been due for malting come back into feed stocks, further supporting this trend.

Price direction

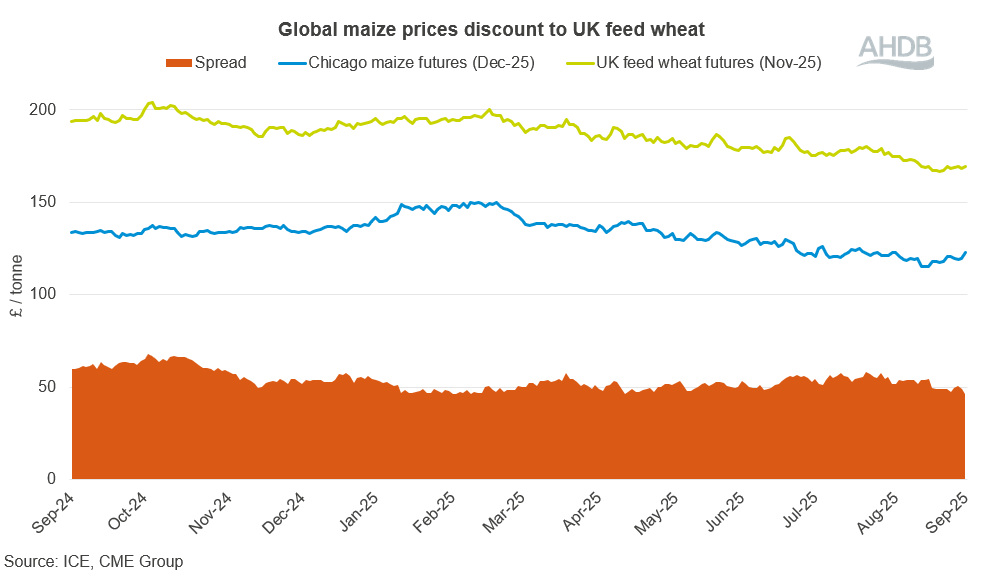

Global maize prices were trading at a significant discount to UK feed wheat futures at the start of last season, with that gap narrowing through the winter but widening again at the end of the season.

Global maize prices have been under pressure with a record US maize crop forecasted, combined with limited support in wheat markets.

Figure 3 shows the price direction of UK feed wheat futures and Chicago maize futures for equivalent expiration dates. The spread has risen in recent months with a large US maize crop keeping Chicago maize (Dec-25) under pressure.

As cereal prices remain under pressure, especially maize, feed buyers are likely to increase cereal inclusion in rations. With cereals offering better value than protein sources, this shift is expected to gain momentum into this season.

In terms of price direction of feed grain, overall, total grain output is forecast to rise for the 2025/26 season.

An increase in global grain production is largely due to a rise in maize output, with a larger US crop driven by increased acreage and yields, and revisions being made to the Brazilian crop forecast. In Brazil, soil moisture is benefiting planting conditions and planting areas have increased.

As a result of these factors, maize has become a key driver in markets at the moment and is underpinning the wider grains complex.

Rapeseed prices remain supported by limited supply, both in the UK and globally, while soya beans continue to trade more competitively. In the short term, vegetable oil markets and tight rapeseed balances offer price support.

However, in the longer term, the International Grains Council (IGC) is predicting a rise in sunflower seed output across the Ukraine, Russia and the EU for 2025/26. This is as well as heavy Brazilian soya bean supplies capping gains.

Conclusions

Compound feed demand is expected to continue its upward trend.

Low forage supplies and suppressed global cereal prices all point towards firm cereal inclusions in rations this season.

Oilseed usage in compound feed this season reflects ongoing supply challenges and shifting price dynamics.

Rapeseed inclusion remains limited due to tight UK and continental availability, while soya beans continue to offer competitive value.

Sign up to receive the latest information from AHDB