How do UK red meat markets balance?

Tuesday, 24 March 2020

In the supply chain for red meat, one of the most obvious effects of coronavirus has been on the eating out sector. At first some, then all, pubs, bars and restaurants closed, while some remained open as take-away outlets. More recently even some of those have found that untenable. It is impossible to enter a supermarket without noticing the changes in consumer behaviour that have taken place over the past couple of weeks.

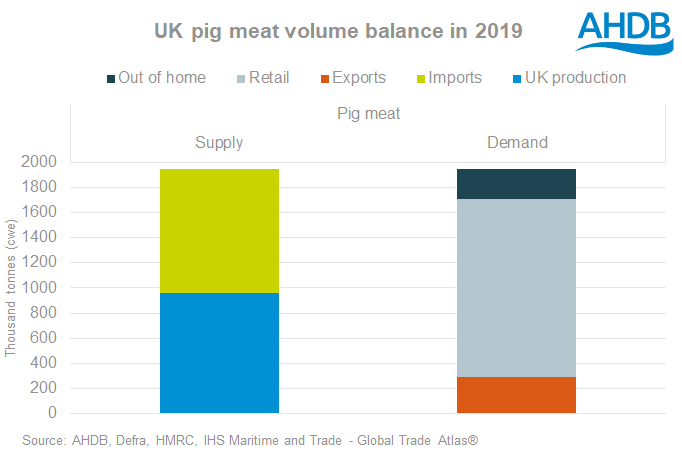

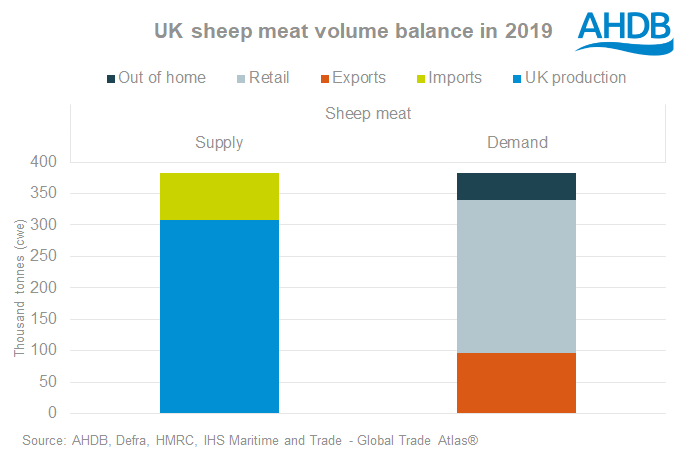

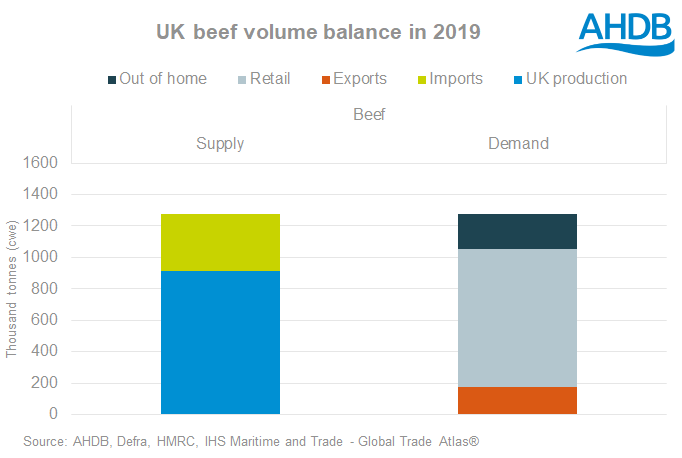

Using Defra and HMRC data, as well as AHDB’s own Eating out review of 2019, it’s possible to approximate how supply and demand balance for each red meat in the UK. Or at least, how they balanced before the coronavirus temporarily boosted retail demand and battered foodservice demand. Official data on retail demand for March will not be available until early April.

In terms of share of UK production and imported meat, we don’t yet have enough information to say how foodservice demand and retail demand are being met. Although, it is understood that imports do relatively well in the food service channel, while domestic production does relatively well at retail. Of course, some UK processors will predominantly serve the foodservice sector.

Supermarkets may also need to address carcase balance, when coping with the wholesale switch of demand from out of the home, to the domestic demand they serve. Although there are similarities, foodservice demand does not mirror domestic demand cut for cut.

Trade also plays a vital part in balancing the carcase, and although there are no reports of widespread disruption, any impact would affect not only the product mixture available on supermarket shelves, but also the value returned to famers.

Economic activity is lower, and there is uncertainty about the amount of time coronavirus will disrupt everyday life. Even if some eating out demand is relocated into the home, overall it is likely that demand will be lower, which could put pressure on prices.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.