GB pig prices: net margins supported despite downwards pressure

Wednesday, 6 November 2024

Deadweight pig prices:

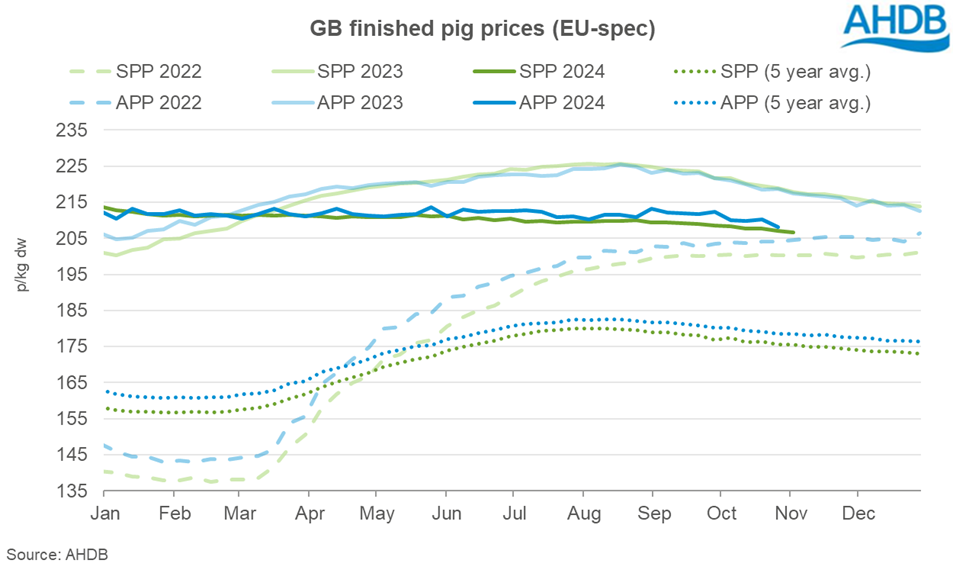

Having been pretty stable for the first five months of the year, the SPP has now been in gradual decline for the last five months, with prices continuing to ease through October. The EU spec SPP for week ending 2 November stood at 206.61p/kg, down 0.53p on the previous week and back 2.03p/kg from the end of September. Although prices paid are now around 11p lower than they were last year, they remain historically high, around 6p/kg above the same week in 2022.

The APP however has remained fairly consistent through 2024 so far, despite more volatile weekly movements. For the week ending 26 Oct, the EU spec APP stood at 208.14p/kg, down 2.17p/kg from the week before. As with the SPP, the APP is lower year-on-year but well supported compared to historic trends.

Net margins improve as COP eases:

AHDB’s estimated quarterly net margin figures have been supported by minimal movement in the pig pricing series through 2024. Our Q3 data shows that net margins stood at an estimated £19/head, up £4/head from Q2. This change has been driven by a decrease in feed costs, lowering the overall estimated cost of production (COP) by 5p/kg to 190p/kg. Typically feed makes up 65-70% of the total COP for pigs, but less market volatility over the summer months resulted in feed costs making up a lower percentage of total cost in the most recent quarter, at 61%.

For much of this year, future quotes for soyameal were hard to find or non-existent with questions lingering over the EU Deforestation Regulation (EUDR) which were due to come into force as of 1 Jan 2025. However, the implementation of this regulation has now been pushed back to 2026 following the European Council announcement on 16 October. Both Brazil and the US are forecasting sizeable soyabean crops this season (2024/25) pressuring prices lower. On grain markets, wheat prices had risen during spring in response to production concerns in Russia, fortunately adverse weather impacts were not as extreme as first feared, with market prices easing over the summer months. Maize prices have also seen downwards pressure with favourable conditions leading to expectations for this season of the second largest US maize crop on record.

With producers now estimated to have recorded six consecutive quarters of positive margins, industry sentiment is noted to have improved. Although many farms will still be recovering their finances after the challenges faced in late 2020 to 2022, there have been positive reports of on-farm investment, especially new breeding stock and updating of buildings and equipment.

Future risks:

However, some uncertainty remains across the industry, with EU pig prices falling there is risk of import volumes to the UK increasing and pressuring prices on the domestic market. Heightened geopolitical tensions are also likely to impact global market dynamics in the coming months.

Closer to home, last week’s government announcement that the UK farming budget is to remain the same, will result in reduced spending by Defra in real terms due to inflationary pressure. This could impact on grants for further on-farm investments to improve efficiency and sustainability or adjustments to any new welfare regulation proposals. Alongside this was the change to inheritance tax, highlighting the importance of proper succession planning for businesses of all shapes and sizes.

Most farming businesses know they need to talk about tough issues; they just don’t know how or where to get started. In October 2024, AHDB held a series of workshops to help farmers bring the people in their businesses – be it family members or other staff – to the table to start the conversation. Click here to watch the podcast extracts.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.