Feed report: 25 August 2021

Wednesday, 25 August 2021

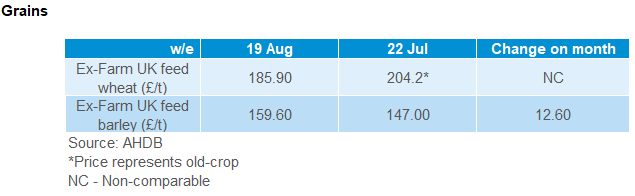

Within the last month a lot has changed for grains. A bullish sentiment in the global market has led to higher domestic prices.

At the end of July, the main driver for the market was global weather. Notably dryness in the Northern US plains and Canadian Prairies causing issues for developing wheat crops. Closer to home, on-going wet weather in Europe slowed harvest and caused quality concerns.

Alongside weather news, forecasters began revising production figures down for key regions.

This came into fruition in the August USDA World Agricultural Supply & Demand Estimate report. This cut 2021/22 global wheat production by 15.5Mt, with notable reductions in Canada and Russia.

This tighter supply picture has supported wheat markets across the month. Barley will likely remain supported by wheat. However, the discount has widened to remain competitive into feed markets.

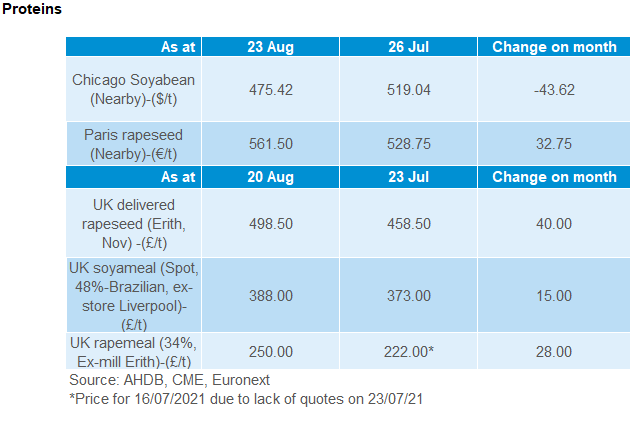

Canadian dryness has also been a key driver in rapeseed. August saw the first insight into the damage of this crop with the USDA report. Said report cut 4.2Mt from its estimate of the Canadian rapeseed crop to 16.0Mt, 21% smaller than last month.

European rapeseed imports for 2021/22, have been cut as high prices contribute to demand destruction. As a result, imports from Canada and Australia are expected to reduce.

For soyabean markets, a key price driver, particularly in the last week, was US crop development. As US soyabeans entered the pod filling stage, weather has been a key watch point.

Despite prolonged dryness across the US, recent rains have tempered the market for soyabeans. This is favourable for soyabean crop development, thus providing a bearish sentiment.

Further to that, a reduced demand for oilseeds is contributing to a bearish market sentiment. This comes as Chinese demand is reportedly slower year-on-year. Then came news that the US Environmental Protection Agency were expected to recommend reducing the 2021 biofuel blending mandates to below 2020 levels. This also pressured the market.

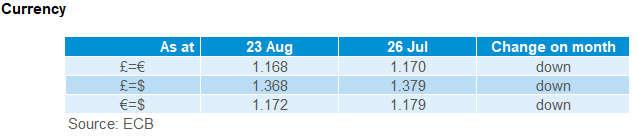

Sterling was weaker against both the dollar and euro from 26 July to 23 August. The US dollar was supported across the month. It is considered a “safe haven” currency, with the issues currently present in Afghanistan.

Throughout August the Euro has had weak points again both the pound and dollar. Concerns came at the end of July, when the European Central bank announced they would not rush into raising interest rates.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.