EU beef and lamb market update: tighter supplies support prices

Thursday, 14 December 2023

Key points

- EU cattle prices have grown in recent weeks, as supplies remain tight. The GB premium to Irish steers sits at 77p.

- Beef production is in general decline from last year, particularly in Italy, Spain, and France.

- Sheep prices have grown in recent weeks, with Spanish lambs gaining large ground.

- Production in key countries has fallen, providing strength to prices.

Beef

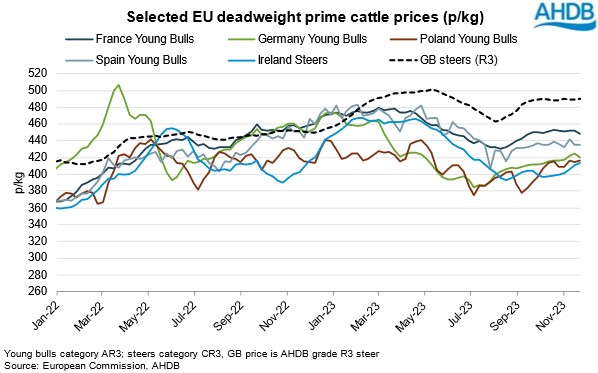

EU prime cattle prices have generally shown growth in recent weeks, with the overall EU R3 steer measure averaging 423.6p/kg for the week beginning 27 November. Prices in France and Germany saw slight dips towards the end of the month in sterling terms. Meanwhile, prices in Poland, Spain and Ireland saw growth across the month. Industry reports suggest that Irish throughputs have tightened in recent weeks, boosting prices as abattoirs look to fill out their kill sheets ahead of Christmas. The price differential between GB and Irish R3 steers has therefore softened in recent weeks to end November at 77.2p, as Irish R3 steers sat at an equivalent average of 413.3p/kg compared to GB steers at 490.5p.

Meanwhile, cow prices have fallen over the last few weeks, continuing the general trend seen since the spring. The EU average cow price stood at 327.4p/kg for the week beginning 27 November, down 35p from the year before. French cow prices have seen large price falls, down 24.4p over four weeks to 371p but remain elevated compared to the EU average. Irish cow prices have seen a slight uptick, up 9.4p in the past four weeks. There has generally been a lack of demand for manufacturing beef/visual lean across Europe, combined with higher kill in some countries, which has dampened the overall price.

Select EU deadweight prime cattle prices p/kg

Source: European Commission, AHDB

Beef production is in general decline in the EU, with large declines from last year. When comparing the total of the first three quarters, production in Spain and France has fallen by 7% and 4% respectively. Italy has continued its decline in production, with a fall of over 100,000 tonnes (-20%) from the first three quarters of 2022 to 2023. Industry reports suggest that poor grazing quality and conditions, coupled with high feed costs have limited production through lower carcase weights.

Cow kill has fallen slightly across the region (-5%) in the year to date, against 2022. Throughputs in France, making up 24% of total cow kill in Europe so far this year, have fallen by 80,000 head (7%) to 1.07m head for the year to date. Throughput has also fallen notably in Italy, Poland and Spain. However, there has been an uptick in kill for the Netherlands (+10%).

Sheep

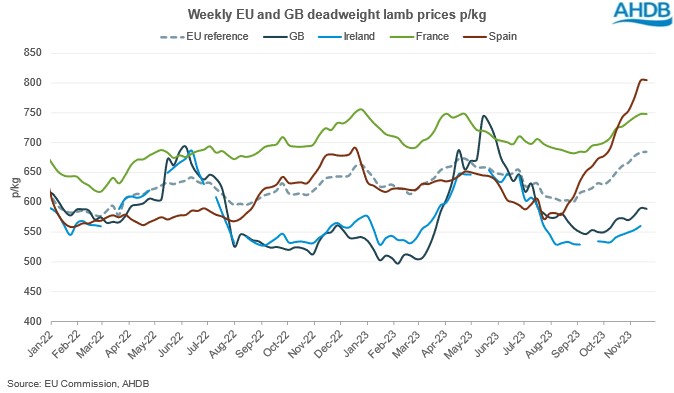

Meanwhile, EU sheep prices have seen more upwards movement. The EU reference price has grown in recent weeks to €786/100kg (equivalent to 685p/kg) for the week ending 20 November. This is a slight increase from the previous week, continuing the trend seen since early September. Spanish lamb prices have soared in recent weeks, breaking the 800p/kg barrier to reach 805p/kg for the week ending 20 November. Price growth has also been seen in France and Ireland, but to a lesser extent.

Weekly EU and GB deadweight lamb prices p/kg

Source: European Commission, AHDB

Sheep meat production in the EU has fallen by 7,200 tonnes (-2%) to 312,000 tonnes in the year so far (Jan-Sep). Key producing countries such as France, Spain, and Greece have seen output fall in the first three quarters of 2023 from last year. Spanish production fell by 8,380 tonnes (9%) as adult sheep kill fell 13% with lamb kill down an additional 7%. Followed by France with an output fall of 5,540 tonnes (9%), with a fall of 9% in lamb kill and a 7% fall in adult sheep kill. Production in Greece fell minimally by 3% to total just under 35,000 tonnes for the year to date, as lamb kill contributed to this decline, falling by 6%. Meanwhile, Ireland has recorded growth in production of 2% for the year to date, with lamb kill up 0.4%, suggesting heavier weights.

Production outlook

The EU short term outlooks see a fall of 3.1% in beef production for the total of 2023, with a 1.8% fall in sheep meat production. Both are predicted to drop a further 1% into 2024, with slight recovery if feed prices continue to lower. High domestic prices will hinder trade opportunities, with consumption hindered by cost-of-living cutbacks.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.