Escalation in the Middle East – Consequences for UK dairy farmers

Thursday, 17 October 2024

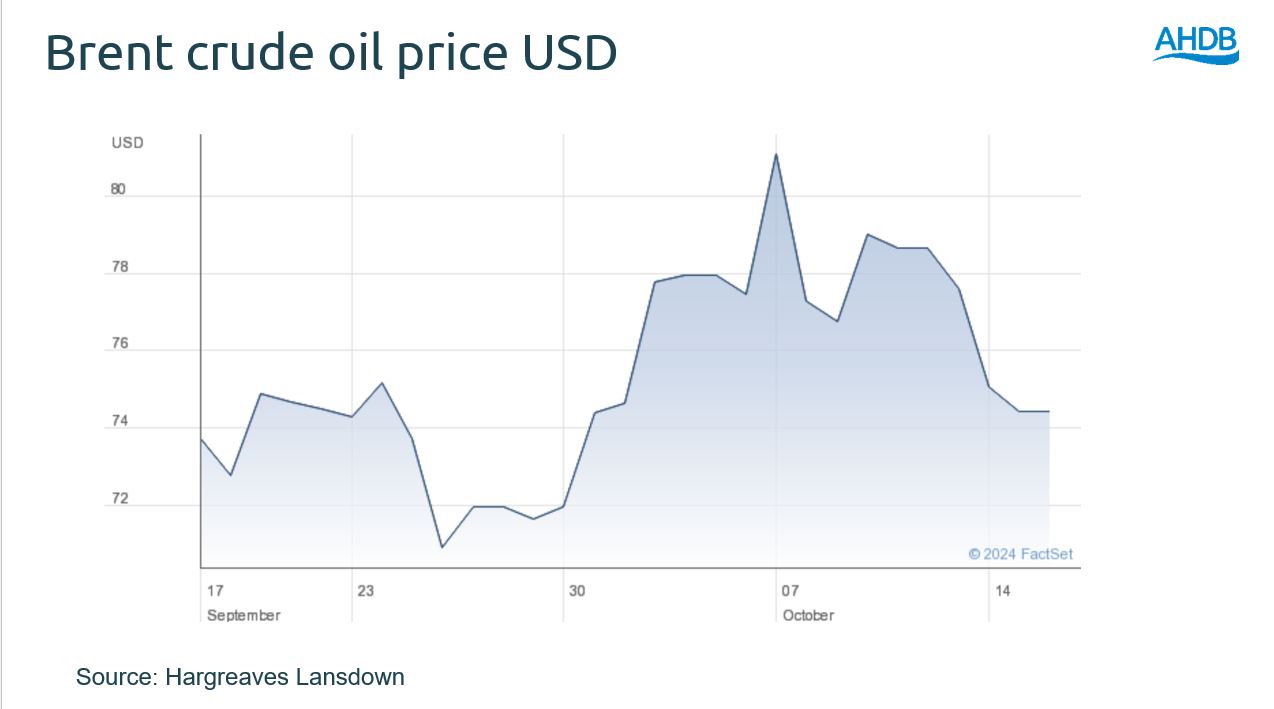

The further escalation of conflict in the Middle East, originally examined back in January, has impacted global oil prices.

After almost a year of cross-border hostilities sparked by the war in Gaza, the conflict has accelerated to include direct conflict between the Iranian-backed Hezbollah and Israel in Lebanon and northern Israel, with the fear that this will lead to all-out war in the region.

The Middle East has been awaiting Israel's response to a missile attack last week that Tehran carried out in retaliation for Israel's military escalation in Lebanon. What is unsettling the markets is the prospect of Israel attacking Iran’s oil producing facilities.

Iran is a major global oil producer, responsible for around 4% of global supply. Source: US Energy Information Administration.

Global prices rose by about 11% immediately after Iran launched about 200 missiles at Israel last week but have drifted back down because of the lack of any actual market disruptions and renewed concern about weak demand from China. This drift has intensified following reports that Israel has assured the USA that any Iranian targets will be military in nature rather than targeting Iran’s oil or nuclear industries, easing fears of supply disruptions. As a result, oil prices dropped to their lowest point in two weeks. However, the situation remains heated and subject to change.

Iran's exports are almost entirely bound for China, and if its supplies are removed from the market, other producers could step in to compensate. However, if Tehran or its nonstate allies retaliate against shipping or infrastructure elsewhere in the region, the situation could escalate rapidly.

The issue with oil prices is that they are a key determinant of costs of production across UK industries, including agriculture. A sudden rise in oil prices could trigger a round of cost-push inflation, just as inflation seems to be closer to ‘normal’ levels after a challenging two years.

Fears of inflation could also influence the Bank of England’s monetary policy committee decisions when it meets to decide interest rates. Despite Andrew Bailey indicating that rates may come down faster and more sharply than previously expected, this may well disrupt this trajectory.

What could be the impact for dairy farmers?

There could be a number of impacts:

- Increased inflation would delay interest rates coming down, which would put further pressure on high borrowing costs

- Higher oil prices ultimately mean higher fuel, energy, fertiliser and feed costs pressuring profit margins

A return of inflation to retail could dampen demand for dairy products, which may weaken commodity and farmgate prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: