Divergence in trend for Chinese red meat imports

Wednesday, 26 January 2022

China’s pig herd has been growing, as the sector recovers from the worst impacts of African Swine Fever. But what did this mean for China’s imports of animal protein in 2021?

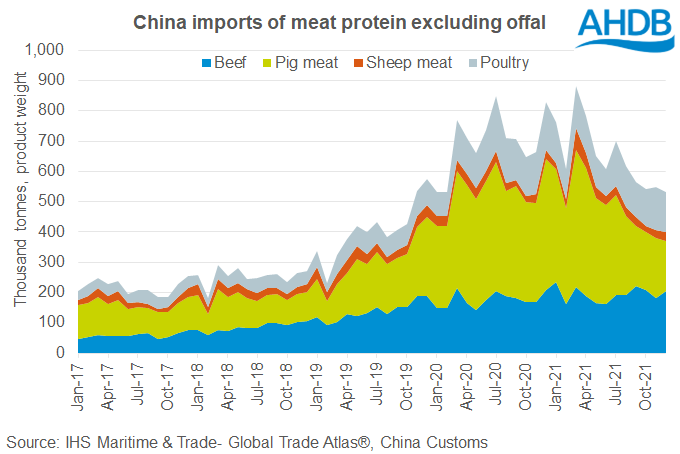

Chinese primary meat protein imports totalled 7.8 million tonnes in 2021, a 6% decline on 2020 levels, according to China Customs data. The decline came from a sharp fall in pig meat and poultry imports, while both beef and sheep meat imports recorded some growth. For all the proteins, imports were significantly above levels seen before African Swine Fever, which struck the country in August 2018.

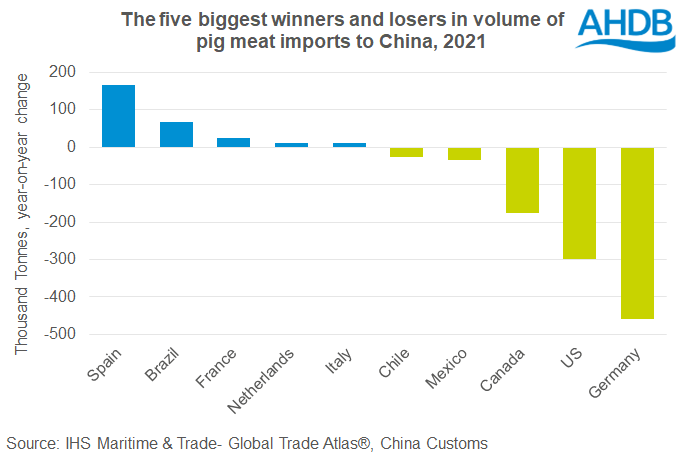

Volumes of imports have waned throughout 2021, most noticeably for pig meat. In Q4 2021 pig meat imports were at around half the level they were in Q4 2020. Not only have volumes decreased, but there has been a change in supplier too. Germany was previously a large supplier, but since its own outbreak of ASF, has been closed out of the Chinese market. There was also a significant decline in volumes from the US and Canada. Until recently, export volumes from Spain had been growing dramatically, underpinning herd growth.

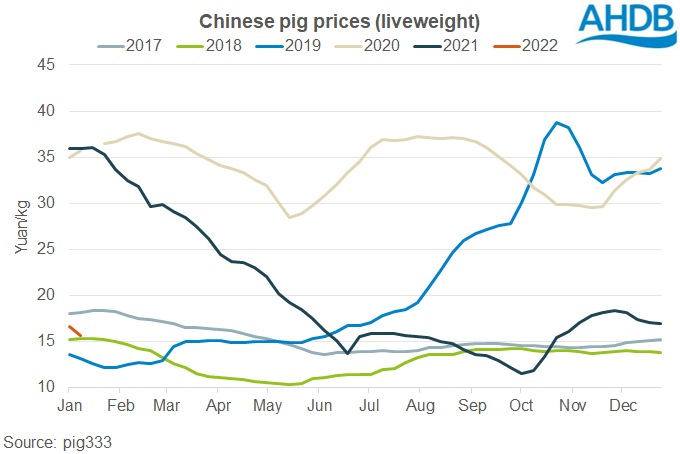

In recent weeks Chinese live pig prices have continued to trade in the region of 2018 prices. This reflects reports that the Chinese pig herd was recovering, and that the Chinese market is more than amply supplied.

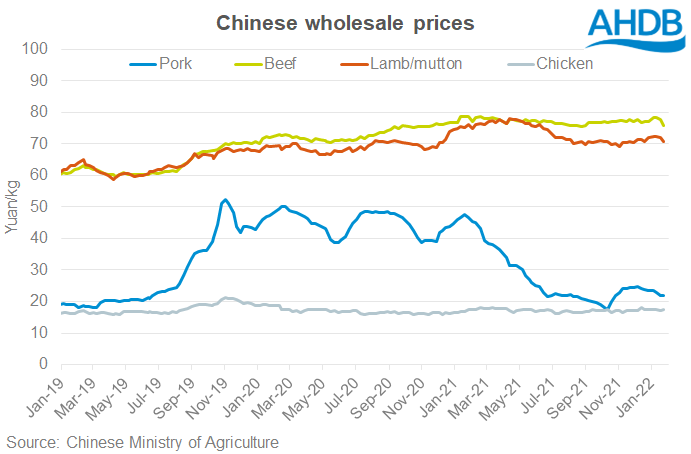

Chinese wholesale prices for pork have also been reflective of plentiful supplies. Chinese wholesale pork prices have moved downwards, while beef and lamb wholesale prices have held their ground.

There has long been speculation that some of the pork demand which shifted to beef and lamb due to the Chinese ASF outbreak would become permanent. This divergence in trends for the prices and import volumes of different meats could be seen to be indicative of this.

UK exporters are still sending product to China, but the market is difficult, and the prospect of increasing volumes and prices seems a dim and distant one. The UK’s other important market, the EU, is also well supplied and is likely to be so for some time, and these factors together could weigh on pig prices here for a while yet.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.