Importance of adapting to evolving eating habits in the home

Thursday, 29 September 2022

The past two years have significantly changed eating habits in the home. The amount of meals eaten at home remain at an elevated level compared to pre-pandemic average.

Remote working and the continued evolution of consumers lifestyles since Covid-19 has led to more time spent eating at home for British households. But how is that time in the house spent and what impact is it having on current food behaviours in the home?

Elevated levels of in-home meals remain

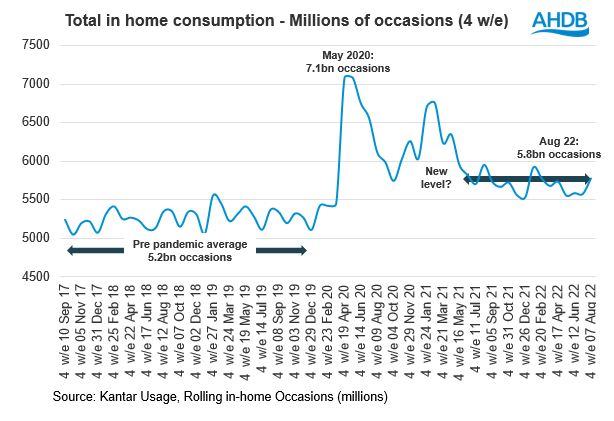

The levels of in-home meals eaten are starting to stabilise a little after a significant period of turbulence. Pre-pandemic, the average number of in-home meals stood at around 5.2 billion occasions – this rose notably during lockdown and eased back as restrictions eased.

The latest numbers reported in Kantar Usage’s State of the Nation indicate that in the 12 weeks to 7th Aug 22, consumption in-home was 7% bigger than the pre-pandemic average of 2018/2019. This has had a knock-on impact elsewhere with out-of-home being 10% smaller and food carried out-of-home 23% smaller.

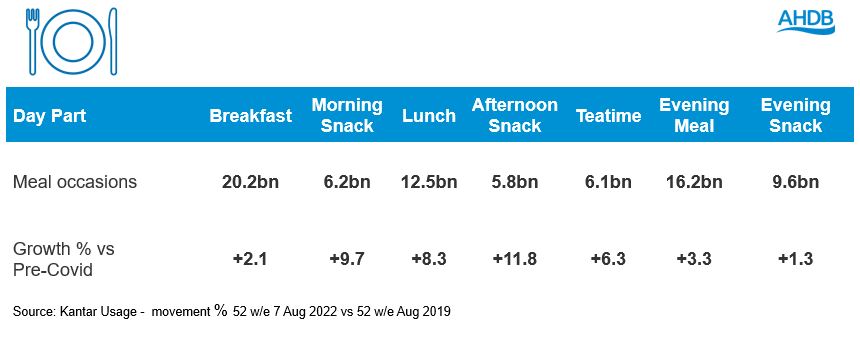

And it’s not just where we eat that is evolving, when we eat is also impacted by changing consumer lifestyles. Lunch and snacking occasions have all seen strong rises. Lunch at home represents the daypart with the biggest increase with an additional 955m occasions in the 52 weeks leading up to 7th Aug compared to pre-covid levels. Interestingly, for snacking, it is those enjoyed earlier in the day, rather than the evening, that have grown the most.

Changing lunchtime dynamic

Since the start of lockdown, 68% of these additional lunches eaten are midweek and eaten by non-retired adults – highlighting the big impact that increased remote working is having on consumption. Lunch is typically dominated by sandwiches, now accounting for a third of occasions, they are a core area for sliced cooked meat and yellow fats such as butter. 75% of these extra lunches had during the week come from more affluent consumers. That said, it doesn’t directly transfer into a more premium occasion, with the average cost of an in-home midweek lunch for a non-retired adult costing £1.59 per person per occasion compared to £1.76 across all households. This shows these extra lunches from those demographics does not necessarily translate into more opportunity. With price very much on the mind of consumers the use of meal leftovers and using what’s available in the home are likely to be attractive options.

Growth in the in home meal doesn’t necessarily mean eating all together

While consumers may spend more time at home, it doesn’t necessarily mean everyone eats together. Currently, the majority (58%) of main meals only have 1 or 2 people present while 42% have 3+ people.

Kantar Usage trends point towards signs that households are being less social and more inwardly focused than we were in 2019, with meals selected as a ‘social occasion’ down 9% and TV dinners up +7%. Also, with more people working from home, more meals are being eaten in front of computers (+27%). These lifestyle changes all impact the type of meals chosen by consumers. For example, more people are moving towards convenient and assembled meals, which is when consumers put together pre-prepared components to make a whole meal – highlighting the desire for low effort, yet tasty meals.

Impact of these eating habits on AHDB sectors is being covered in an upcoming webinar series

The current cost of living crisis has led consumers to re-assess consumption habits given tight household budgets. There have already been significant changes in eating habits since the pandemic which has resulted in those elevated in-home occasions. For AHDB’s sectors, it is vital to adapt to the evolving needs of consumers and remain relevant. Understanding and adapting to the way people are consuming food is critical for strong long term category performance. AHDB’s Retail and Consumer Insight are running a series of webinars which are available to sign up online . These will take an in-depth look at consumer demand for red meat and dairy and reputational issues across the industry in the backdrop of the current consumer landscape.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.