Canned meat and UHT milk set for cost-of-living renaissance?

Thursday, 18 August 2022

Canned meat and UHT milk saw a surge in sales at the start of the pandemic as people stocked up their cupboards. Since then, sales have eased. But with the financial impact of inflation hitting households, could these foods help ease their financial pressures?

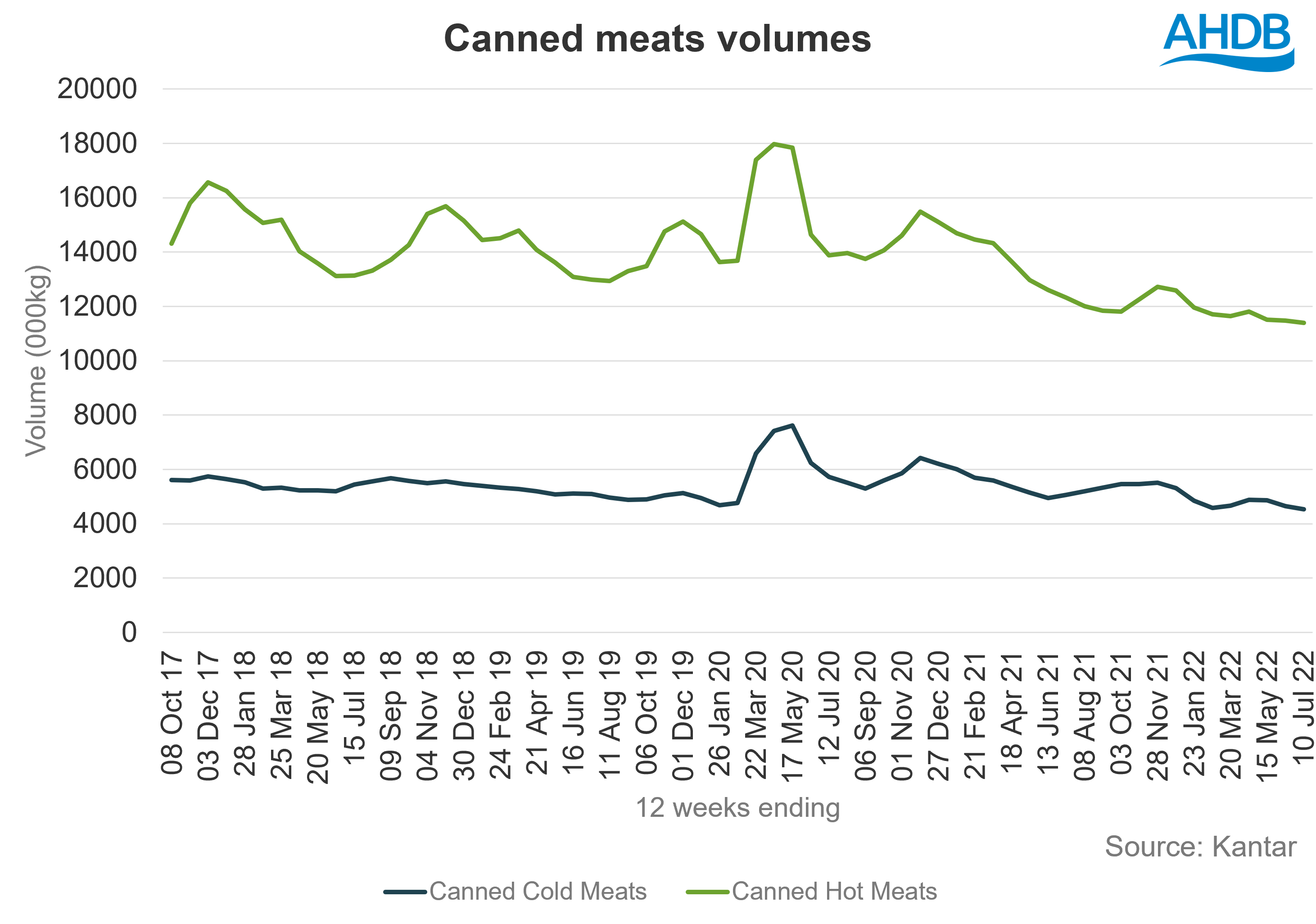

When the first lockdown was announced in March 2020, almost every grocery category experienced a spike in sales. Figures from Kantar show that overall volumes of canned food soared by 35% year-on-year in the 12 w/e 17 May 2020 (incorporating the peak panic buying period). Volumes of canned hot meats (meat products that can be eaten as a meal such as hot dogs, pies and meats in sauces) were up 31% over this period, while canned cold meats (mainly corned beef and ham/pork) increased by 50%. Within milk, UHT volumes rose by 24%.

By August 2020, a third of consumers said they were making sure they had plenty of food in their cupboards, more than they were pre-pandemic (AHDB/YouGov Consumer Tracker). Come the following summer, even after ‘freedom day’, this behaviour prevailed with 26% saying they were doing this more than previously (August 2021). So, does this mean sales of canned meats and UHT milk have remained elevated?

Canned meats

Since the surge in sales at the start of the pandemic, canned meat volumes have returned to the decline they were experiencing before. This means that in the latest 52 w/e 10 July 2022, volumes of canned hot meats are 19% lower than they were five years ago, and canned cold meats are 9% lower over the same period (Kantar).

The main area of growth for canned hot meats in 2020 was hot dogs, which accounted for approximately 40% of canned hot meat volumes. In the year ending 12 July 2020, ambient hot dog volumes rose by 10% year-on-year.

In cold canned meats, corned beef also saw an increase in sales, with volumes up 14% in the year ending 12 July 2020.

However, since then, volumes of hot dogs and canned corned beef have returned to decline and are now 9% and 15% lower than five years ago, respectively. In contrast, meatball volumes (which sit within canned hot meats) are still 10% higher than five years ago, suggesting it’s an area for further innovation.

This general downward trend shows that the uplift in sales of canned meats was short-lived and the likelihood of any mass return to the category seems low. With increased focus on health, environment and animal welfare, these products have challenges to overcome and more premium canned products will require more considered sourcing.

UHT milk

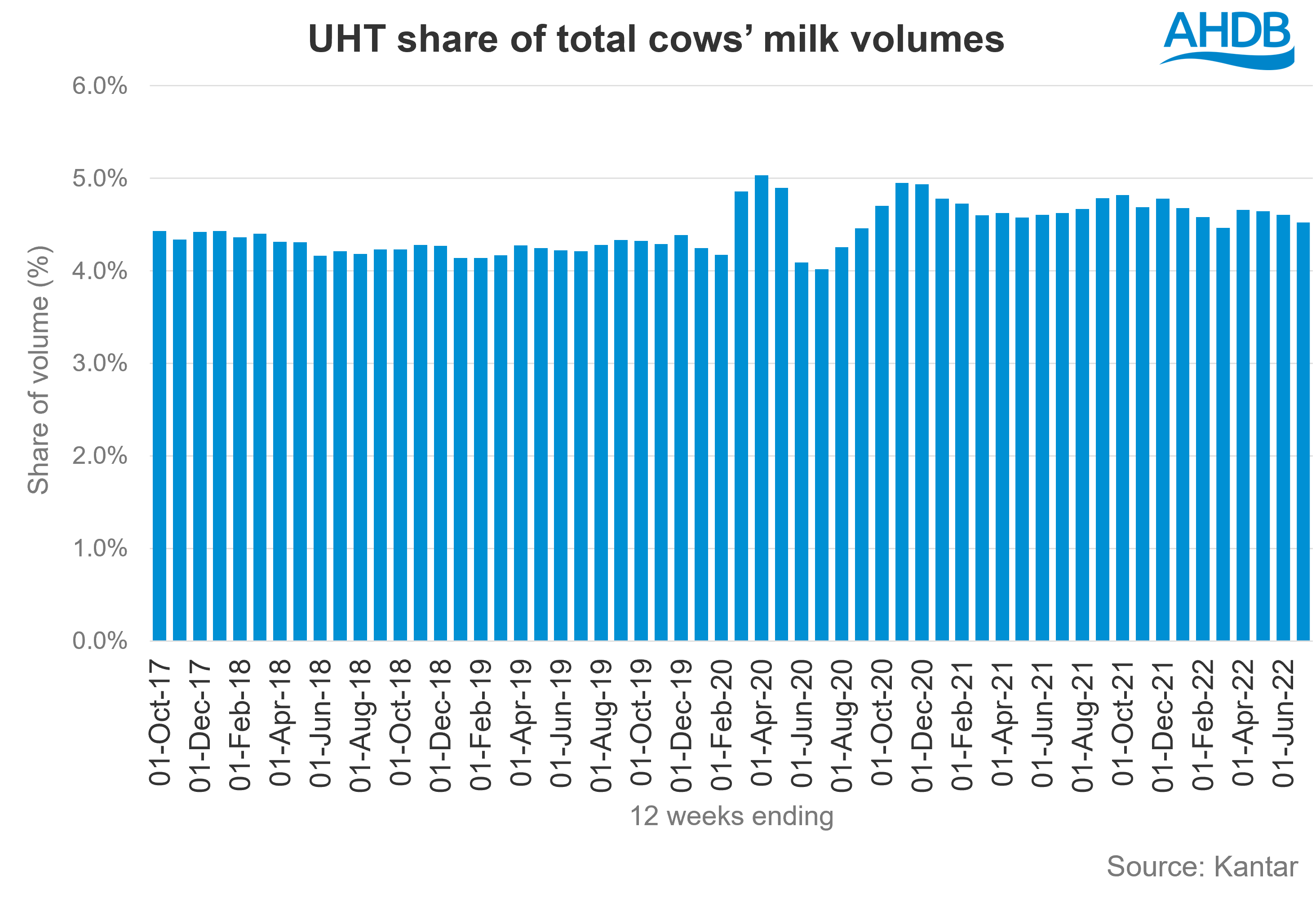

Although UHT milk volumes have eased when compared to their pandemic peak, volumes in the 52 w/e 10 July 2022 are still 6.2% higher than they were five years ago.

As total cows’ milk has moved into decline at a faster rate, UHT has actually gained share of the category. Prior to the pandemic, UHT milk accounted for just over 4% of total cows’ milk volumes. This shot up during the first lockdown and, after a period of readjustment, now maintains a higher share than pre-pandemic.

Key to this is an increase in the proportion of households buying UHT milk. In the 12 w/e 10 July 2022, 17% of households bought UHT milk, compared to 14% in the same period in 2019.

Recent sales have been boosted by the hard discounters’ performance. These retailers (Aldi and Lidl) account for 33% of UHT milk sales, compared to a total grocery share of 18%, making them key to UHT’s overall performance. The discounters are regaining market share and forecasts, such as those from IGD, suggest they will continue to gain share as shoppers look for ways to reduce their spend on groceries.

Focus on cost

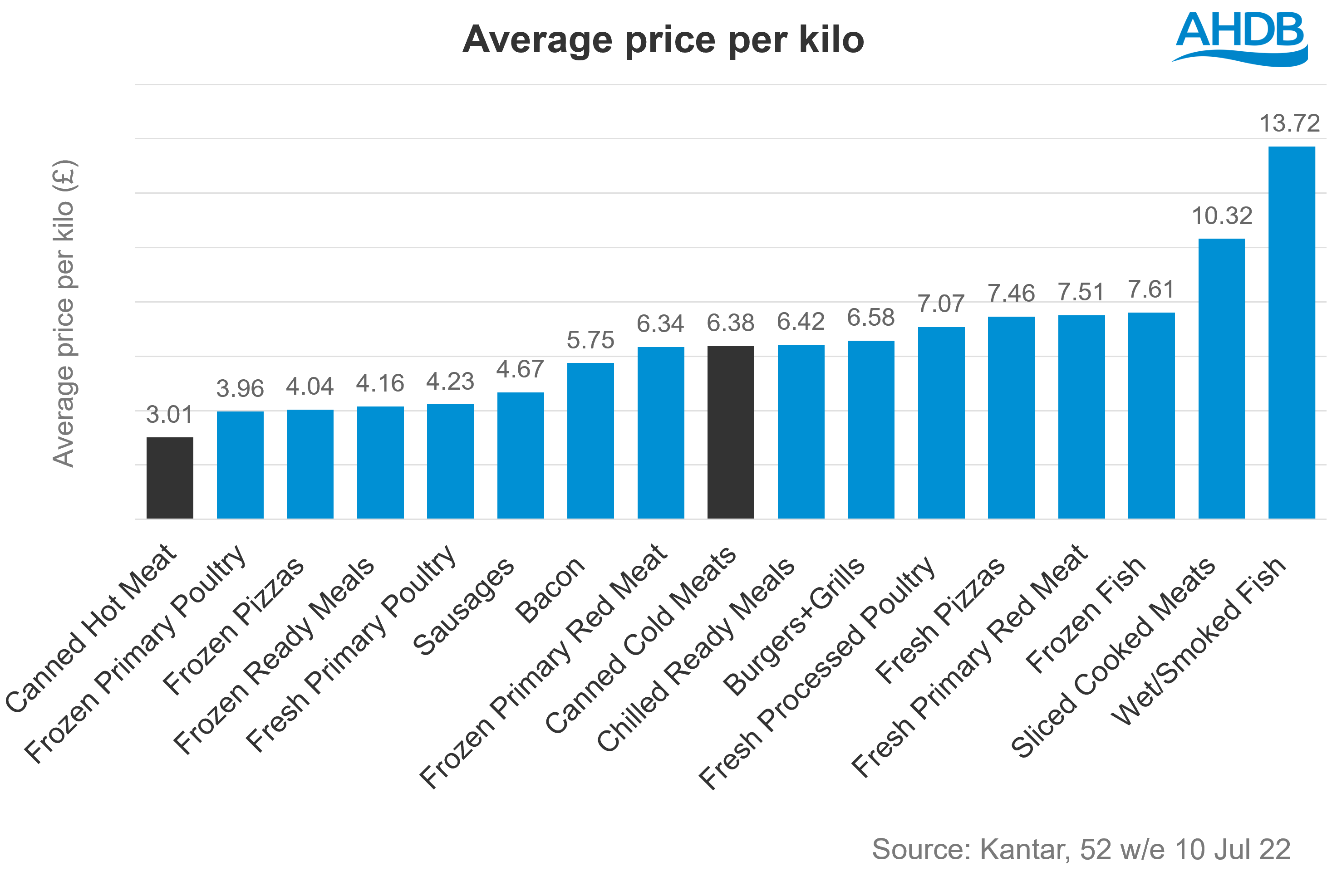

According to IGD, 39% of shoppers are focussing more on saving money in the next year – up from 13% just a year ago (Jul 2022). The lower outlay cost of canned products could play into this.

Canned hot meats not only have a low outlay compared to fresh and frozen options, but they also have a low £/kg. Canned cold meat (primarily corned beef) is the more expensive canned option but is still much cheaper than fresh meat.

UHT milk is slightly higher priced than pasteurised milk, at 74ppl on average, it is 8ppl more expensive. However, it is 12ppl cheaper than filtered, which is usually purchased for its longer shelf-life, similar to UHT. However, as UHT is mostly sold in one litre units, compared to the most widely sold four pints for pasteurised and two litres for filtered, the outlay per pack is much cheaper.

There are also many consumers whose household finances are still affected by the economic shock of the pandemic. Of those whose finances have been negatively impacted by Covid, around half said they were reducing food waste as a way to manage food consumption and spend (AHDB/YouGov Consumer Tracker, May 2022). The longer shelf lives of tinned foods and UHT milk help them meet this need to reduce the amount of waste.

While canned meats and UHT are not immune to price increases, they remain a cost-effective alternative to fresh. However, fresh primary meat, fish and poultry remains a far more popular option, bought by 91% of households in the last 12 weeks, compared to 34% for canned. It’s likely that British sourcing is far more prominent in fresh meat, than in canned, and therefore providing recipes to use fresh alongside other tinned staples, such as tomatoes, beans and soup, could help inspire cost-effective meals with British meat. Scratch cooking is expected to rise again, which could play into this, and could also provide an opportunity for UHT milk as an ingredient.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.