- Home

- News

- Can the cost-of living crisis provide opportunities for the struggling home baking market?

Can the cost-of living crisis provide opportunities for the struggling home baking market?

Wednesday, 16 November 2022

The trend for home baking has continued to slow over the past year. The cost-of-living crisis poses a further challenge to home baking, but previous recessionary insights suggest that there are also opportunities within this.

Cost-of-living context

At the moment, consumers are still eating at home more than pre-pandemic, and current consumption behaviours are shaped more by the pandemic than the cost-of-living crisis. However, consumers are looking to save money on their food and grocery shopping and are, therefore, utilising methods such as trading down and buying fewer items.

In addition to this, many consumers say they are looking to reduce their spend on eating-out and leisure activities to combat the squeeze on household budgets. However, despite rising food costs and the challenges posed to household finances, previous data taken during times of recession, suggest that home baking could increase. One reason is that baking can be an alternative to other, more expensive, leisure activities during recession, with 43% of parents saying they bake to occupy their children (Mintel, 2020).

While a cost-of-living increase in scratch cooking hasn’t yet been seen, scratch cooking is expected to increase. Of those whose household finances have worsened, 33% expect to cook from scratch more over the coming months (AHDB/YouGov Consumer Tracker, August 2022). This could provide an opportunity for all types of flour, but particularly plain flour due to its versatility within a range of savoury dishes.

Home baking trends

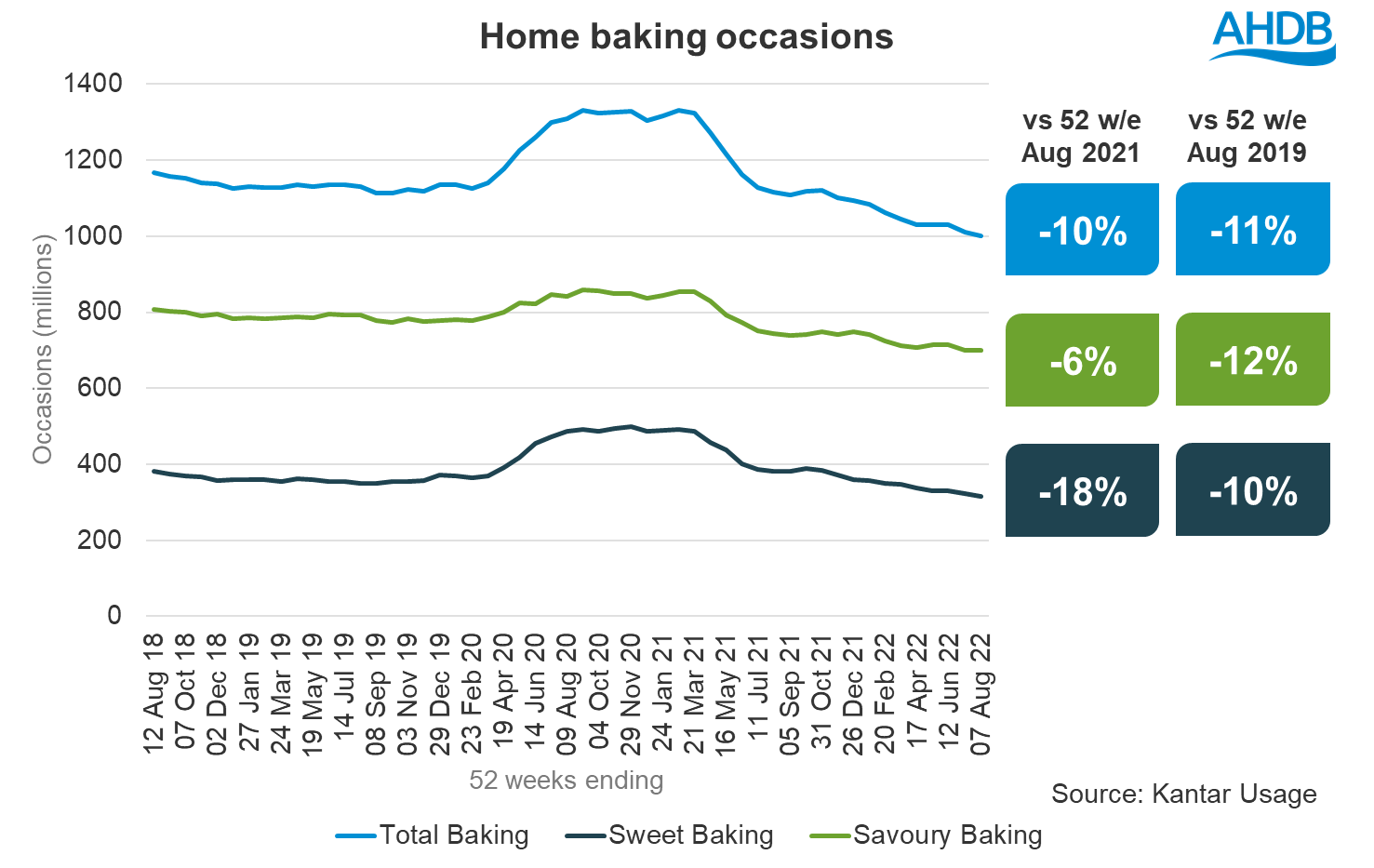

In the year ending 7 August 2022, there were 113 million fewer home-baked occasions than the year before (Kantar). In addition to this, baking occasions are now 11% lower than pre-pandemic.

Sweet baking occasions (-18%) have been declining more rapidly than savoury baking occasions (-6%) over the past year. Savoury and sweet baking occasions are very different, with savoury tapping into more evening meal occasions, whereas sweet is biased towards more snacking occasions and teatime.

At the moment, snacks are a key growth area for in-home consumption, with snacking occasions up 6% when compared to 2019. This is expected to continue as consumers look for small, affordable, indulgent treats, providing an opportunity for sweet baking, such as homemade cookies and cakes.

Pre-packed flour sales

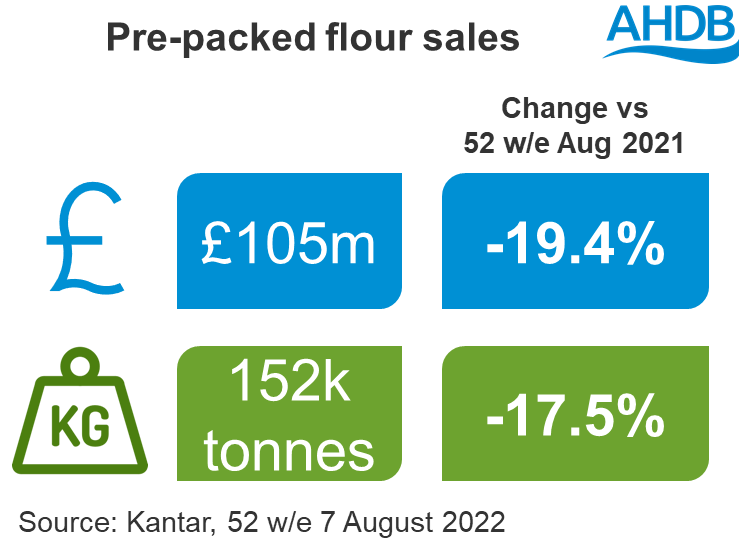

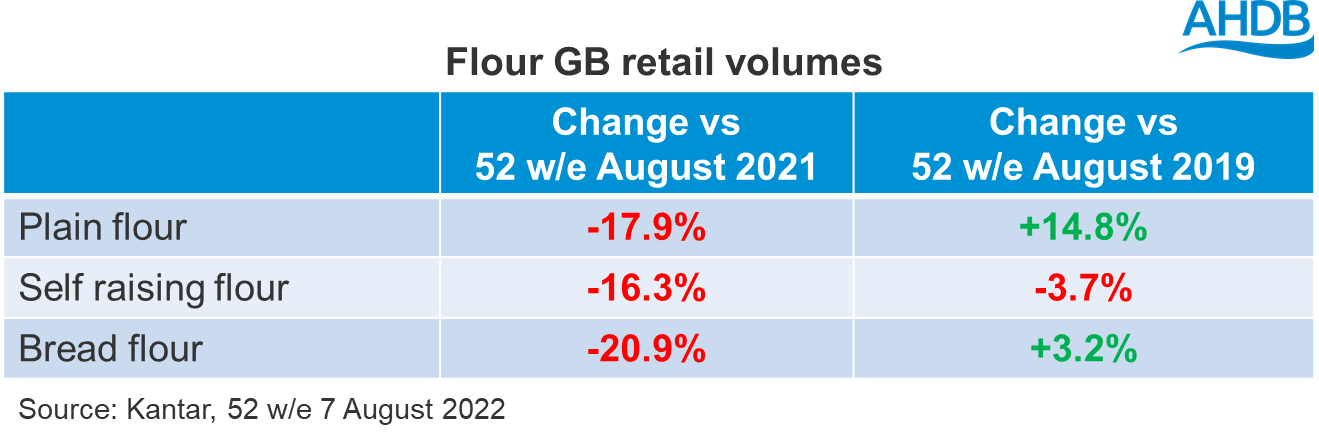

Pre-packed flour retail sales amounted to £105 million, in the year ending 7 August 2022. In volume terms, this was 152 thousand tonnes (Kantar). However, value and volume both experienced significant declines (-19.4% and -17.5%, respectively), driven by a fall in home baking, with shoppers dropping out of the category or buying into it less frequently.

Plain flour made up the majority of flour sales over the last year, accounting for 53% of total pre-packed flour volumes. This is followed by self-raising flour, with 33% of volume, and bread flour, accounting for 14%.

All flour types have experienced heavy declines year-on-year. However, plain flour and bread flour volumes are higher than pre-pandemic.

Conclusion

The cost-of-living crisis brings about huge challenges for grocery sales as consumers look to manage their spend, but there are opportunities for the flour and baking market in scratch cooking and indulgence:

- There is an element of fatigue with baking and certain meals at home. Look to re-engage lost shoppers as they start to cook from scratch more often

- Remind consumers of baking as a leisure activity, particularly families. Reframe the cost versus an out-of-home activity or occasion

- Snacking has already started to increase. Encourage affordable homemade snacks that tap into the elevated need for a treat

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.