A second lockdown: What it means for consumer demand

Monday, 2 November 2020

With England about to enter a second national lockdown and Wales under firebreak rules, a large proportion of the GB population will yet again not be able to eat out.

Combined with regional restrictions in Scotland, which include curfews on cafés, pubs and restaurants, the eating out market faces another tough period.

Foodservice operators will still be able to offer takeaways and delivery but, based on the reaction to the first lockdown, this is unlikely to do much in the way of compensating for lost volumes in the eating out market. However, the retail market is likely to see significant growth again, with consumers changing how they shop and cook, here are the learnings from last time.

Out-of-home (OOH) learnings from the first lockdown

The first national lockdown in March resulted in huge losses for all sectors. With big takeaway chains also closing temporarily, this meant that any gains for takeaways were relatively slow to materialise.

The one exception to this was lamb, due to lamb kebabs, as these tend to be purchased from independent operators, rather than being reliant on a handful of big brands for volumes.

-1.png)

This time round we could expect a similar pattern for non-takeaway volumes, which includes eating-out volumes and food-to-go – both of which are heavily impacted by restrictions. Reduced food-to-go footfall has affected pork in particular, due to fewer out-of-home sandwiches and savoury pastries being bought.

However, the main difference between this second lockdown and the first is that many operators who didn’t offer takeaways previously have started offering this service during the coronavirus pandemic. They have also had six months to understand how to offer collections and deliveries in a Covid-secure way, which was a huge challenge last time round and was a key reason for chains closing temporarily, especially impacting beef and potatoes.

Takeaway volumes have remained elevated for all sectors over the past few months and there should be more consumer confidence in takeaways and deliveries this time round. This will mitigate some losses, but it remains small in comparison to eating out volumes.

OOH coming out of second lockdown

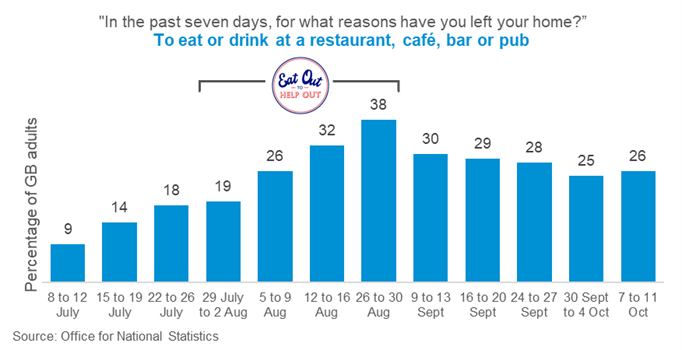

Upon reopening last time round in July, footfall to the eating out market was subdued. The Eat Out to Help Out scheme was introduced to help stimulate visits.

Eating out visits increased in response to this but, following the end of the scheme, only around a quarter of British consumers continued to eat or drink out.

The beef sector particularly benefitted from the Eat Out to Help Out scheme, as it encouraged trade up to steaks as consumers aimed to make the most of the discount. View the trend in the recording of our recent red meat consumer insight webinar. However, in the four weeks ending 4 October, estimated volumes of steaks edged back behind 2019 levels – indicating that sustained uplifts will be hard to come by.

Total non-takeaway volumes for all sectors remained in decline in August, despite the discount offered by the scheme and it taking place during the summer months, when consumers were able to eat outside.

This time round, when England leaves its lockdown the winter season will be underway and financial worries will also be elevated as the furlough scheme finishes. Both factors will suppress demand and, given the experience coming out of the last lockdown, we would expect there to be a slow recovery for the eating out market when it reopens again.