China’s dairy imports H1: Weak demand could drive global prices down further

Wednesday, 16 August 2023

Key trends

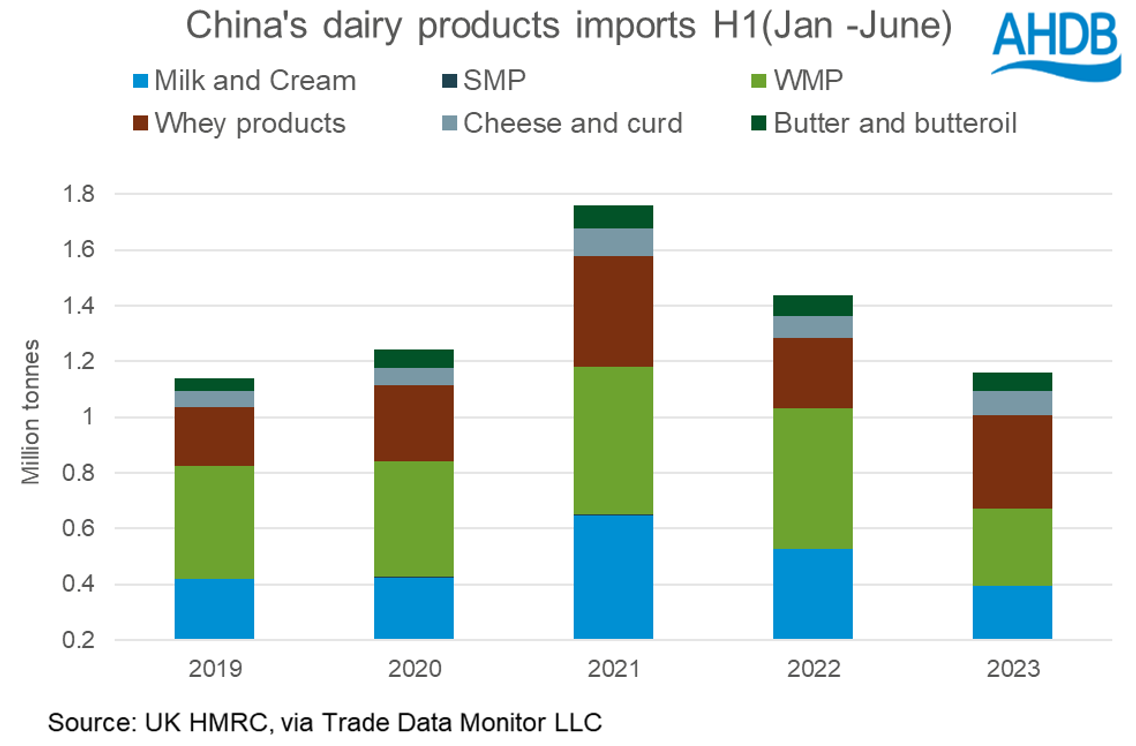

- Chinese dairy imports continue to decline in H1 2023.

- Total imports for the period are at a four-year low.

- WMP imports fell most by 45% to 0.28 Mt.

- Trend to continue amid higher domestic production.

- Domestic availability, demand, margins, weather, inflation remain key watch points in determining imports.

High stocks of whole milk powder (WMP), higher international prices and government support for domestic self-sufficiency impacted Chinese dairy imports in 2022. The trend has continued in 2023, with lower imports recorded in the first half of the year compared to the previous year. Demand for dairy has declined amidst a heat wave across the country and a slowdown in economic growth. There is a strong correlation between China’s economic growth and dairy imports. In the first half of the year (Jan–June), China’s total imports of dairy products stood at 1.39 Mt, a decrease of 15.2% year-on-year.

Whey and cheese buck the trend

Most product category imports have declined during the period except for cheese and curd, and whey products, which bucked the trend. Imports of whey products have increased, with the nation focussed on rebuilding its pig herd. With zero-COVID policy now easing, the demand for cheese and curd has increased from the hospitality sector, with imports seeing an increase of 12.8% during the period.

Powders, milk and butter decline

Imports of WMP declined by 44.9% (277,000 t) in the first half of the year. Milk and cream, and butter and butteroil imports declined by 24.9% and 14.3% respectively. Lack of demand from bakeries and the food processing sector weighed on butter imports. All major exporting countries have shipped lower volumes of dairy products to China except USA. New Zealand continues to be the major exporter of dairy products to China but year-on-year, have seen exports down by 22.5% to 0.63 Mt in the first half of the year. Exports from Australia declined by 20% to 0.1 Mt and that from European Union declined by 13.8% to 0.4 Mt. USA is the only country which showed growth of 19.2% during the period.

Domestic supplies to increase

In 2023, China’s production of milk is expected to increase by 4.6% compared to 2022 to 41 Mt according to the latest estimates released by USDA in July. WMP production in China is forecast to increase to nearly 1.12 Mt due to strong growth in domestic milk production. With milk supplies outpacing demand, local government in the major dairy producing regions have allocated funds to subsidize WMP production.

Demand from China for WMP looks to be limited currently. China is one of the major importers of WMP and strongly influences the prices in the global market. These lower imports are driving much of the weakness seen in global markets.

Ongoing poor demand from China is important because it is so influential in global markets which will, in turn, impact on farmgate prices here in the UK. The latest GDT auction fell by a further 7.4%, demonstrating there may still be further weakness and downside in prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.