China pork update: challenging economy impacts production and demand

Wednesday, 4 October 2023

Key points:

- China’s pork production in 2024 is expected to decline by 1% on the back of reduced pig inventories

- Wholesale prices show some sign of recovery after government replenishes national reserves

- Consumer demand weakens as the economy slows

- The US, Brazil and Canada have grown their market share of China’s pig meat imports as EU volumes decline

Production

According to the latest USDA figures, China’s pork production in 2024 is forecast to decline by 1% to 55.95 Mt year on year. This results from lower slaughter due to a reduced pig inventory and the continued influence of disease.

Lower pig prices so far in 2023 have led to a challenging environment for Chinese pig producers. As a result, some have been selling pigs early and reducing their production capacity, with some smaller producers exiting the industry altogether. Increased culling and concerns over animal disease outbreaks have resulted in some animals going to slaughter before reaching ideal market weights. The current forecast for this year’s pork production in China is 56.50 Mt.

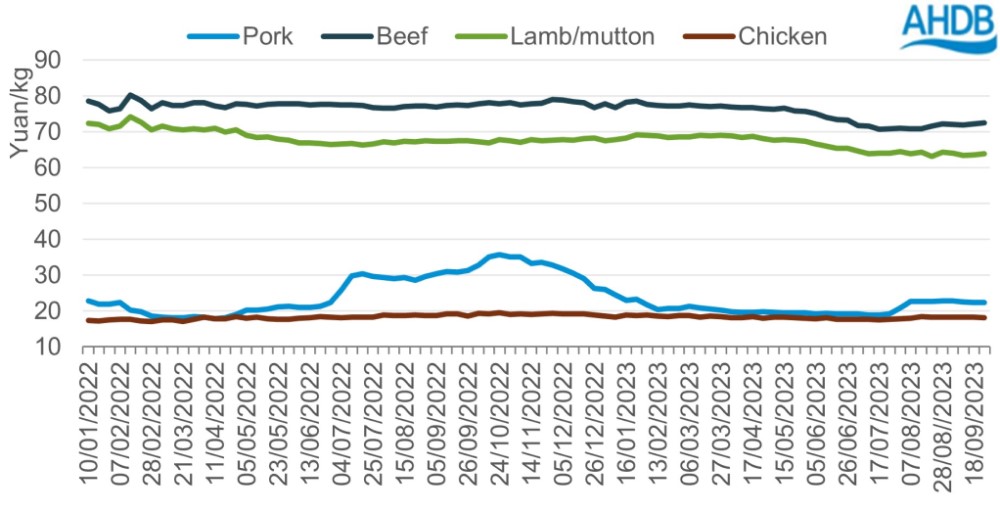

Prices

Wholesale prices have seen some volatility in the last 12 months, reaching a high of 35.7 yuan/kg in October 2022 and falling to a low of 18.8 yuan/kg in July this year. Prices have seen a slight recovery in recent weeks sitting at 22.4 yuan/kg in the last week of September.

Market intervention is relatively common practice for the Chinese government. After pork prices surged over winter, reserves were released to the market in February to stabilise prices. On the contrary, in July the Chinese government is reported to have stockpiled 40,000 tonnes of pork, according to USDA, to replenish national reserves which supported prices.

Chinese wholesale prices

Source: Chinese Ministry of Agriculture and Rural Affairs

Consumption

Pork accounts for around 60% of all meat consumed in the China and has seen steady growth over recent years with a rise of the middle-class population. However, the lifting of covid restrictions did not see the sharp rebound in consumption that was expected in early 2023. Instead, a slowing economy is proving a challenge, weakening demand despite upcoming autumn national holidays. Due to lower forecasted domestic production and the challenges facing the economy expected to continue, consumption is anticipated to dip in 2024 with hospitality and retail demand maintaining similar levels to this year.

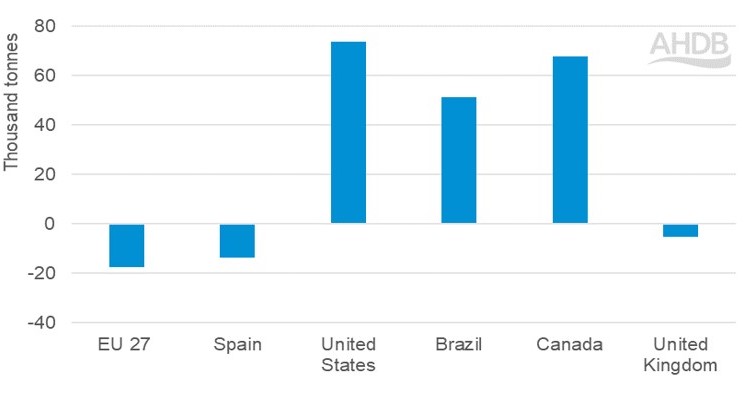

Imports

So far in 2023 (Jan-Aug) China has imported a total of 1.90 Mt of pig meat. Although this is an increase of 165,000 tonnes compared to last year, when compared to volumes seen in 2021 it is down by 1.74 Mt. The majority (61%) of this product falls into the fresh/frozen category, totalling 1.16 Mt, up 10% year on year. Offal almost fills the rest of the import volume at 738,000 t, a year on year increase of 9%.

Spain remains the top exporter to China, shipping 436,000 t of pig meat so far this year. However, volumes from Spain to China have fallen year on year resulting in a loss of market share, down from 26% in 2022 to 23% in 2023. This is a trend repeated across Europe as production declines reduce the volume of available product. The UK market share has fallen from 5% last year to 4% this year, with a total of 81,000 t of pig meat shipped to the China for the year to date.

Making up for the volume losses from Europe are the US, Brazil and Canada, all of which have recoded significant year on year volume increases. This has grown the market shares of the US and Brazil to 16% for both nations, up from 14% and 15% respectively last year. Canada now holds a 9% market share, up from 6% in 2022.

With China now lifting the ban on imports of pork from Russia, there could be another key competitor on the market in the coming months.

Year on year volume change in Chinese pig meat imports by key country

Source: China Customs Statistics, compiled by Trade Data Monitor LLC

Conclusion

China remains a key player in the global pork market, consuming around 40% of the world’s pork. Domestic production and pig meat import volumes are in line with those recorded before the outbreak of ASF in the region. Comfortable supply means demand will be instrumental in driving the market in the coming months.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.