Brazil pork market: Exports scale new highs amidst higher production and demand

Tuesday, 10 June 2025

Key points

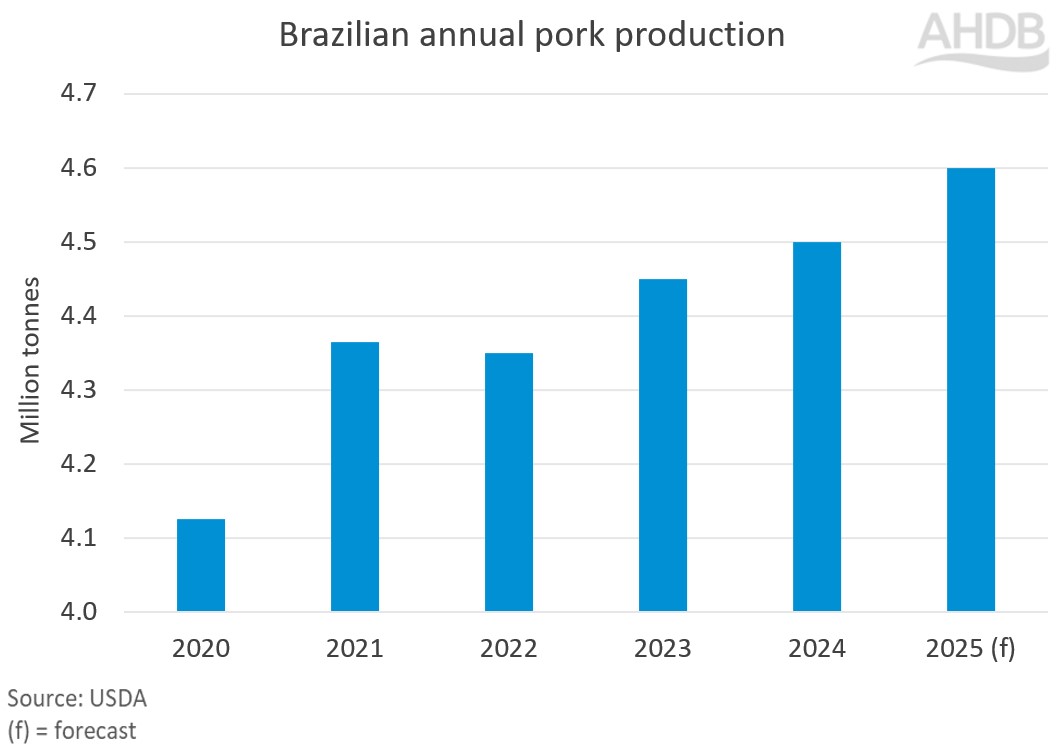

- Brazilian pork production is estimated to grow 2% year-on-year in 2025, driven by good demand and better margins

- Per capita consumption recorded an all-time high of 19 kg in 2024, although competition from chicken continues

- Pig meat exports set new record at 502,700 tonnes in 2025 so far, with global geopolitics potentially creating further opportunities for Brazil’s export market

Production

Brazilian pork production is expected to enter its eighth consecutive year of growth in 2025, according to the Brazilian Association of Animal Protein (ABPA). Brazil is the world’s fourth largest pork producer following China, the European Union and the United States. Both the United States Department of Agriculture (USDA) and ABPA are forecasting year-on-year growth of 2%.

Production gains are supported by an increase in both domestic and export demand as well as lower feed and labour costs.

Higher farmgate prices are also incentivising farmers to produce more. Margins are reportedly better compared to the previous year and remain favourable despite recent price decline. According to Rabobank, margins are expected to remain stable in Q2 2025 supported by seasonal increase in demand.

Consumption

Pork is the third most preferred meat to consumers in Brazil, after beef and chicken. Per capita pork consumption was at an all-time high of 19 kg, growth of 32% compared to 2016 (data from ABPA). Consumption in 2025 is forecast to increase by 1% year-on-year following price decline in the domestic market, according to USDA.

Consumption trends in Brazil are mainly driven by price and not a matter of taste. Pork consumption continues to face competition from chicken, which is cheaper.

Trade

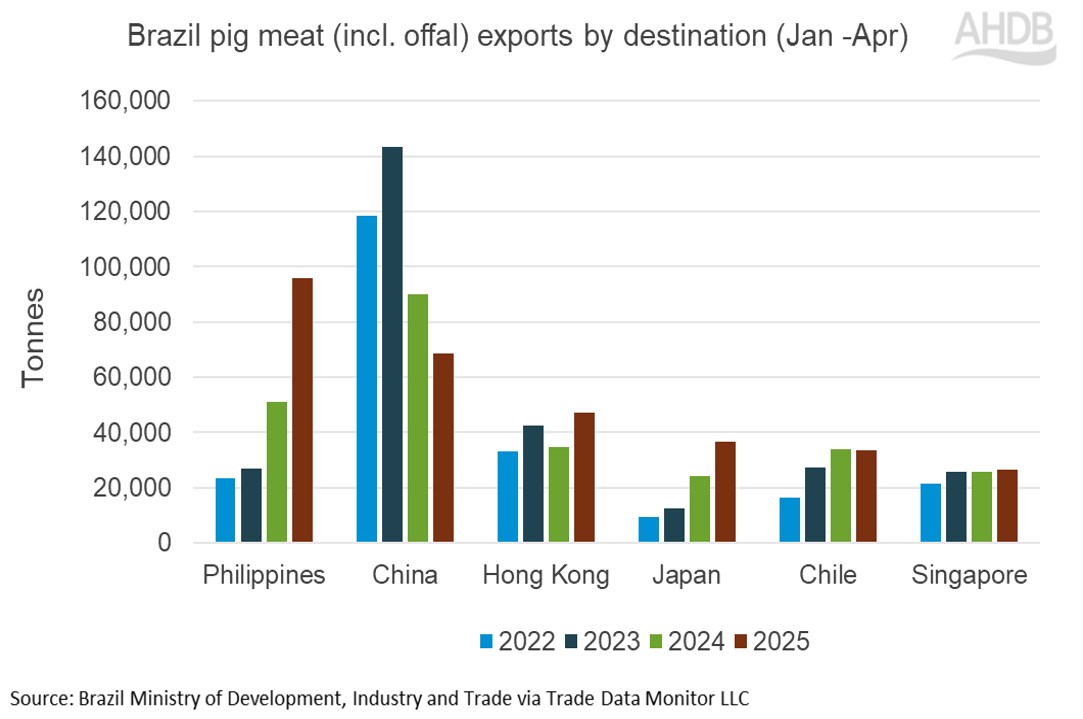

Total pig meat exports (including offal) from Brazil have grown by 18% (76,400 tonnes) for the year to date (Jan–Apr), compared to 2024, at 502,700 tonnes. This is the highest volume of pig meat exported by Brazil on record during the period. The devaluation of Brazilian currency continues to make Brazilian product competitive on the global market

The Philippines, China, Hong Kong, Japan, Chile and Singapore are the top six export destinations for Brazil.

The Philippines has overtaken China as the number one export destination in 2025 having seen volume increased by a substantial 87% (44,700 tonnes). With the exception of China and Chile, volumes to all other major destinations have picked up during the period. The decline in volumes to China (-24% or -21,600 tonnes) has been more than offset by gains in the Philippines. There has been also notable increase in exports to Argentina and Mexico in 2025.

The trend of scaling new highs is likely to be seen throughout 2025 fuelled by good demand in the global market, especially China and South East Asia.

The ongoing tariff trade war in the global market is likely to influence trade flows in the coming months. The retaliatory tariffs by China on US pork may open the door for more Brazilian pork. The outcome of the Chinese antidumping investigation into European product is also expected this month, which could provide further opportunities for Brazil’s export market.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.